By Ryan James, Dividend Analyst Fellow

Big Tech’s Dominance

The so-called “Magnificent Seven” stocks—Apple (NASDAQ: AAPL), Alphabet (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), Amazon.com (NASDAQ: AMZN), Meta Platforms (NASDAQ: META), Tesla (NASDAQ: TSLA), and Nvidia (NASDAQ: NVDA)—have been dominating the stock market lately, dragging it in whichever direction they move.

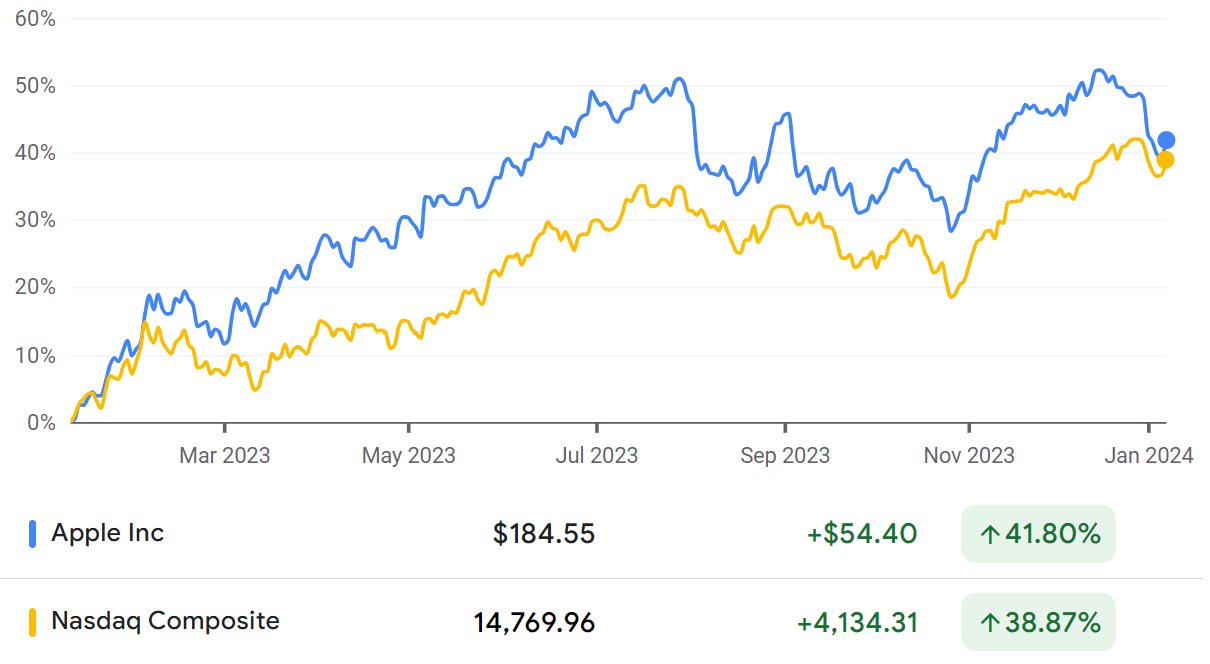

These stocks recently led a nine-week win streak for major US indices in an end-of-year “Santa Claus rally” to boost 2023 stock gains. The S&P 500 ended up 24.2%, the tech-heavy Nasdaq went up 43.4%, and the Dow Jones Industrial Average increased 43%. The Nasdaq increased about 20% in the last nine weeks of the year alone.

The Santa Claus rally has ended with the new year. High interest rates and the Dow’s falling from its recent all-time high have investors wary. However, a recession seems unlikely, and it should be short and mild if one is to occur.

Apple’s Performance

Apple experienced a similar performance to the Nasdaq until mid-December, falling about (-8.5%) from December 13th through January 5th. Apple has had some negative news affecting its stock price lately. Most recently, the company has pulled the most recent versions of its Apple Watch from shelves following a patent dispute.

According to Benzinga, “Overall, Apple Watch revenues are pegged close to $20 billion.” It is unknown how long this issue will persist. If it lasts very long, Apple will lose out on significant revenue. Otherwise, this could present a good buying opportunity, for Apple will be able to recoup its losses relatively quickly.

Outlook

Companies like Microsoft, Google, and Nvidia have greatly benefited from their advancements and investments in artificial intelligence. Apple has not had such developments, but it seems possible for Apple to release a large language model (LLM) that could more than compete with OpenAI’s GPT-4 and Google’s Bard and Gemini.

Consumers are often wary of adopting new cutting-edge tech products, such as these, because they are difficult to understand, and many users prefer to stick to one platform. Apple has three prominent advantages in this space.

The company stockpiles cash—famously enough to buy Disney outright. The company has $61.555 billion in cash on its balance sheet. It often uses this cash to rapidly acquire smaller companies, especially startups, as often as every three to four weeks. This gives Apple the position and rationale to acquire competent AI startups for their products and talent.

Apple is a research powerhouse. They are constantly on the bleeding edge of tech. They have also had lackluster product launches recently, with less innovation than typical. This shows that Apple may be investing in and gearing up for a big AI software launch.

Apple does not need to convince users to learn how to use a new, complicated AI platform because it already has one its users know how to use, Siri. Siri could easily be revamped and retrofitted with advanced artificial intelligence capabilities available to users across its product platforms.

As exemplified by the Internet, some winners emerged late, and some early players survived while others did not. Apple did not get as early of a start as many of these other companies, but they will likely release a more sophisticated product than those with which OpenAI and Google started.

New technologies like the Vision Pro headset (set to be released on February 2nd) and a future AI model will allow Apple to expand beyond new iterations of its current lineup. Some consumers are growing bored of slight changes to products that are otherwise identical and will be excited by new product releases.

Valuation

Apple appears to be overvalued, as do most major tech stocks right now. It has a P/E ratio of 30.08. It is trading at a premium compared to competitors like Microsoft, Amazon, Meta, and Nvdidia, but it is still expensive.

The stock seems to be overvalued by roughly 15% based on a discounted cash flow (DCF) model. The stock has a fair value estimate of $160.64, meaning that it is overvalued; however, this does not necessarily mean that the stock will decrease in value.

The stock has positive technical indicators. Its moving averages are very strong, and its oscillators are neutral. This indicates that somewhat strong performance is likely without intense volatility.

Dividends

Apple has a dividend yield of 0.52%. This is low but acceptable. Some of its peers (e.g., Google) do not offer dividends.

Its small dividend is growing but at a slow pace. It has grown 6.15% over the past five years, (-23.45%) lower than the sector median of 8.03%.

The safety of Apple’s dividend is very high. As aforementioned, the company is far from a shortage of cash. Apple is also likely to continue to reward investors because of such exceptional performance. Apple has little excuse to not pay its dividend to shareholders. But it is also unlikely to significantly increase its dividend growth rate, as investors seem to ignore the low dividend yield.

Future Performance

The stock should continue to slightly outperform the Nasdaq while behaving in line with the index, as it has been doing. If the market continues to do well, Apple will likely do the same. However, Apple would be significantly affected by a market downturn.

The company has a very wide economic moat. The rate at which its moat has widened has likely decreased in recent years but will accelerate with new product offerings in future years.

Apple is the largest company in the world. It has a market cap of $2.87 trillion. It has become a staple investment in most investors’ portfolios. That is unlikely to change any time soon. Apple should use its dominant position and significant capital to continue to invest in its growth. The stock exhibits less risk than other names in big tech but still has significant possible upside. More moderate gains are expected in FY2024 than in FY2023, but significant gains are expected nonetheless. If the overall market increases whatsoever, an increase between 12% and 35% would be reasonable.

More Stories

WHICH SEMICONDUCTOR STOCK WILL END UP ON TOP?

3M: IS THIS DIVIDEND KING LANGUISHING?

THE BASICS OF INVESTING WITH RYAN JAMES: CHARACTERISTICS OF A GOOD STOCK