By Ryan James, Dividend Analyst Fellow

Market Ferver

Currently, despite ongoing recession fears, large tech stocks—especially any company that so much as mentions the usage of AI—have seen massive surges in their share price. This is especially true for companies at the forefront of AI, those creating artificial intelligence, and those manufacturing the resources needed for AI (e.g., semiconductor computer chips). For example, Microsoft (NASDAQ: MSFT) holds a significant stake in ChatGPT maker OpenAI.

Nvidia (NASDAQ: NVDA) experienced a severe rout after its November 2021 highs until the market reached its recent lows in October. Since then, the stock is up nearly three hundred percent, outperforming the S&P 500 roughly twelve-fold. As of the end of May, Nvidia and four other tech stocks made up 96% of the S&P’s gains year-to-date. The stock has even sustained a market capitalization of over $1 trillion, one of only six with a thirteen-digit market cap currently.

Statista cites, “Alphabet, Meta, Microsoft, Amazon and Apple collectively mentioned the term “AI” almost 200 times in their latest earnings calls, up sharply from less than 40 mentions a year ago.” As of early May, AI was mentioned over a thousand times in companies’ earning calls in 2023. The term has been described as “Pavlovian” for investors, such as those of Palantir (NYSE: PLTR), whose stock increased over 22% following profit guidance and the announcement of a new AI platform.

This hype is crushing other companies. For instance, Chegg (NYSE: CHGG), a site many students use for homework “help,” has experienced a decline of over 90% in its stock since its peak in February 2021. Many students prefer ChatGPT or other AI products to Chegg, a platform that requires users to pay for many of its products. It does not help that the company said just that during an earnings call, causing a rapid near-fifty percent decline. Less than a month prior to the company’s peak valuation, Forbes released an article entitled “This $12 Billion Company Is Getting Rich Off Students Cheating Their Way Through Covid”; the company is now worth less than $1.25 billion, nearly ten times less.

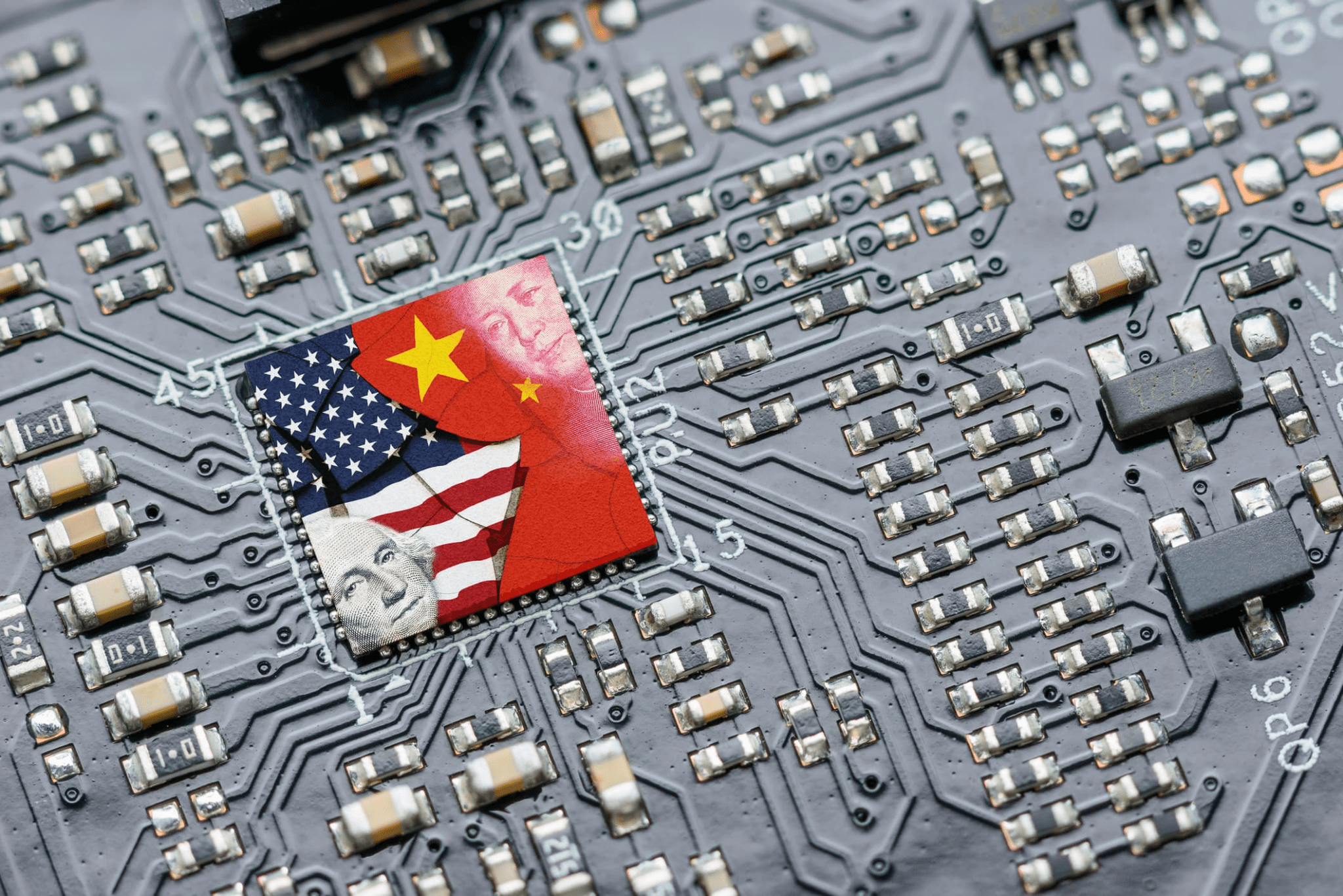

Tensions between the United States and China, as well as between China and Taiwan, are a heavy burden on this industry. China is curbing its exports of rare earth metals gallium and germanium to the United States. China is a global leader in the mining of precious resources for many emerging areas of tech, such as lithium for electric vehicles and gallium and germanium for semiconductors.

However, it appears the United States has a strategic stockpile of germanium. This could counteract the deficit imposed by China, but a lack of gallium is a severe threat.

With all of this in mind, which semiconductor stocks are best positioned to keep taking advantage of these urgent trends?

Nvidia

Nvidia (NASDAQ: NVDA) is currently the leader of the pack. The stock is up over 275% since October, well over double AMD’s gains and far more than double those of TSMC and Intel.

Nvidia now has a market cap of over $1 trillion. An advantage of this stock is that it is much larger than the others, but it potentially has already seen the bulk of its growth. It could experience a steeper fall than its competitors if the semiconductors industry experiences a downturn.

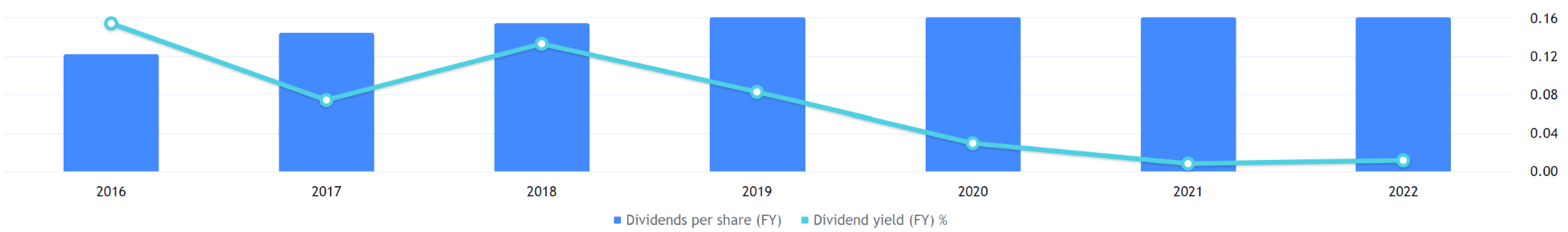

The stock has a 0.04% dividend, almost negligible. It also has no dividend growth over the past year. Over the past five years, its dividend growth rate of 1.64% has trailed the industry median by nearly 80%.

The dividends per share of Nvidia stock from 2019 to 2022—four consecutive years— remained at just $0.16. In 2022, that was a yield of just 0.08%. This emphasizes Nvidia’s determination to increase growth by driving as much cash as possible back into the business to generate more revenue. Still, it disincentivizes investors from purchasing the stock.

The Biden administration may be considering new curbs on exports of semiconductors to China as tensions tighten. The countries are experiencing an ongoing “AI arms race” evocative of the out-of-control nuclear arms race between the US and USSR during the Cold War. This has the potential to hurt Nvidia the most because AI chips would be the main target of these curbs. Nvidia has already received over $1 billion in orders from Chinese company ByteDance for GPUs to fuel AI operations. However, Secretary of the Treasury Janet Yellen’s recent diplomatic trip to China may secure better economic relations between the two countries.

As the AI hype seems to have leveled out in mid-June, Nvidia’s stock has performed the best (as of EOD July 10). It is only down (-3.72%). Compare this to (-12.08%) for AMD, (-7.11%) for TSMC, and (-9.98%) for Intel. But Nvidia and AMD still have the most room to fall as the hype dies down.

The stock appears to be overvalued and overhyped. But it remains an excellent choice for investors who are incredibly confident in this industry and in the strength of the market.

The average P/S ratio of all of the semiconductor industry stocks in the S&P 500 (plus TSMC) is 8.306, a number much higher than that of the average industry in the S&P 500. Nvidia’s P/S is 39.88, over 380% higher than the industry average, and it is by far the highest in the semiconductors industry. Its P/E is 219.23, over 156% higher than the industry average within the S&P 500 (excluding Intel and Micron Technologies because neither of which have valued P/E ratios, and it excludes TSMC because it is not in the S&P 500). The only S&P 500 company within the semiconductors industry with a higher P/E ratio is its competitor AMD.

AMD

Advanced Micro Devices (NASDAQ: AMD) can be considered colossally overvalued. The stock has a P/E of 471.29. That is over 450% higher than the average of the twelve semiconductors stocks within the S&P 500 with valid P/E ratios.

Despite this, though, the stock still has room for potential growth. It is down (-28.37%) from its November 2021 all-time high. Nvidia, conversely, is at its all-time high. AMD has not benefited quite as much as Nvidia from this recent AI boom. Therefore, an investor looking to capitalize from such should look at Nvidia rather than AMD.

However, an investor looking for a strong, quickly growing semiconductor stock with less exposure to the risks of AI and a proven history of growth should look towards AMD.

AMD’s acquisition of Xilinx offers great potential to the company. It broadens its portfolio of chips and increases its manufacturing capabilities. Even with its currently high valuation, this could be a significant upside for the company.

In comparing AMD to Nvidia, Nvidia does have a higher dividend because AMD does not offer a dividend; however, Nvidia’s dividend is small enough to essentially be ignored unless the investor holds an enormous position in the company.

AMD has all positive or neutral technical indicators (except for the Hull Moving Average), indicating a “strong buy” over the past month. The moving averages perform better than the oscillators, but both show positive signs.

While AMD does not have the artificial intelligence capabilities of Nvidia, it is still at the forefront of semiconductor manufacturing. And it is riding the AI wave led by Nvidia.

AMD has the smallest risk profile of AMD, Nvidia, and TSMC. It can still grow at a robust and steady pace in a capable market, but it has less exposure to the threats of lackluster AI popularity growth and China’s geopolitical threat. It is a great pick, but it has neither the greatest possible upside nor the greatest possible downside.

Taiwan Semiconductor Manufacturing Company

The risk of a Chinese invasion of Taiwan is an existential threat to the company. It is even rumored that the United States or Taiwan would destroy the Taiwan-based factory in the event of an invasion to prevent China from obtaining the chips and the ability to improve their own chipmaking because of it.

The CHIPS Act is a piece of legislation in the United States that rewards chipmakers who make their products in the United States. In part due to this, TSMC (NYSE: TSM) opened a $12 billion factory in Arizona, an emerging tech hub within the United States; however, the bulk of its chips are made in Taiwan, forcing less exposure to the incentives of the CHIPS Act relative to US-based semiconductor companies.

TSMC is up about 34 percent over the past year, about 52% more than the Nasdaq Composite (INDEXNASDAQ: .IXIC). The stock has a beta of 1.16, meaning it is slightly more volatile than the overall market. But it is more stable than its competitors which all have higher betas. It also has positive technical indicators.

TSMC has a mediocre but existent dividend yield of 1.72%. This is low, but it is 8.81% above the sector median of 1.58%. Its dividend growth, however, is much worse. It has grown 6.29% over the past five years, far below the sector average of 8.03%. Its dividend growth has been slowing relative to its sector. Over the past ten years, TSMC’s dividend growth has been nearly forty percent greater than the sector median, shrinking to seventy-five percent less than the median over the past year.

The stock is not in the S&P 500. This means it is missing out on a solid symbol of prestige and importance. Its exclusion from the S&P 500 could lead investors away from the stock.

This stock is evaluated as a safer choice for sustainable growth than its competitors because of lower volatility. Yet it has the greatest chance of cratering to zero or near zero in the case of a catastrophic invasion that would devastate the entire Taiwanese economy and temporarily debilitate the tech sector. Legendary investor Warren Buffett originally realized the upsides, deciding to invest in the stock. But he later sold his stake in the company—primarily because of the geopolitical risk factors facing the company.

Intel

Founded in 1968 in Silicon Valley, Intel was once a leader in the semiconductor industry. It is now laggard, marked by a gradual decline in its stock, relevance, and market share.

Many computers could be seen with an “Intel Inside” sticker, denoting that the computer uses an Intel chip. Many of these computers are now seen as old and/or outdated. Intel’s competitors seem far more inventive.

The stock is down over 50% from its recent high in April 2021. Its all-time high was in 2000, during which the stock experienced a brief spike from which it fell as quickly as it ascended. In March 2001, after the spike, Intel laid off 5,000 employees due to abysmal performance and a terrible revenue outlook.

Intel is putting some effort and resources into innovation, though. The company is building a $25 billion manufacturing plant in Kiryat Gat, Israel. Due to the Encouragement of Capital Investment Law (ECIL), Intel will receive a grant of $3.2 billion as a result of its capital investment in the State of Israel. Israel is regarded as the world’s “start-up nation,” a global leader in science and technology. This is not the beginning of Intel’s operations in the country. Intel began operating in Israel in 1974. It has development centers for AI in Haifa and Petah Tikvah and a development center for autonomous vehicles, communication, and cybersecurity in Jerusalem, Israel’s capital. It will open its most advanced manufacturing facility yet in Kiryat Gat in 2027. A potential drawback, though, is that, as stated in Intel’s 10-K SEC filing, Intel contributes significant funds toward “R&D, and to the extent our R&D efforts are unsuccessful, our competitive position can be harmed, and we may not realize a return on our investments.”

The company is also cutting costs. It is temporarily cutting employees’ wages, separating its manufacturing and business units to remove inefficiencies and unnecessary costs, and terminating non-core lines of business. For example, Intel has even stopped production of its NUC PCs as it reassesses its position in the computer business.

The average analyst rating for Intel is worse than any of the other mentioned stocks. It has a potential downside of up to (-30%) in the next year. Intel does have the heftiest dividend yield of the listed companies at 3.6%. However, it is likely to decrease, as its forward dividend yield is far lower at just 1.48%, more similar to TSMC’s. The stock’s dividend has been growing far slower than the industry median. Over the past year, it has grown just over three percent, nearly 67% lower than the industry median. The same has been true over the past ten years.

Intel’s innovation and long-term thinking show potential for a resurgence, but it is unlikely. The stock has loosely followed the Nasdaq Composite over the past six months while its competitors have blown far beyond it. Regardless of whether its performance will be positive or negative in the future, it is set to be far less active than its competitors. This stock can be usefully held in a highly diversified portfolio but is an unwise pick otherwise. The best way for an investor to expose his or her portfolio to this stock would be to purchase one of the following ETFs.

ETFs

An exchange-traded fund can be an excellent alternative to directly buying an individual stock. The following ETFs offer “baskets” of semiconductor industry stocks and are provided by large, established ETF issuers.

ETFs have existed for just over twenty years. They are still rapidly increasing in popularity. They are a popular alternative to mutual funds, which trade outside market hours; ETFs trade just like individual stocks. While the number of stocks listed on the NYSE and NASDAQ decrease over time, the number of ETFs listed on US markets is actually increasing.

These ETFs offer instant diversification, allowing investors to invest in many stocks across the semiconductors industry at once with one security without taking on as much risk as buying one individual stock, especially one in this industry.

One major drawback of ETFs is the expense ratio. Investors are charged a premium to invest in the security and to have it managed by the issuer. An ETF can be worth it despite this premium, especially if the investor wants to own many different semiconductor stocks concurrently.

VanEck Semiconductor ETF

The VanEck Semiconductor ETF (NASDAQ: SMH) is the only ETF holding all four listed semiconductor stocks. However, its holdings are less balanced than the other ETFs’. Nvidia and TSMC lead the holdings by far, making up 18.64794% and 11.4862% of net assets, respectively, while the other eight holdings make up 4-6% each. Nvidia is the best-performing semiconductor stock, and TSMC is one of the best-performing, so this is helping it do well.

It is more diluted than the others. Only 99.91% of its assets are equities; the other 0.09% is cash, while the other ETFs have 99.99% of their holdings as equities and only 0.01% as cash.

This ETF has a high dividend growth rate of 52.61%, 15.95% above the industry median, though it slightly lags behind that of the SPDR ETF.

This ETF’s market cap of 9.81B is the largest of the four. This makes it the most established and reliable. VanEck can focus more resources on this ETF than the other issuers on their ETFs.

Over the past month, the VanEck Semiconductor ETF has the most robust technical indicators of the four listed ETFs. This is a very positive sign for its future performance.

The dividend yield of this ETF is 0.75%, high relative to the other listed ETFs but not the highest. This dividend helps to counteract the high expense ratio of 0.35%.

This ETF may be worth its high cost. If its high price is bearable, this is likely the best option; however, if the price causes too high of a barrier to entry, there are other good options with lower expense ratios.

Invesco PHLX Semiconductor ETF

The Invesco PHLX Semiconductor ETF (NASDAQ: SOXQ) offers flashy features to make up for what it lacks—it is far less established than its counterparts. The security has only existed since June 2021, just over two years. And the VanEck ETF’s market cap is over seven thousand percent larger than the Invesco ETF’s market cap of $137.7 million.

The ETF offers a meager expense ratio of just 0.19% and has the lowest price per share (just under $30), making it a good option for investors who want to avoid higher-cost ETFs.

Another flashy feature is its higher dividend yield. It is not high relative to the entire market, but it is higher than those of the other four ETFs at 0.95%. This higher yield and many of the other flashy features are at risk as the ETF ages are at risk. The dividend growth rate is (-22.03%), (-58.29%) below the median for all ETFs.

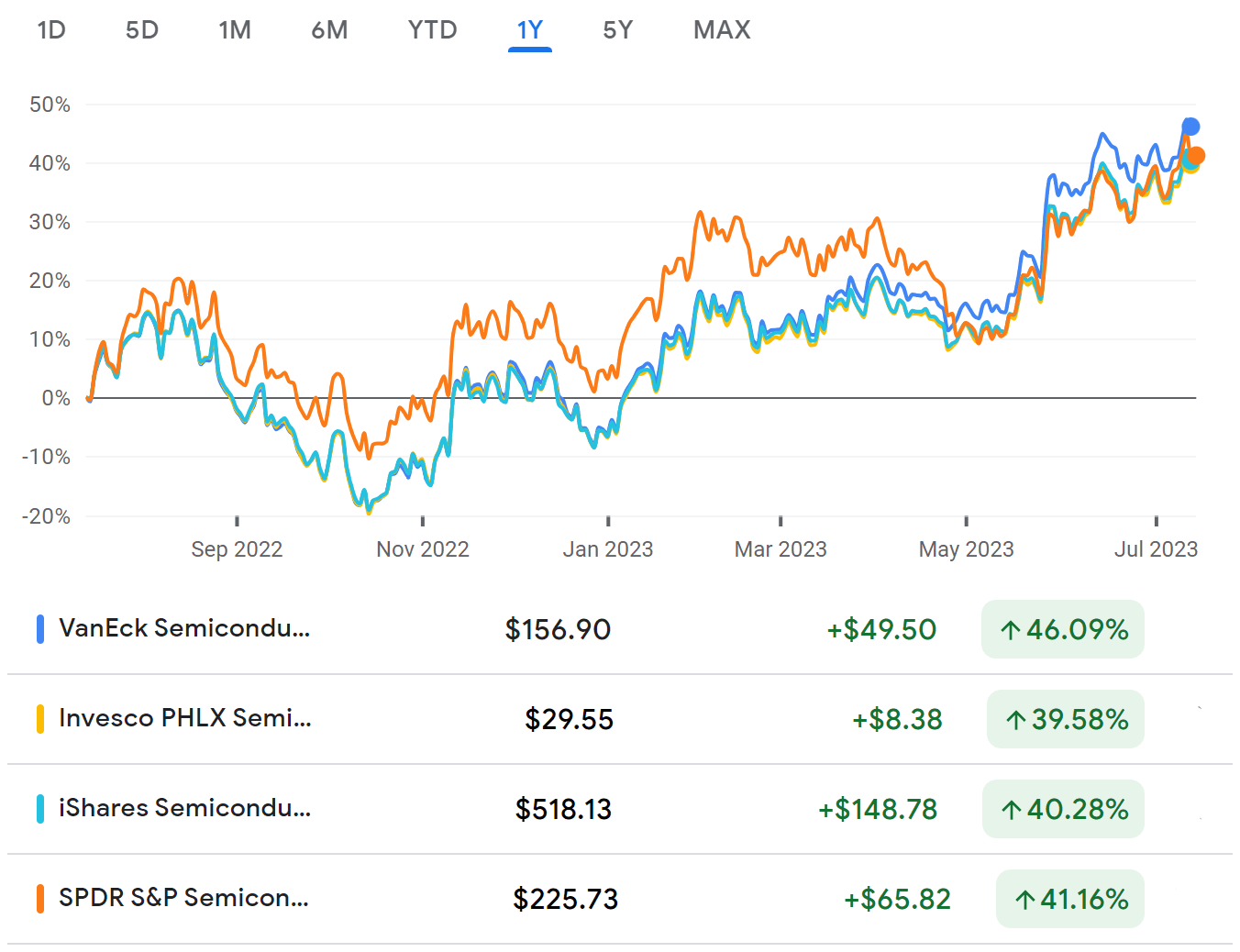

This fund can be a viable option for smaller investors looking to avoid the highest expense ratios and share prices, but it seems riskier in the long term. And it aligns differently from the necessary goals met by some of the other ETFs. It is also the worst-performing of the four ETFs over the past year, albeit underperforming by very little. It has a very high reward relative to its risk but is a little expensive.

iShares Semiconductor ETF

The iShares Semiconductor ETF (NASDAQ: SOXX) is BlackRock’s semiconductor ETF. BlackRock is the world’s largest asset manager, with nearly $10 trillion AUM.

The ETF does have a dividend. The dividend yield is 0.87%, which is low but higher than that of SPDR and VanEck ETFs. However, this is strongly counteracted by a substantial expense ratio of 0.4%, the largest of the four ETFs.

Despite this high expense ratio, the ETF is not the best performing over the past year. It is performing worse than all listed other than Invesco PHLX Semiconductor ETF. But they are all very closely linked, so their performances are similar.

Nvidia, AMD, and Intel are among the ETF’s top five holdings, but it does not hold TSMC stock whatsoever.

It is among the better ETFs but could be better. Its expense ratio makes this ETF not worth the cost.

SPDR S&P Semiconductor ETF

The SPDR S&P Semiconductor ETF (NYSEARCA: XSD) is not oriented toward the same goals as the other ETFs. Its only holding of Nvidia, AMD, TSMC, and Intel in its top ten holdings is Nvidia, and it is only the seventh-largest holding, making up less than three percent of its assets.

The largest holding of this ETF is Lattice Semiconductor Corp (NASDAQ: LSCC), a semiconductor stock that is not included in the S&P 500. This stock is down (-0.28%) over the past three months, while the industry is up significantly.

While this ETF does not have the highest expense ratio of the four, it is still very high at 0.35%. Its dividend is lower than this at 0.33%, meaning investors are losing money from fees.

This ETF is listed on the NYSE Arca exchange, an ETF exchange based in Chicago after the NYSE and Archipelago exchanges merged in 2006. The NYSE is traditionally less tech-heavy than the NASDAQ. These semiconductor companies are very tech-oriented, so NASDAQ-listed funds may be a better choice.

This ETF has a low daily average volume, causing extra blocky, less organic movement. This is not good for a stock, especially when trading in shorter intervals.

One drawback of this ETF is that it is a very high-risk, high-reward relative to the others. The risk may outbalance the reward in the long term. This ETF is unlikely the best choice for any type of investor.

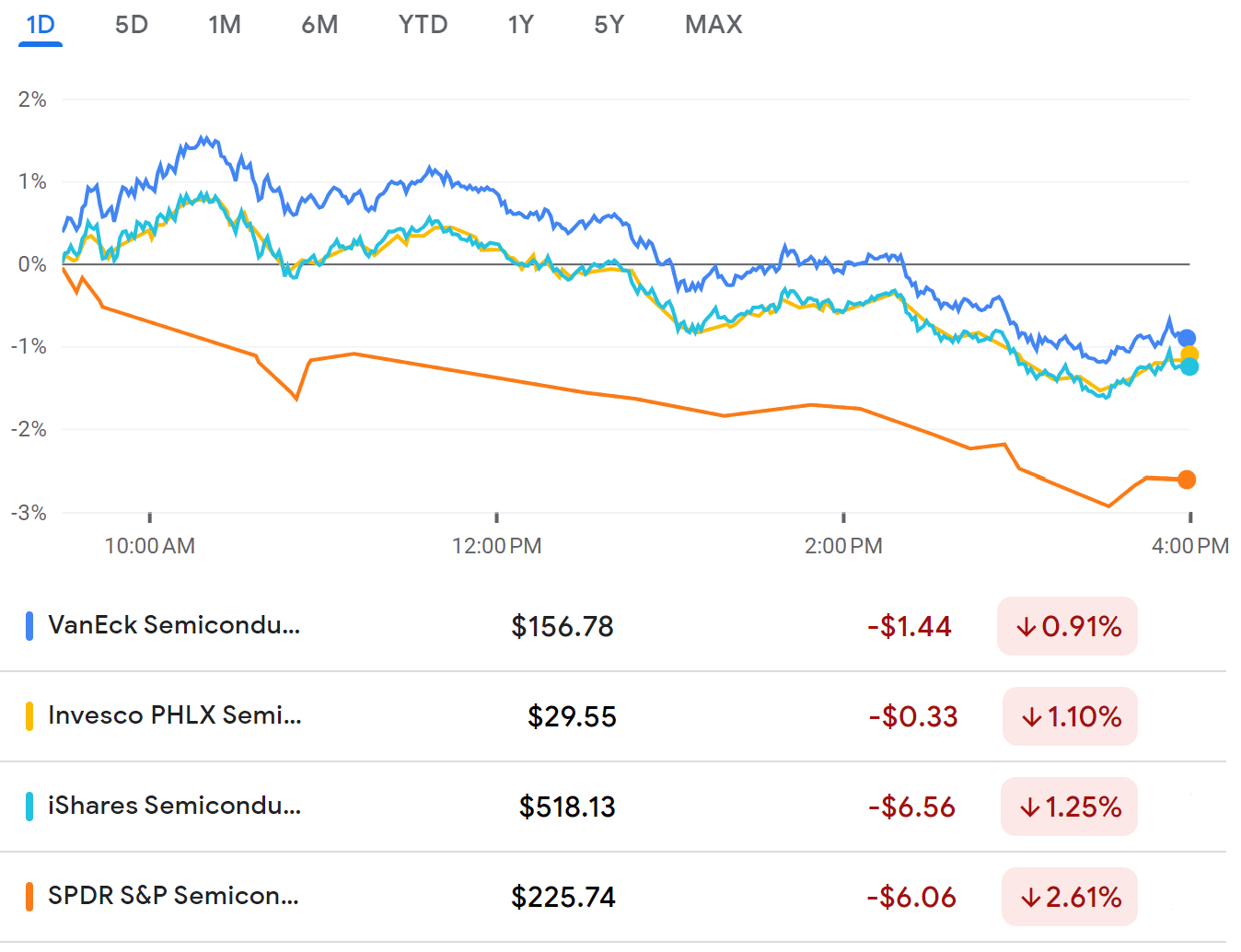

Semiconductor ETF Overview

All investors should likely avoid the SPDR ETF, but a reevaluation might be necessary in a few years. The VanEck, Invesco, and iShares ETFs can all be viable options, but certain types of investors might be inclined to choose different ETFs based on their personal investment plans.

The VanEck ETF is likely the best for the average investor. The Invesco ETF is an excellent choice for low-budget investors, but there are probably better options for those willing to put more money into this investment. The iShares ETF is overly expensive but somewhat makes up for it with its dividend; it is not the worst pick of the four but is unlikely to be the best for anyone.

Overall Industry

The semiconductor industry proliferates during times of greed in the market. It is possible that these stocks have peaked or will do so soon. Because of the unpredictability of the market, Nvidia and AMD are the likely winners in a best-case scenario, and TSMC is the potential winner in a worst-case scenario.

Because of this, while one stock will inevitably outperform the others, there is no inherently best stock. Conservative investors could benefit from considering Nvidia’s stock as it has the most significant potential upside. Intrepid, aggressive investors could benefit from considering stocks like TSMC which offer a higher likelihood of gains without too much risk.

BlackRock, the world’s largest asset manager, published in their mid-year 2023 outlook statement, “New AI tools could analyze and unlock the value of the data gold mine some companies may be sitting on.” This could open massive opportunities for semiconductor, artificial intelligence, and cloud computing companies.

When considering whether to invest in one of these securities, an investor must consider the stability of the entire semiconductors industry. In the event of a recession, semiconductor stocks, especially Nvidia and AMD, will likely be hit harder than those of other industries.

While TSMC and Intel would be safer bets in the event of a market downturn, they would also decrease in value, so their added safety may not be worth it to some investors.

The evaluation of the semiconductors industry is that it will continue to heavily outperform the overall market during times of greed in the market. But it will underperform the market during times of fear in the market. The hype over AI may continue to grow in the short-term, but it will likely experience logistic growth in the long-term, evening out at some point in the future to a sustainable level; therefore the bulk of the rapid short term growth is likely over, but the stocks will continue to increase in value in the long-term.

Nvidia, AMD, and TSMC appear likely to continue their rapid increases as the market continues its bull run. When the market either reaches an all-time high or enters a bear market, these stocks must be reassessed. Intel does not appear to be a good choice as it continues its gradual decline and rapidly loses relevance and market share relative to its competitors. Nvidia will likely remain on top, with AMD trailing closely behind.

More Stories

APPLE: A FUTURE AI POWERHOUSE?

3M: IS THIS DIVIDEND KING LANGUISHING?

THE BASICS OF INVESTING WITH RYAN JAMES: CHARACTERISTICS OF A GOOD STOCK