By Ryan James, Dividend Analyst Fellow

Company History

Founded in 1902, the multinational conglomerate 3M (NYSE: MMM) deals with materials science, industry, healthcare, consumer goods, and countless other industries. It now employs nearly one hundred thousand employees and has multiple of its products in virtually every American household. The company offers over sixty thousand products. The company’s largest shareholder is The Vanguard Group, the second-largest investment management firm (behind BlackRock); it owns 8.5% of 3M’s outstanding shares.

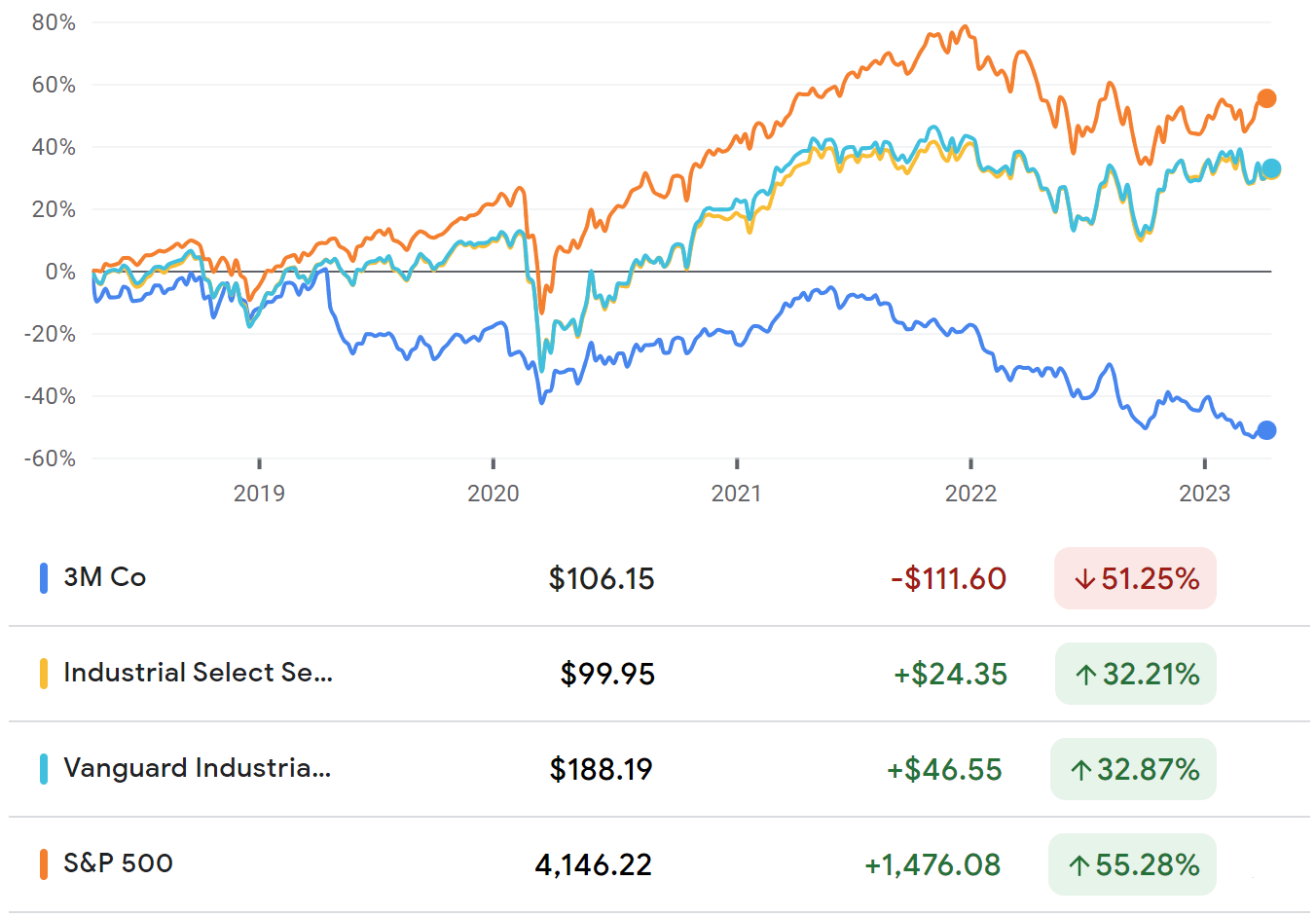

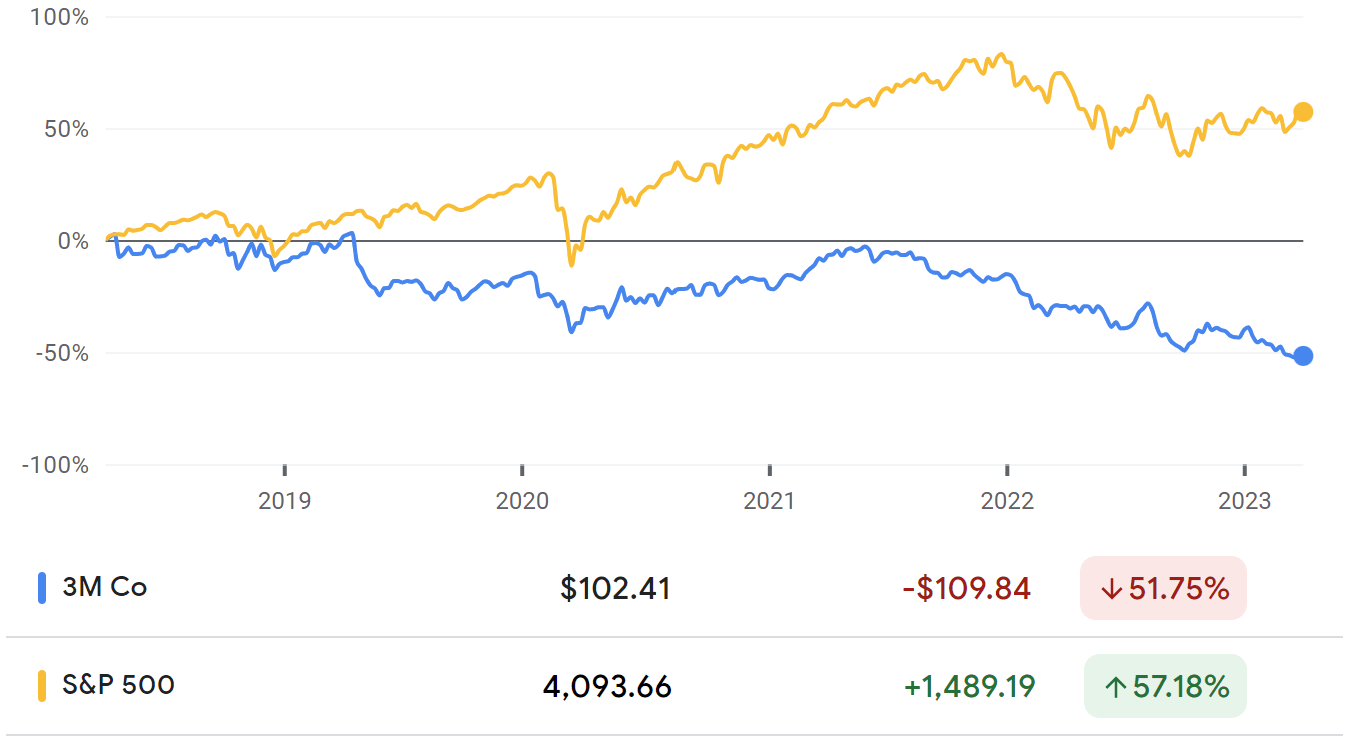

3M is a classic example of a blue chip stock. Despite this, its stock price has been suffering, even relative to the overall market. 3M is in the Industrial Conglomerates sector of the Industrials sector. Although the industrials sector has underperformed relative to the overall market over the past five years, it has increased; 3M has not—it has continuously and steeply decreased, losing over half of its value, an approximate (-51%) decline. Concurrently, the S&P 500 has increased in value by more than 3M has decreased, rising over 55%. The Vanguard Industrials Index Fund ETF (NYSEARCA: VIS) and Industrial Select Sector SPDR Fund (NYSEARCA: XLI), which represent the Industrials sector, have strongly outperformed 3M, increasing about 32% over the period.

Controversy

3M faces about 2,000 lawsuits currently. The predominant focuses of these lawsuits are defective products (i.e., their earplugs) and chemical contamination (i.e., PFAS). States, veterans, and many other individuals/entities have brought on these lawsuits.

3M is facing a plethora of difficulties because of controversies, including legal troubles. Per- and Polyfluorinated Substances (PFAS), or “forever chemicals,” are artificial chemicals that occur in many consumer goods, such as nonstick pans and many of 3M’s legacy products. They cause significant, long-lasting harm to the human body and the environment. The company faces many lawsuits related to its environmental contamination with PFAS. Litigation risks remove the potential fundamental benefits.

3M began selling a PFAS called PFOA (or “C8”) in the 1950s to DuPont (NYSE: DD) to create Teflon (polytetrafluoroethylene), the chemical compound in non-stick pans, which allows them to be “non-stick.” 3M knew the harmful properties of the PFAS they generated. The company was aware that the chemical accumulated in humans and animals as early as the 1950s. A decade later, the company realized “the chemicals did not degrade in the environment.” Rob Bilott, an attorney working against DuPont and 3M, claims that for over forty years, the companies had been conducting medical studies on PFOA, through which they discovered the harmful medical properties in animals which could be translated to humans. 3M alerted DuPont of the potential for congenital defects attributable to PFOA in 1981, leading DuPont to test its own employees’ children, of whom two-sevenths had eye defects. The worst environmental damage occurs when the C8 enters waterways; the companies eventually began to purposefully dump the chemical into waterways despite internal records indicating just how harmful that is. 3M has begun a lackluster effort to reduce the amount of C8 that ends up in waterways. The company has additionally committed to cease its manufacturing of PFAS by 2025, but the damage done by the chemical has already occurred, and the company ought to do so immediately rather than in 2025.

According to Ken Cook, the President of Environmental Working Group, DuPont sought to test the levels of PFAS in their employees’ blood. 3M urged DuPont to use a control group. They could not find one, as PFAS had infiltrated the blood of nearly everyone around the world. The companies then resorted to using blood samples preserved by the United States military which were collected long prior to the invention of C8. As of 2007, 99.7% of Americans have some level of C8 in their blood; that level is likely to be even higher now.

3M and DuPont kept all of this information private to save face. This further damages their brand image and reputation because they willingly and knowingly caused human and environmental damage through a product that generated profit for the companies. Because Teflon products generated revenue for both companies, including about one billion dollars annually for DuPont, they decided against alternating to a safer, less toxic product—the monetary risk was too high.

In addition to PFAS-related litigation, 3M faces a massive lawsuit over another of its products. Nearly 300,000 military veterans are suing 3M over hearing loss claims due to alleged insufficiencies with the 3M Combat Arms Earplugs. The plaintiffs argue that the product is defective and fails to prevent hearing loss and tinnitus. 3M did not develop this product; its wholly-owned subsidiary, Aearo Technologies, did so before the companies’ merger and acquisition, which effectively eliminated Aearo Technologies and rebranded all of its products under the 3M name and logo.

3M has adopted a bankruptcy strategy to shirk the lawsuit and the responsibility, fiscal and otherwise, with which it comes. Despite Aearo Technologies being effectively defunct since the M&A, it still exists; consequently, 3M is attempting to have Aearo file for bankruptcy and take the blame, altogether avoiding any consequences. The legal validation of the bankruptcy is being challenged in court. Both the lawsuit and the bankruptcy have been stalled and slow-moving, but it will likely end in a settlement with no bankruptcy being permitted.

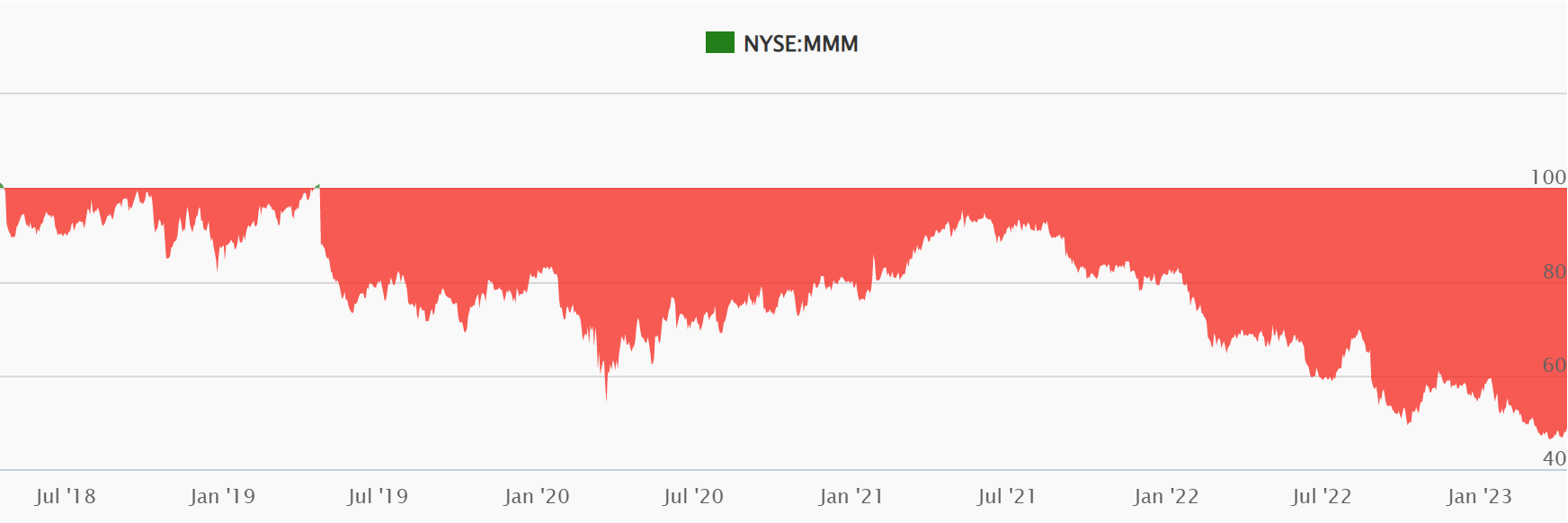

When a judge denied bankruptcy protection for the earplugs lawsuit on August 26, 2022, the stock fell (-9.54) on the day. In the 56-day period between August 12 and October 10, 2022, surrounding the legal decision, the stock fell (-29.37%). The S&P 500 fell (-15.6%) over the same period. 3M’s stock decrease during the period was (-88%) greater than that of the S&P 500.

3M is classified as a leader in environmental, social, and governance considerations (ESG). However, the aforementioned controversies challenge this classification, especially in the environmental and social categories. It is ranked as average in the environment category; the company has a pipeline of clean technology products, but environmental contamination from 3M-manufactured PFAS dilutes the positive impact of clean tech.

Dividends

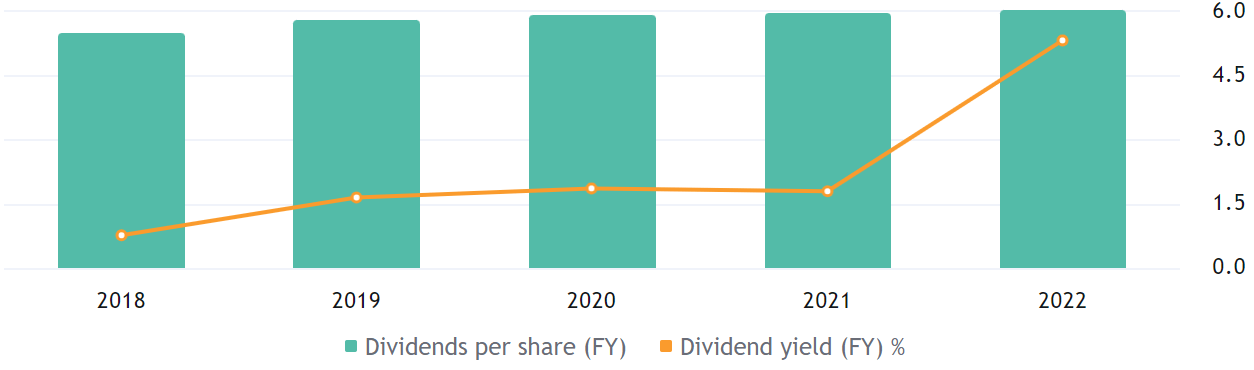

A bright spot for 3M, it has quite a high dividend with excellent dividend growth. 3M’s dividend yield is 5.87%, nearly 90% higher than the industry average of 3.1%. In the past five years, 3M has never failed to increase its dividend per share; however, the dividend yield fell mildly in 2021 from 3.36% to 3.33%, a (-0.89%) decrease.

The most recent dividend payment took place on March 11, 2023. The payout was $1.50 per share. Since the second fiscal quarter of 2016, the dividend payment has remained the same or increased every quarter.

3M’s one-year dividend growth rate is 0.68%, (-91.89%) below the sector median. Its five-year dividend growth rate is 4.09%, (-46.11%) below the sector median. While 3M’s dividend is very high and is growing, it is growing at a far slower rate than the overall industrials sector. High dividends are a great benefit a stock can offer, but dividend growth is an underappreciated, critical factor.

Valuation

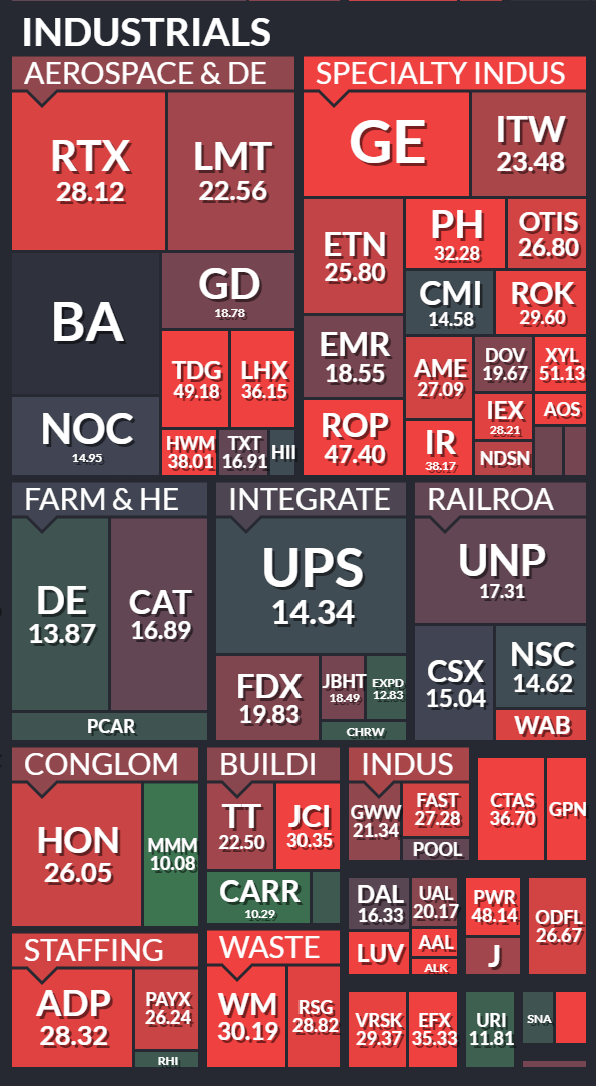

Despite the stock’s decline, investors still see it as overvalued. Yet it has a relatively low P/E ratio, 10.08. 3M stock is highly overvalued enough that it has room to fall over 50%.

In the past five years, 3M stock has fallen about (-51%). Its compound annual growth rate over the period is about (-13.4%). If one were to invest $100, about the price of one share today, five years ago, that individual would have about $48.76 (plus dividends) today with fewer than one share owned.

The below heat map represents the P/E ratios of every S&P 500 stock in the industrials sector. Of the two S&P 500 stocks in the Conglomerates industry, 3M’s P/E is by far the lowest; its P/E is over sixty percent lower than that of Honeywell International, the other Conglomerates stock in the S&P 500. It is additionally the stock with the lowest P/E of the S&P 500 stocks within the entire Industrials industry.

Technicals

Bearish patterns have been detected as the price has crossed the moving average. The short-term, mid-term, and long-term performance outlook is poor. Over the past month, the technical indicators present sell signals. The oscillators are neutral, but the moving averages are strongly negative.

A bullish “triple bottom” pattern has occurred. Most other indicators are bearish or neutral. This pattern could indicate positive movement in the short term.

Earnings

The fiscal fourth quarter 2022 earnings report led to a 6.21% decline in stock price for the day. 3M presented weaker earnings than Wall Street had estimated and announced 2,500 job cuts, citing “persistent” global macroeconomic difficulties. 3M posted an EPS of $2.28, 4 cents less than the estimate of $2.32, a (-1.72%) surprise.

Risk Assessment

The risk assessment for 3M is high. 3M’s five-year beta is 0.82. This is 18% lower than the market average of 1. Yet the stock has decreased at about the same rate over five years as the S&P 500 has increased.

The litigation against 3M could cost the company copious amounts of money, damaging its bottom line. High inflation and increased cost of living could impair its consumer discretionary and cyclical operations. Their products are experiencing decreased demand, further increasing the company’s exposure to the harmful impact of inflation. The company’s considerable diversification of business practices could help mitigate these risks, but they do remain high. Its revenue exposure is split into many business practices. Each generates no more than 15% of the company’s revenue.

Decisions and news related to 3M’s lawsuits could also generate unwanted, mostly negative, volatility. If in the future, 3M is to settle its lawsuits and repair its brand image, the risk associated with the stock would significantly decrease. Low ESG and a poor brand image may hurt potential future gains because investors will avoid this stock.

3M’s gross profits generated from research and development have begun to slow, especially since the onset of the COVID-19 pandemic. Sales are weakening, decreasing (-3.2%) from 2021 to 2022.

Future Outlook

In the long term (over one year), the stock will presumably decrease in value, continuing the post-COVID trend. The stock’s all-time high was in 2018. It had a strong rebound, like most stocks, in the first two fiscal quarters of 2020, increasing about 65%. The stock somewhat briefly reached and maintained pre-COVID levels for about eight months in 2021, never again to reach those levels, falling far more from its post-COVID peak to now than during the initial COVID-induced crash, which practically affected the entire market.

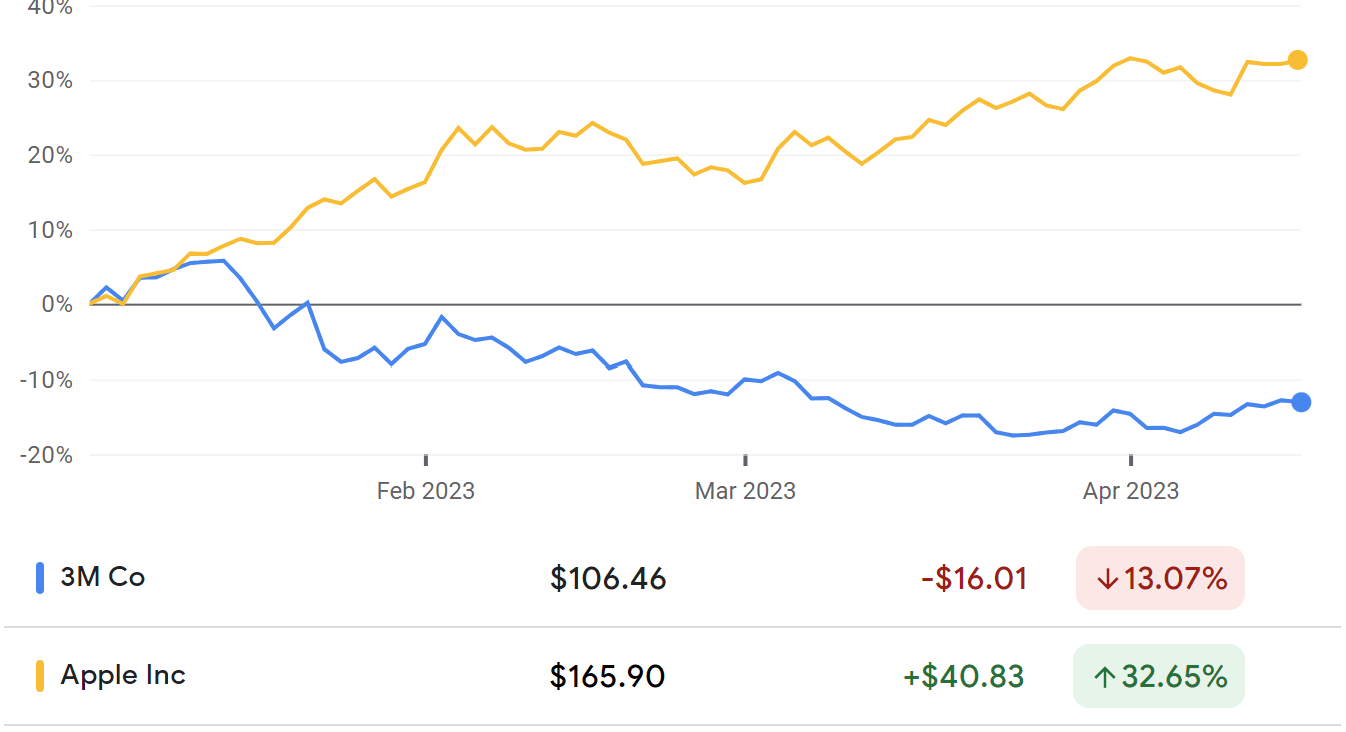

Over the short term, it could increase, but it would be unlikely to outperform the S&P 500 and industry benchmarks. The stock has been trending up since late March 2023, about matching the gains of the S&P 500. This shows a potential positive upside but no greater prospects than a broader ETF based on the risk assessment.

Until the end of fiscal year 2017, 3M was a blue chip stock that exerted high, reliable gains. It then reached a peak to which the stock price seems it will never return, at least not for a very long time. YTD (2023) 3M stock has decreased at a rate of about 2.5x greater than the rate at which Apple (NASDAQ: AAPL), the best-performing stock in the Dow Jones Industrial Average (INDEXDJX: .DJI), has increased. 3M is the worst-performing stock in the Dow year-to-date.

It is the opinion of this report that the stock is overvalued. The fair value estimate is assigned at $70.62, 34% below the current market value. Such a low value has not been achieved since 2009. Despite its low P/E, it remains highly overvalued and presents a high risk of falling further into its rout. ESG investors and those who wish to invest responsibly and follow the UN Principles for Responsible Investment (PRI) should especially avoid this stock.

More Stories

APPLE: A FUTURE AI POWERHOUSE?

WHICH SEMICONDUCTOR STOCK WILL END UP ON TOP?

THE BASICS OF INVESTING WITH RYAN JAMES: CHARACTERISTICS OF A GOOD STOCK