8,000,000,000. That gargantuan number represents the world’s current population. Just for reference, the United States represents roughly 330,000,000 people, or less than 5% of the world’s total population. The world’s population has doubled since 1980, and there is much more growth to come. Despite falling birth rates in much of the world, the United Nations estimates that the world will host 9.8 billion people by 2050 and a whopping 11 billion by the year 2100. These numbers translate to one practical reality: a whole lot of mouths to feed. And Archer, Daniel’s Midland aims to profit by feeding all of these new people.

By Stanley N. Getz, Securities Analyst

Archer Daniels Midland (ADM) is a global leader in the production of food ingredients, animal feed, and renewable fuels. With over a century of experience, ADM has built a strong reputation for its commitment to quality and innovation. The company operates across more than 160 countries and employs over 38,000 people worldwide.

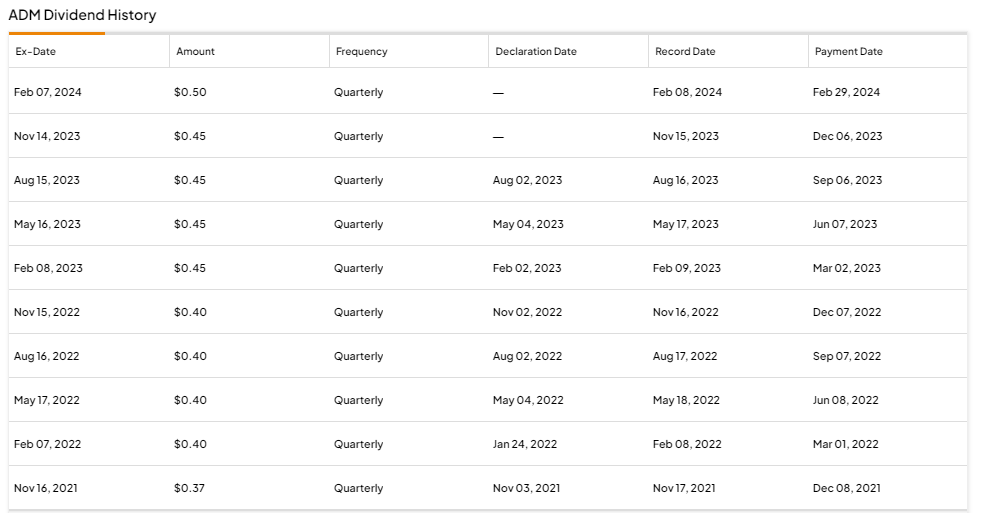

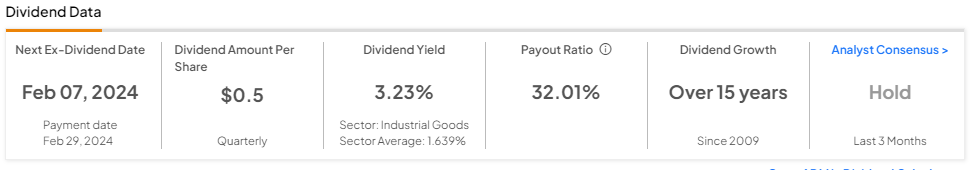

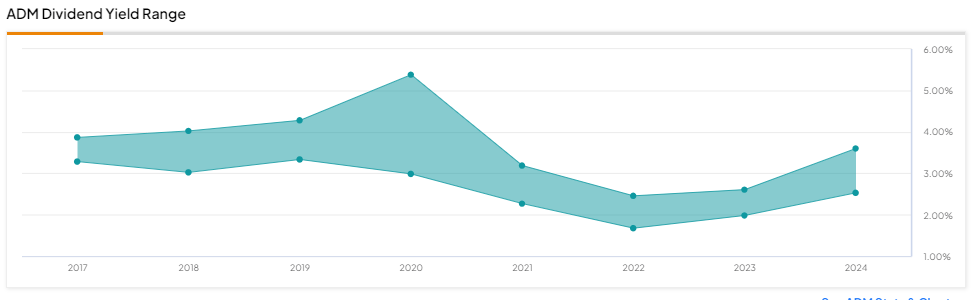

One of the key indicators of a company’s financial health is its dividend history. ADM has a long-standing track record of consistently paying growing dividends to its shareholders. Since 1927, the company has paid dividends every year, making it one of the most reliable dividend-paying companies in the market. The company has also demonstrated a consistent pattern of increasing its dividend payout over the years, reflecting its strong financial performance and commitment to rewarding its shareholders. As the number of hungry mouths has grown, so has ADM’s profit.

Analyzing the Sustainability of ADM’s Dividend

Archer Daniels Midland has a commendable track record when it comes to dividend payments. However, the sustainability of a dividend is a multifaceted consideration. One key metric to gauge this sustainability is the payout ratio. This ratio reveals the percentage of a company’s earnings that are distributed to shareholders in the form of dividends.

In ADM’s case, the company adopts a conservative approach to its payout ratio. A conservative payout ratio means that only a portion of the earnings is distributed as dividends, leaving a significant portion retained within the company. This retention is crucial as it provides ADM with the financial flexibility to reinvest in its operations, research and development, acquisitions, or other strategic initiatives. Currently, ADM only pays out 32% of it’s profits. Typically, a payout ratio of less than 60% is considered healthy. This means that ADM has ample space to keep raising it’s dividend for many years to come.

By maintaining a conservative payout ratio, ADM ensures that it has ample resources to fund ongoing business activities and future growth opportunities. This disciplined financial strategy not only safeguards the sustainability of the current dividend but also positions the company for potential dividend growth in the future.

Exploring the Growth Prospects for ADM and Its Dividend

Archer Daniels Midland operates in an industry that’s constantly adapting to change. It’s crucial for investors to grasp the potential for growth within this dynamic landscape. The company finds itself in a strategic position to leverage the surging global demand for food, feed, and renewable fuels. ADM’s significance becomes even more apparent as the world’s population continues its upward trajectory. The company’s diverse range of products is instrumental in meeting the escalating need for sustainable food and energy sources. This dual focus on food and renewable fuels aligns with the global shift towards more eco-friendly and responsible practices.

Moreover, ADM has been proactive in expanding its footprint into emerging markets, unlocking substantial growth avenues. As billions of people in emerging markets transition to a more “western” diet, their foods become more industrialized, demanding more of the kind of additives that ADM produces.

These markets not only provide new consumer bases but also open doors to diverse opportunities, further solidifying ADM’s position in the industry.

Considering these factors collectively, the future outlook for ADM appears promising. Its strategic alignment with global demands, commitment to sustainability, and penetration into burgeoning markets all contribute to a positive trajectory for the company’s growth. Investors can look forward to not only sustained performance but also the potential for increased dividends as ADM navigates and thrives in this evolving landscape.

ADM has implemented several strategies to drive growth and enhance shareholder value. One key strategy is its focus on innovation and product development. By investing in research and development, ADM aims to create new and improved products that meet evolving customer needs. Additionally, ADM has been actively pursuing strategic acquisitions to expand its product portfolio and geographical reach. Through these acquisitions, ADM gains access to new markets and technologies, enabling it to drive growth and create value for its shareholders.

Identifying Trends That Could Drive Growth for ADM

Several trends in the global market present opportunities for growth in ADM’s business. One such trend is the increasing focus on healthy and sustainable food options. Consumers are becoming more conscious of their dietary choices, creating a growing demand for plant-based proteins and clean-label ingredients. ADM, with its expertise in plant-based proteins and sustainable food production, is well-positioned to capitalize on this trend. Furthermore, the shift towards renewable energy sources and biofuels presents another avenue for growth for ADM, given its leadership in the production of renewable fuels. By leveraging these trends, ADM can drive further growth and enhance its market position.

The food and agriculture industry is subject to various trends that can impact ADM’s growth prospects. One such trend is the increasing demand for sustainable and traceable food products. Consumers are placing greater importance on knowing where their food comes from and how it is produced. ADM’s focus on sustainability and transparency positions it well to capitalize on this trend. Furthermore, advancements in technology, such as precision agriculture and data analytics, can significantly enhance ADM’s operational efficiency and productivity. By staying at the forefront of these industry trends, ADM can continue to drive growth and maintain its competitive edge.

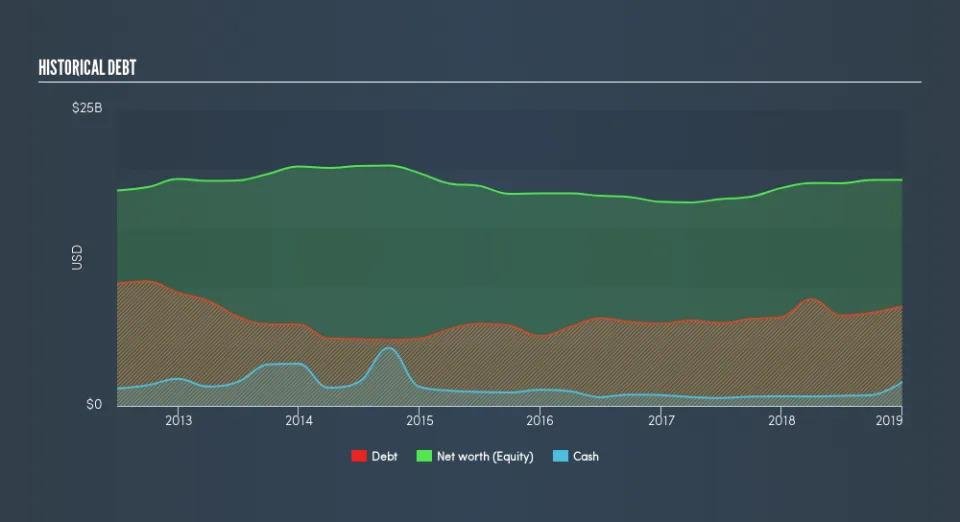

Assessing the Safety of ADM in Terms of Debt Levels

Debt levels play a crucial role in determining a company’s safety and financial stability. ADM has maintained a prudent approach to managing its debt, with a manageable debt-to-equity ratio. This indicates that the company has a reasonable level of debt compared to its equity, reducing the risk of financial distress. ADM’s ability to generate consistent cash flows and its strong credit rating further enhance its safety in terms of debt levels. By maintaining a healthy balance sheet, ADM can withstand economic downturns and continue to invest in growth opportunities.

To gain a better understanding of ADM’s debt position, it is essential to compare it with industry benchmarks. ADM’s debt levels are in line with industry norms, indicating that the company is not overly leveraged. This is a positive sign as it suggests that ADM is managing its debt prudently and not taking excessive financial risks. By maintaining a healthy debt position relative to its industry peers, ADM demonstrates its commitment to long-term financial stability and growth.

Opportunity Through Scandal

Despite all of these promising aspects, the company’s share price has been taking a beating lately. In January and early February, the shares have plunged from $72 to $52. This has left the stock with a profit to earnings ratio of just 7.5. This is considered to be a very low P/E ratio for a company with a solid balance sheet and such an established long term track record.

Unfortunately, ADM has lately suffered a tsunami of bad publicity due to a potential accounting fraud that has been discovered in it’s nutrition unit. An anonymous whistle blower triggered an SEC investigation, and it looks like some numbers were inflated to help unscrupulous executives hit bonus targets. High level executives have been fired, and some earnings may need to be restated.

While this situation represents a potential risk for investors, it may also provide a golden opportunity to purchase a marquee company for cheap. As Fortune magazine points out, the division in question accounts for less than 10% of the agricultural giant’s total revenue. This means that any accounting restatements are likely to be minor, almost non-material to the company’s overall profits and prospects. Ultimately, billions and billions of people still need to be fed, and there are only so many established companies that can do the job.

It’s rare to be able to access this kind of steady dividend growth for just 7.5 times annual earnings. Some investors may find this to be an attractive risk/reward trade off.

Strong Potential

Based on its rich history of fostering growth and providing value to shareholders, Archer Daniels Midland (ADM) stands as a potential investment opportunity. Its demonstrated ability to consistently increase dividends, alongside a dedication to sustainable and innovative practices, positions ADM favorably in the face of global demand for food, feed, and renewable fuels. Moreover, the company’s keen attention to industry trends and prudent debt management bolster its potential for growth and the sustainability of dividends. As ADM leverages its strengths and capitalizes on market opportunities, investors may find confidence in its capacity to foster long-term growth and yield appealing returns.

More Stories

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?

MCDONALD’S: SERVING UP TASTY DIVIDEND PROSPECTS