By Mackenzie Deming, Equity Analyst

Let’s talk about Abbvie– this company was derived from Abbott Laboratories, a primary healthcare and medical device company that is very well known nationwide in the United States. Back in 2011, Abbott Laboratories decided that it was going to split into two different publicly traded companies– Abbott being focused on diagnostic equipment, medical devices, etc. while Abbvie would be the research-based branch of the pharmaceutical company (Sunrise House). Abbvie was in turn formed on April 10, 2012 and was listed on the New York Stock Exchange on January 2, 2013. Additionally, this spin-off from Abbott houses the massive breakthrough drug, Humira. Having produced about $21 billion in revenue for Abbvie in 2022, Humira is administered via injection and is used to treat rheumatoid arthritis, Crohn’s Disease, plaque psoriasis, and ulcerative colitis. Up until now, Humira has been the best selling drug of all time.

While Abbvie is best known for its production of Humira, some of the company’s other popular manufactured drugs are: Celexa & Lexapro (treatments for depression), Loestrin (form of birth control), Norco (used for moderate pain), and Vicodin (narcotic pain medication) (Sunrise House). In 2022, Abbvie was taken to court in an antitrust case against an alleged “patent thicket” they placed on Humira in an attempt to block any competition. However, the pharmaceutical company won an appeal of the case, and the court ruled that its 132 patents related to Humira didn’t violate any antitrust laws.

While Humira faced a patent cliff in 2016, the company was concerned that they couldn’t compensate for this lost revenue as Humira contributed to about 50% of Abbvie’s revenue (Seeking Alpha). However, Abbvie was able to to launch about 20 new products by 2020, allowing them to diversify away from Humira and become an even more attractive stock than its parent company, Abbott (Seeking Alpha). Abbvie now has a predicted revenue growth to over $35 billion by 2025, and places an emphasis on diligently investing into R&D through spending $4-5 billion annually during 2015-2017.

Now that we’ve been introduced to Abbvie’s story, let’s now consider the pharmaceutical company’s dividend and future growth prospects. Abbott Laboratories has a track record for paying its shareholders a rising dividend each year; the company has increased its dividend for 40 consecutive years. How has Abbott’s spin-off, Abbvie, done in this department?

Abbvie’s Current Dividend

When considering Abbvie’s dividend, the dividend began at around $0.40 each quarter in 2013, and has since increased each year to reach a total of $1.48 each quarter in 2023, resulting in an annual dividend payment of $5.92 to its shareholders. Abbvie (ABBV) has a dividend yield of 4.43%, better than most of it’s peers in the world of Big Pharma. Additionally, Abbvie has a noted price-to-earnings ratio of 32.15, indicating that the company is valued more highly than the typical average market P/E ratio of about 20-25. This P/E ratio isn’t too alarming, however, it could potentially be a bit lower.

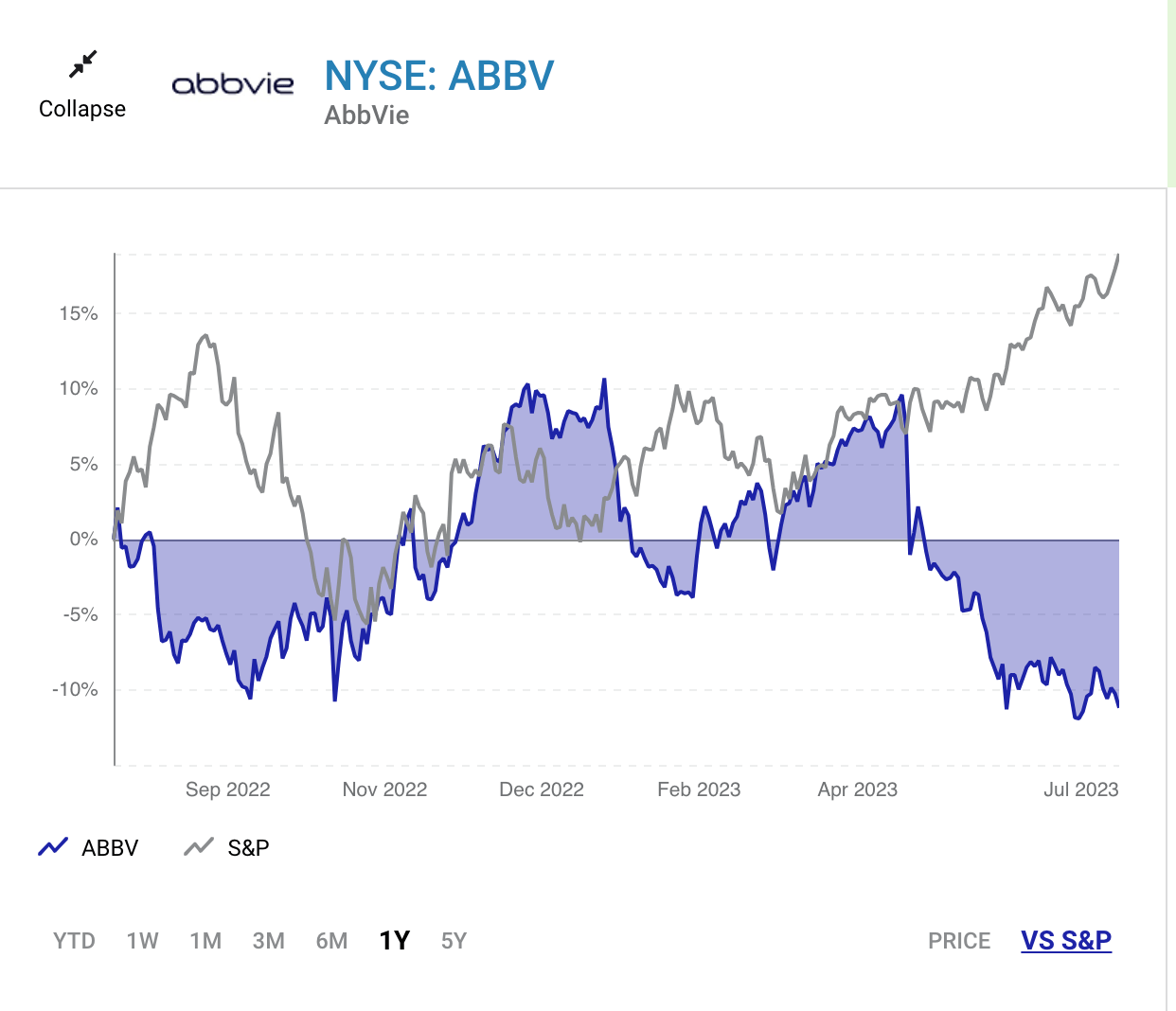

Abbvie’s infamous cash cow drug, Humira, lost its patent exclusivity recently, and the company has undoubtedly taken a financial hit this year. In January of this year, the first biosimilar product to Humira hit the market, and Abbvie lost its edge in its primary market share of this product (The Motley Fool). Let’s look at the stock fluctuations in comparison to the S&P 500 over the past year or so.

As you can see, there was a very obvious dip starting around April 2023 and resulting in about a 10% loss in market valuation. So the real question is– how safe are Abbvie’s dividends really? Considering the patent expiration of the world’s best selling drug, are the company’s dividends still a good source of long-term stable income?

Measurements of Dividend Sustainability

As Abbvie turns to other sources of revenue after Humira hit its peak, the company has a payout ratio of 134.35%. This is rather high considering this is the amount that Abbvie pays out in dividends to its shareholders in comparison to its total earnings. However, the cash payout ratio is about 41%, which makes it clear that Abbvie can afford to raise its dividend for longer. You may ask how this is possible– in considering the high payout ratio, this is the number derived from Abbvie’s accounting profits that is being given back to shareholders in the form of dividends. When we turn to the cash payout ratio, this number is used far less in determining how a company can allocate its money for future growth of earnings and dividends, but it is by far the most accurate. Considering that the cash payout ratio places an emphasis on what is actually needed to pay the dividends out (cash on hand), investors should never overlook this metric. At the end of the day, dividends come from cash flows, not intangible accounting fictions having to deal with net income. In calculating cash payout ratio, this number is derived from operating cash flow only after the excess capital expenditures and preferred dividend are subtracted. Therefore, Abbvie’s 41% cash payout ratio is a number that has been protected from further manipulations that earnings would face. From this, investors can note the strong sense of cash flow Abbvie has established.

For the past year even, Abbvie’s market value has fallen continuously. Of course it has its peaks and troughs, but starting on July 11, 2022, the market price was $153.62 per share, whereas on July 14, 2023 the market price sat at a decreased $136.01 per share. This past quarters revenue growth was about -9.7%, and quarterly earnings growth was about –94.70%. Again, this last measurement refers only to GAAP earnings, not to the cash the company actually generated. The debt-to-equity is 469.53%. This could raise concern for investors that Abbvie will not be able to pay off their long-term debt seeing as the company carries a substantial gross debt load.

However, let’s take a deeper dive into the financial plumbing of Abbvie. A majority of their long term debt is locked in at low interest levels that are fairly protected against rising interest rates, so today’s higher interest rate environment isn’t necessarily a concern for Abbvie in paying off debt. In 2021, Abbvie had a recorded long term debt of $64.189 billion, but this was a notable 17.23% decrease from 2020. The company’s long term debt has steadily decreased each year since, and it sits at $59.292 billion as of March 31, 2023 which is a 6.66% decrease from the previous year. While Abbvie still holds a large amount of debt regardless, it isn’t as bad as it looks considering that they have a market capitalization of $289.4 billion, indicating that they can raise capital if needed.

Looking at the earnings through taking net debt divided by Abbvie’s EBITDA value generates a ratio of about 2.0 (Yahoo Finance). This gives investors a sigh of relief seeing as the use of debt is relatively moderate when we consider the business’s still robust cash flow. Additionally, Abbvie’s EBIT value is about 10.1 times the interest expense it holds, indicating that the debt they hold is pretty minimal. Again, it is more worthwhile considering their cash on hand rather than the mere accounting profit numbers– so it is worth noting that Abbvie produced more free cash flow in comparison to EBIT the past three years (Yahoo Finance).

Abbvie has been well aware of the financial stagnation caused by the loss of Humira’s patent exclusivity. It is projected that new drugs Skyrizi and Rinvoq will be able to compensate for the loss of Humira by 2025 (The Motley Fool). In fact, it is expected that Skyrizi and Rinvoq will even surpass the amount of sales from Humira by 2027. Additionally, drugs such as Teliso-V (potential therapy for non-small cell lung cancer) and a gene therapy for wet age-related macular degeneration are expected to earn approval soon and hit the markets (The Motley Fool). Abbvie has also discussed getting into collaborations with smaller drug production companies with promising products.

As for the future growth prospects for Abbvie’s dividend, the company is considered to be in what is known as the “Dividend Kings” club– meaning that they have an attractive dividend payout continuously paid out to investors. The company recognizes that it’s revenue will fall a bit in the short term, however, Abbvie is committed to increasing its dividend for its shareholders. Abbvie has promising new products about to hit the markets soon, and has been preparing for the downfall of the infamous Humira for years. This company is prepared to be resilient against the loss of Humira, and is dedicated to rewarding its loyal shareholders.

More Stories

TOTAL ENERGIES: PREPARED FOR THE UNKNOWN

VERIZON COMMUNICATIONS INC: DIALING UP A HIGH DIVIDEND

ZOETIS: A BREAKOUT OPPORTUNITY