By Mackenzie Deming, Equity Analyst

The Pfizer public perception versus reality: let’s talk about it. In the face of falling revenue, many questions arise about the stability of the company and its ability to pay off debt and pay out dividends. Pfizer’s breakthrough COVID-19 vaccine appears to be coming down from its peak. Does that mean that it is all down hill from here for Pfizer shareholders?

Pfizer is a top national biopharmaceutical company that prides itself in its breakthrough medicines and drugs. Founded in 1849, cousins Charles Pfizer and Charles Erhart founded the company in a small building in Brooklyn, New York (Pfizer.com). The company quickly expanded over the years, moving headquarters to Manhattan, New York and sales had reached a whopping $3 million by the time Charles Pfizer died in 1906 (Pfizer.com).

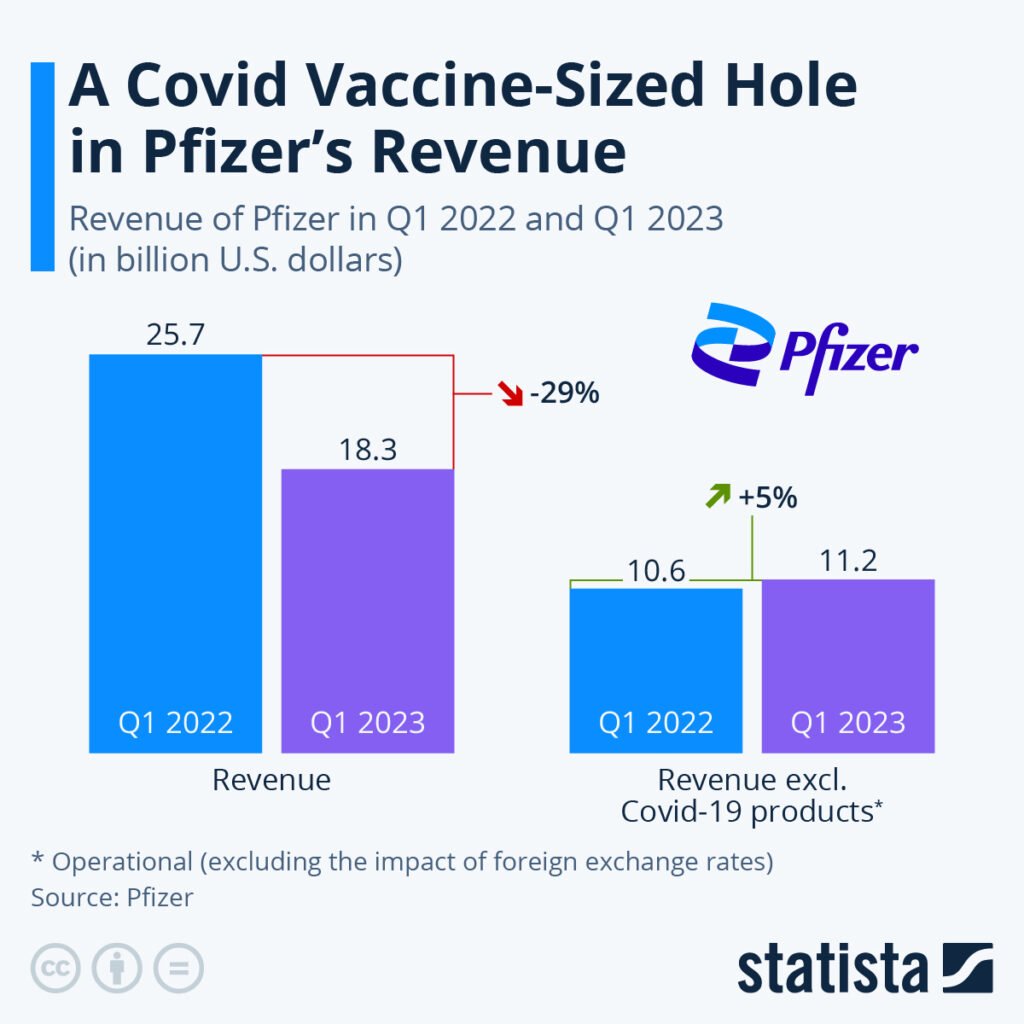

Pfizer’s company motto of “breakthroughs that change patients’ lives” truly reflects their core values of scientific innovation and breakthroughs, driving change, and care for others’ lives. Some of Pfizer’s most popular and well-known drugs have been Advil, Bextra, Celebrex, Diflucan, Robitussin, Viagra, and the famous COVID-19 vaccine (DrugWatch.com). In 2022, Pfizer had record revenue of $100 billion, with the COVID-19 vaccine accounting for approximately $37.8 billion which was only a 3% increase from this vaccine’s sales in 2021 (CNBC). It was noted that Pfizer in fact told investors to expect about a 33% decline in the company’s revenue in 2023 as the demand for blockbuster COVID-19 vaccine dies down. The expected COVID-19 vaccine decline for this year was projected to be 64%, taking the vaccine sales from $37.8 billion to $13.5 billion.

Financials Under the Microscope

Essentially, concerns about the greater financial well being of the company are being brought to surface as the pressing need for the Pfizer COVID-19 vaccine starts to fade. Sales and revenue are decreasing, and investors are getting concerned about the company being able to pay out dividends, continue to produce a profit, and be able to pay off its massive amount of debt.

However, it is worth noting that without including the effects of the COVID-19 vaccine, the company actually increased its revenue by 5% from Q1 in 2022 to Q1 in 2023.

Now turning to why investors are concerned, Pfizer has experienced some minor setbacks this year. As previously explained, obviously the COVID-19 vaccine isn’t as hot of a commodity as it has been the past years. Additionally, Pfizer stopped the process of developing a once-daily pill for those who suffer from diabetes and transitioned into the production of a twice-daily pill (Investors.com). However, companies such as Nordisk and Eli Lilly already have a one-up on this drug, taking a market lead. Thus, Pfizer’s stock has “slouched 29% this year”.

Looking at Pfizer’s SEC filings for the first quarter of 2023, investors may experience panic looking at the decrease in both current assets ($51.259 billion to $50.078 billion) and total assets ($197.205 billion to $195.617 billion). Additionally, the net income decreased from April 2022 to April 2023 from $7.879 billion to $5.555 billion. This may lead investors to be hesitant to invest into Pfizer since it appears that their profits are shrinking. The net cash from operations decreased significantly, from $6.541 billion in 2022 to $1.212 billion in 2023.

However, Pfiizer’s dividend payout ratio still looks promising; with a ratio of 31.1%, this means that 68.9% of annual profits are left over for the company to reinvest into its business. This is a strong payout ratio that indicates the company has room to invest into other growth opportunities and holds a solid financial position.

While there are some of the hesitations that investors are facing, we have to take a deeper dive into the financials. The reality is that Pfizer is doing absolutely fine. If we turn to Pfizer’s SEC filings once again, we can see that since December 2022 through April 2023, it was able to decrease its short term obligations from $42.138 billion to $36.562 billion. The total liabilities decreased over this period as well from $101.288 billion to $94.381 billion. The company does carry many billions in debt, but that debt has been mostly locked in for very long time periods at the exceptionally low interest rates of the last ten years. Pfizer is currently paying off its obligations with no problem, and there is no reason to believe this won’t continue into the future.

Since 1999, Pfizer has been able to raise its dividend consecutively every year. Starting at just a mere $0.08 in 1999, the dividend has since then increased to a quarterly $0.41 resulting in a yearly dividend of $1.64. In considering the dividend yield, this number comes out to be about 4.43%, which is higher than most of its Big Pharma competitors. Remember, even at this prodigious dividend yield, Pfizer is still only paying out a fraction of its total profits in the form of quarterly dividends. Even with Covid-19 revenue evaporating, the company could continue to grow its dividend for years.

Future Prospects

So we can see that, even with topline revenue heading in the wrong direction, Pfizer is in stable financial condition and currently has no problem meeting its financial obligations and paying its hefty dividend. But what about the future?

As of May 2, 2023, there are 38 drugs in Phase 1 testing, 28 drugs in Phase 2, and 23 in Phase 3 (Pfizer.com). You will remember that Phase 3 is the last experimental phase for a drug, and many of these will eventually become viable commercial products. The company is working overtime to reach their goal of treating 225M individuals with their breakthrough treatments by 2025. In fact, AstraZeneca just bought into a $1 billion deal with Pfizer to buy a “portfolio of rare disease gene therapies” from them. Pfizer also just partnered with Flagship Pioneering to create a pipeline of 10 new programs, with hopes of generating $700 million for each successful drug created. The purpose of this partnership is to address the unmet needs of Pfizer’s areas of interest– vaccines, inflammation/immunology, oncology, rare diseases and internal medicine (Fierce Biotech). This will allow Pfizer to bring a sense of commercial and research expertise to Flagship and in turn Flagship will share their “diverse portfolio of technology platforms”. The company’s management is currently working day and night to achieve its next smash hit blockbuster drug, and it likely has the expertise and resources to produce that next big hit.

While Pfizer may seem to be unattractive to the short-term thinker, taking a deeper dive into the operating activities of the company will reveal that it is doing just fine and is showing promise to continue to drive revenue as well as increase its dividend. Pfizer’s price to earning ratio as of July 2023 is 6.96, which could be considered outrageously low; some investors may see this company as “undervalued” or “on sale” because the market price is so small in comparison to its earnings. In comparison to its competitors, Merck & Co has a PE ratio of 20.7 and Eli Lilly has a PE ratio of 74.84. As we can see, these two big pharma peers come in with much higher numbers, and this should indicate to investors that there is hidden potential in Pfizer. The dip in revenue was expected from the company in the short-term, as COVID-19 immunizations are no longer the hot commodity they once were. Pfizer will continue to be the pharma powerhouse it is, and the future prospects realistically appear to be promising.

More Stories

J&J: THE NEXT ELI LILLY?

ELI LILLY GOES BEAST MODE!

IS PFIZER’S STOCK ON SALE?