By Ryan James, Dividend Analyst Fellow

About the Company

Spun off from Pfizer in 2013, Zoetis (NYSE: ZTS) is the largest producer of vaccines and medications for pets and livestock. It has been an S&P 500 company since its inception as a separate entity from Pfizer. It is also a Fortune 500 company.

Zoetis offers over three hundred product lines, diversified over eight animal species; this could provide protection from factors like the avian influenza outbreak that affect one animal species. The company has introduced about one thousand new products and innovations in the past five years. This emphasizes the company’s constant innovation and potent product pipeline fueled by its research and development department.

The stock has a market capitalization of about $80 billion, making it a large cap stock. And its dividend yield is 0.86%. Unfortunately, this is below the pharmaceutical industry average yield of 2.35%. It will only allow for a distribution of about $1.50 per share at the current stock price of about $175, as of February 15, 2023; however, the five-year annualized dividend growth rate is 25.08%, nearly four times higher than the sector average of 6.5%. The company also sports a dividend payout ratio of just 35%. This means that only 35% of the company’s current profits are paid out as dividend. There is plenty of spare cash that could be distributed to shareholders in the future.

The company’s moat is wide and stable. While a growing moat would be ideal, this is still significant because it shows strength in a competitive industry.

Market Trends

Synthetic meat companies like Beyond Meat (NASDAQ: BYND) have been trending down since their peaks in 2019 and 2020, and, over decades, people have been treating their pets more and more like family. Parents have essentially begun equating their dogs as siblings to their human children. A German Shepard named Gunther IV is worth about half a billion dollars and is now the subject of a popular Netflix series entitled Gunther’s Millions.

Dogs and other pets are treated like royalty—or at least like humans; some pet owners have spent up to $3.2 million on jewelry for their dogs. The average annual cost of owning a dog is $480-$3,470. Once that dog reaches old age, veterinary expenses can be incredibly high as owners spend copious amounts to keep their beloved pets alive.

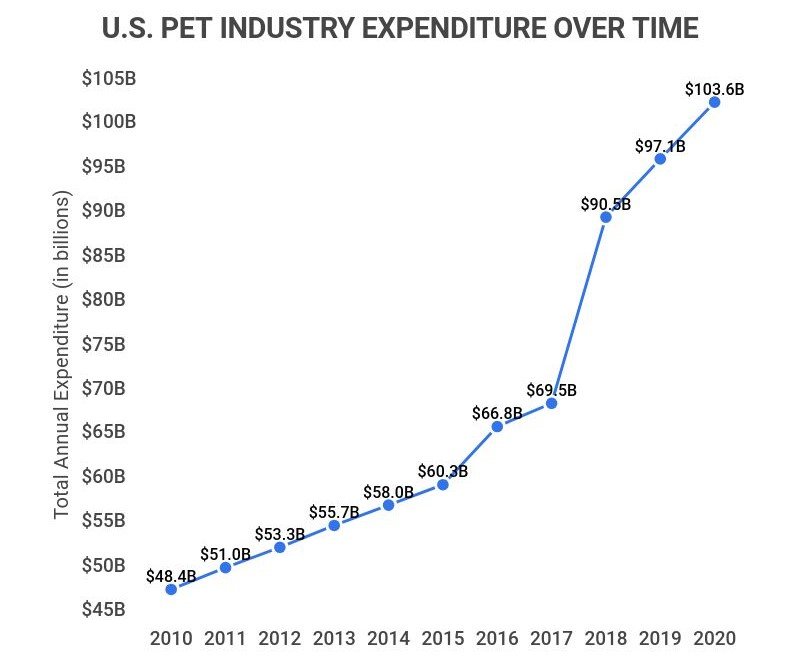

Many owners of elderly dogs purchase large quantities of medications to keep them alive. They often also spend primarily on treatments for a vast range of conditions and on veterinarians. The overall spending on pets in the United States is increasing drastically, even in comparison to CPI. The increase in the chart below is over 114%, compared to a 19% increase in buying power over the same period, according to the United States Bureau of Labor Statistics CPI Inflation Calculator.

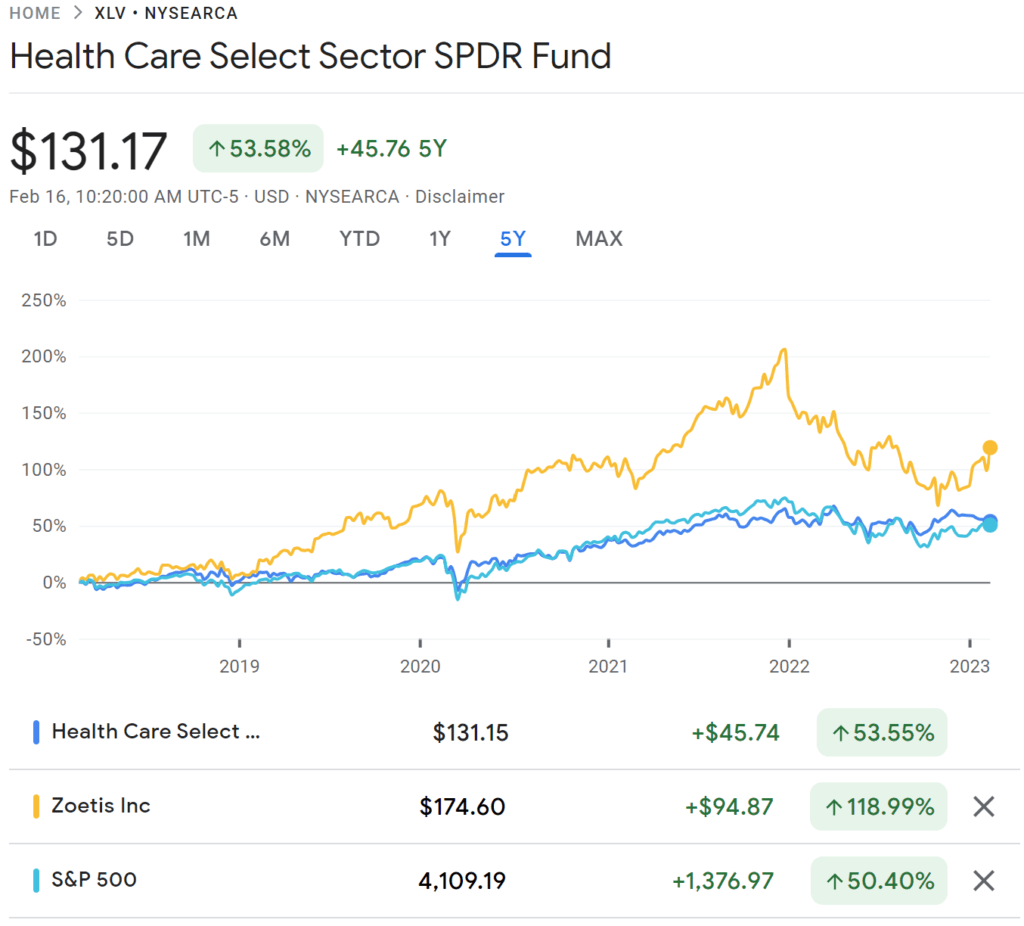

Over the past five years, Zoetis stock has outperformed the Health Care Select Sector SPDR Fund (NYSEARCA: XLV), an ETF with over $40 billion AUM which tracks the healthcare sector of the S&P 500, by over 75%. The Health Care Select Sector SPDR Fund has slightly outperformed the S&P 500 over the same period. Zoetis is the nineteenth-largest holding in the ETF, with 3,809,923 shares held, valued at over $650 million.

As people have fewer children and more pets, this becomes a growth market. With fewer children, one has more expendable income for discretionary spending and necessities, much of which can be spent on pets and pet products. Many wealthy individuals’ pets receive far better healthcare than most humans worldwide.

Dr. James W. Lloyd of Animal Health Economics wrote an article entitled “Pet Healthcare in the US: Are There Enough Veterinary Specialists? Is There Adequate Training Capacity?” In the article, Lloyd cited, “Strongly rooted in the ongoing evolution of the human-animal bond, consumers’ willingness to spend on pet healthcare has been increasing for at least 40 years. This increase in spending is showcased through increased numbers of visits, along with more and higher value products and services per visit.”

Fourth Quarter and Full Year 2022 Earnings Report Analysis

Zoetis reported $2 billion in revenue in Q4, an increase of 4%, which misses the previous estimate of $10 million. The stock is up over 7.2% since reporting earnings on February 14 before the opening bell, as of February 16. The company expects between 6% to 8% operational growth in revenue.

Shares reached a six-month high after beating the earnings estimates. The earnings show prospects of positive growth for the next quarter. No significant obstacles were mentioned during the earnings announcement. Investors cheered after the earnings announcement, indicating that the company not only performed well on paper but also presented good qualitative signals.

Technical Analysis

Over the past month, the technical indicators have been positive. The oscillators have received a “buy” rating, as have the moving averages. Among the most critical metrics, Zoetis displays positive momentum and seems to have been trending upwards since Rep. Curtis’ most recent purchase. The research methodology to determine these ratings necessitated eleven different oscillators and fifteen moving averages.

Recently, the stock’s commodity channel index has presented bullish signals. This indicator compares the live price level to the average over time. This is a bullish event.

Overall, technical indicators for ZTS have been bullish, expressing far more bullish patterns than bearish ones.

Financials

Zoetis is a very profitable corporation. Its total revenue of about $2 billion is approximately 56.25% greater than its operating expenses of $1.28 billion, far above the industry average. This leaves the company with $723 million in profits, far above the industry average.

According to the company’s Q3 2022 financial statement, animal companion (pet) products have been experiencing an increase in sales, and livestock products have been experiencing a decrease in sales. About 55% of the quarterly revenue came from the United States segment. The report communicates that many of their individual products are continually receiving approval in more countries. They have multiple first-of-their-kind innovative products, as seen with Liberla (bedinvetmab), the first injectable pain relief monoclonal antibody treatment for dogs with osteoarthritis.

Zoetis completed its acquisition of Jurox, a biopharmaceutical company based in Australia. This grows its pharmaceutical portfolio and expands its international business segment. Zoetis acquired Basepaws in June 2022. They have since greatly expanded Basepaws’ product output, suggesting that the acquisition has benefited Zoetis and that the addition of Jurox will likely yield similar results.

The company’s P/E ratio is 31.4, demonstrative of investors’ willingness to pay more of a premium for Zoetis stock than the average publicly traded pharmaceutical stock, as the industry average is 12. Whereas this could hinder growth prospects, it shows that investors believe in the company’s merits.

Investment Prospects

Vetsource has recorded a robust year-over-year increase in vet visits, an encouraging sign for companies like Zoetis.

Zoetis is an ESG leader, especially among its peers in the pharmaceutical industry. If the trend of investors continually caring more about ESG over time persists—and it very likely will—Zoetis’ higher ESG score will help to attract and retain investors. Zoetis is especially strong in the social category.

Zoetis has little exposure to possible future market conditions that could strongly affect its bottom line. Its main vulnerability is that, in a high inflationary environment, some customers may purchase generic alternatives; however, inflation seems to have peaked, and this has not appeared to be much of an issue.

Zoetis maintains strong pricing power because its products are for animals, not humans. Interventions such as Medicare and Medicaid and insurance companies with the ability to negotiate prices significantly reduce the pricing power of pharmaceutical companies that manufacture products made for humans. Animals do not have these.

There is a growing interest in alternatives to antibiotics for livestock. This could present a valuable opportunity for innovation. If Zoetis seizes this opportunity, it could create and introduce several new products with little competition.

The company’s most recent 10-K SEC filing presents no significant risk factors that could not be applied to other companies in its sector except for slight restrictions due to its relationship with Pfizer. These restrictions should have neither a notable impact on company operations nor the value of the stock.

Zoetis holds $13.9 billion in assets and $9.356 billion in liabilities. This nets $4.544 billion for the company.

Zoetis demonstrates the qualities of a low-to-medium risk stock, especially with a somewhat low beta of 0.94, suggesting that the stock carries slightly less volatility than the overall market (which has a beta of 1).

The stock is neither overvalued nor undervalued. Its high P/E ratio expresses overvaluation. But its auspicious growth prospects and poor one-year performance, among many other factors, show encouraging signs that the stock can continue to increase. Insider activity, while not heavily tracked for this stock in particular, is highly favorable.

As explained in “Abbott and Abbvie: The Power Of Spinoffs, Illustrated” by Equity Analyst Jiayi Lang, spinoffs can provide two separate, strong stocks for which the spinoff is mutually beneficial. The spinoff from Pfizer allows Zoetis to focus solely on manufacturing biopharmaceutical products for animals, while Pfizer prefers to target human-centered products.

The stock shows encouraging signs that it will outperform the market. Because of this and all of the aforementioned, Zoetis could be an excellent long-term investment. It is likely to perform best over the next three-to-five years but may also be a viable investment vehicle in the longer term.

More Stories

VERIZON COMMUNICATIONS INC: DIALING UP A HIGH DIVIDEND

HOW SAFE IS ABBVIE’S DIVIDEND?

DIGGING FOR BURIED TREASURE: BHP LIMITED