Coca Cola, Procter&Gamble, and Johnson&Johnson are not financial names that titillate today’s Robinhood Generation. But maybe they should be. These kinds of household names have generated massive wealth over time for patient investors. And young people have a unique advantage in the world of dividend investing: time.

By Mackenzie Deming, Financial Analyst

When considering dividend stocks, people’s minds are typically drawn to an older investor population. This older population typically utilizes the stability and secure growth that dividends have to offer once they reach retirement. Additionally, because the retirement age has increased, social security benefits for the future are questionable, and low risk investments (such as T-bills) have slowly decreased in yields (up until about one year ago), the mature investor population needs to turn to another source of a stable stream of income – hence dividends. Because of the increasing interest rates in today’s economy, risk free bonds essentially serve as competition to dividend stocks. However, what truly differentiates the benefits of investing in dividend stocks? The answer is their promising potential for growth.

Today’s younger population is becoming more increasingly interested in building their portfolios and investing in the markets– with that being said, there is a heavy focus among the younger investor population to invest in “flashy”, higher-risk, more volatile stocks. While these investments may yield a higher return in the short run, it is worth questioning why these younger investors aren’t attracted to the stable source of income that could be generated through dividend stocks.

The advice to “start investing early” is thrown out to the younger populations, however, little guidance is ever provided on how they should get started. When considering dividends, each quarter (sometimes semiannually or annually) a portion of the company’s earnings are distributed to the shareholders. There is a declared date that the company will do so, and then in turn these dividends can either be liquidated into cash, or can be reinvested.

The Power of Growth

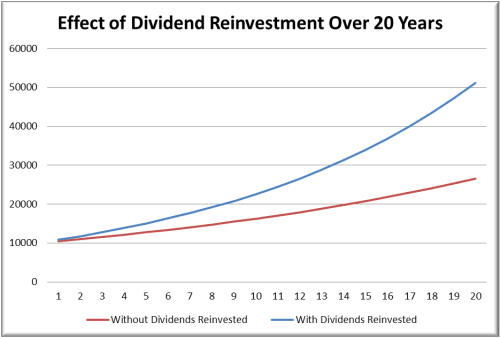

An attractive quality that should catch the eye of a younger investor is the potential for the dividend to grow over time. This is where the idea of compounding comes into play; compounding is essentially the additional interest earned over time on the principal amount invested through the continuous reinvestment of the dividend. Therefore, the key to this idea of compounding is to continuously reinvest your dividends rather than immediately cashing them out. For example, if you were to purchase 10 shares of a company’s stock for $150 per share, and the company paid a 1% dividend, then the quarterly dividend paid out would add up to $1.50 per year. Your total yearly dividend for 10 shares would be $15. Now if you take this $15 and reinvest it rather than cash it out, you now technically own a little bit more than 10 shares, and assuming the stock price hasn’t changed, your new dividend for the next quarter would be $15.15. In the short term, this doesn’t seem as attractive to younger investors as investing in higher-risk stocks such as Tesla. However, long term reinvestment in dividends provides growing and stable income.

If you were to invest in dividends that pay 3.5% over 20 years with a growth rate of the capital value of shares of 5%, there is a long term difference between the value of dividends that were immediately cashed out and spent and those that were reinvested. If you spent your dividends, then you would still have $26,533 after 20 years, whereas if you reinvested your dividends, you would have a whopping $51,120 after 20 years. By simply investing $10,000 in boring shares of companies that people use every day, you would have grown your wealth by 500% without much work on your part. That is the power of a growing dividend!

While most dividend stocks are taxable, it is worth noting that the dividends paid into accounts such as a 401k plans, IRAs, and Roth IRAs are not taxed. Should you invest into any one of these, they are what is referred to as tax-deferred. An individual would not be taxed on the amount they invest into their 401k account, and in turn, the earned dividends would not be taxed either. It also decreases your overall taxable income. A 401k’s dividend distribution can work in the same two ways– you can choose to reinvest the dividends in the form of shares, or you can accept the dividends as cash payments. When considering a traditional IRA, dividends work in a very similar manner. One can invest in stocks within this retirement account, which again is tax-sheltered, and then in turn reinvest these dividends to increase total money in the retirement account (TheBalanceMoney.com); a traditional IRA gives tax benefits today (Schwab.com). When considering a Roth IRA, contributions to the account come from after-tax dollars, and will benefit an individual when he/she wants to make withdrawals in the future (Schwab.com). The main difference between a traditional IRA and a Roth IRA, is that proceeds from the Roth IRA will not be taxed, even when you take them out to spend in your retirement.

Delayed Gratification and Growth

The younger population seeks out immediate high yields, where they should rather be thinking long term. Another key component for younger investors to look into when investing in dividend stocks is to seek out stocks that have the potential to grow rather than to take the dividend with the highest yield today. A high-yield dividend stock essentially pays a higher dividend than their particular industry or the stock market in general. Typically, real estate investment trusts, telecommunications companies, and utilities companies pay higher yielding dividends; the reasoning behind this is because they have better and more stable future predicted cash flows and have the ability to distribute out a higher dividend to its shareholders today (TheStreet.com). But in return for a higher dividend today, they may not grow these dividends much over time.

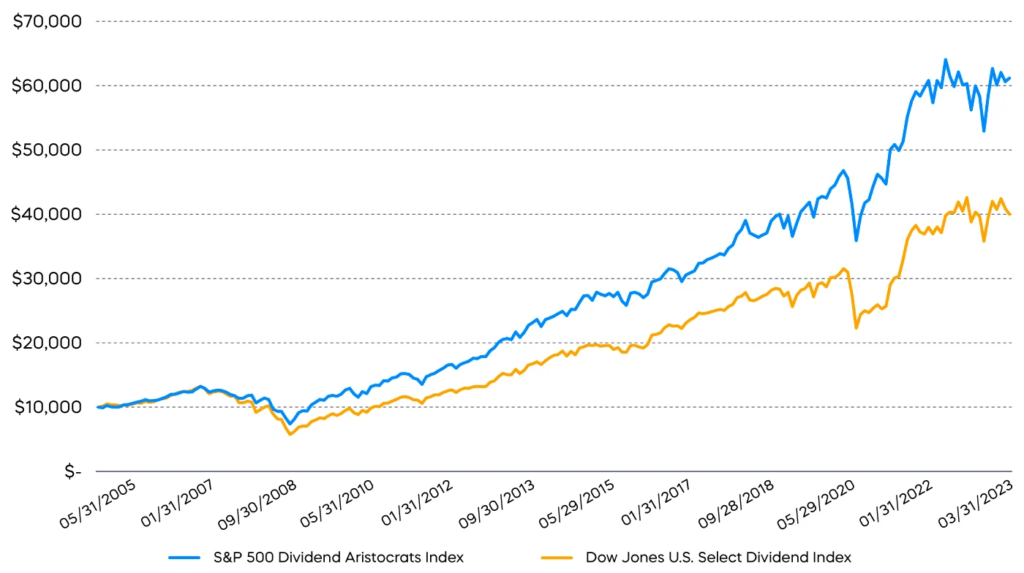

When considering which dividend stocks to invest in, younger investors should keep their eyes peeled for companies that have the potential for future dividend growth. Looking at the previous dividend history for a company is a good indicator of whether or not it has the potential for growth. For example, if a company has increased their dividend over the past 50 years, that would be a decent indicator that the company will likely continue this practice into the future. Even though the yields may not be as immediately high as some, dividends with potential to grow will serve to increase the balance and growth and income long-term. For example, Bloomberg Data illustrates this growth path from March 2005 to March 2023 using the S&P 500 Dividend Aristocrats Index as a representative for steady dividend growth and the Dow Jones U.S. Select Dividend Index to represent highest dividend yields. Over time, dividend growth provided greater returns than the highest yielding dividends.

Early Earning, Early Savings = Greater Wealth, Sooner

A larger trend that society has seen more and more of in the younger generations is the desire to go to graduate school in hopes of obtaining a greater salary. Let’s run an analysis on the return of graduate school. The average cost of attending graduate school is about $38,200 per year. Over a 2 year graduate school period this amounts to a cost of $76,400. The average salary of someone with a bachelor’s degree is about $59,600 per year, and the average salary of someone who completed their master’s degree is about $81,848. The current inflation rate that will be used for the sake of the NPV calculation is 4.0%. After conducting an NPV analysis calculation on the cost of attending graduate school and the additional value it provides factoring in the cost you could’ve made with just a bachelor’s degree, the value comes out to be $140,557.16. This is over a 45 year period assuming that is how many years after graduate school you will be in the workforce until retirement.

However, let’s say you invest just one-third of the graduate school cost, $20,000, into 200 stocks that provide dividends with a share price of $100 per share. If you do not attend graduate school and factor in the same amount of time with the added two years (about 47 years) at a 5% dividend growth rate, the projected value of that original investment will amount to $198,119.42. Not only does this exceed the additional value of attending graduate school, but with a significantly lower original investment. Now this is the power of investing in dividend stocks at an early age!

Another thing to consider when investing in dividend stocks is the concept of yield on cost, or a way to measure the growth of a dividend over time compared to the original investment. Investing into dividend stocks with high potential for growth will result in a higher yield on cost, and the key is to hold onto these stocks for many years. For example, consider Warren Buffet and his notable success in investing into common household names, specifically Coca Cola. His original investment in Coca Cola was calculated to be about $3.2475 per share and the dividend had been increased for the 30 or so years before Buffet had invested in the company. After the 35 year period that he invested into the company, 56.7% was the calculated yield on cost for Buffet’s company. Again, the returns on dividends come in time, hence the importance of younger investors starting to dive deeper into the world of dividend stocks now.

Dividends serve as a steady source of income, and if your investment cards are played right early on enough, the returns are significant. The younger populations are hesitant to invest in these “unattractive” and “boring” companies due to the stigma that surrounds them– that they are for the old timers and retirees. The appeal of higher-risk, higher-return, more volatile stocks is attractive short term, however, the rising investing generation should take a more long-term view on their portfolios. With the opportunity for growth and the variety of different options to invest in, dividend stocks could be the secure and financially beneficial solution that works for younger investors.

More Stories

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?

MCDONALD’S: SERVING UP TASTY DIVIDEND PROSPECTS