By Cole A Trane, Jr, Securities Analyst

Johnson & Johnson (JNJ) is a multinational pharmaceutical, consumer goods, and medical devices company that has been operating for over a century. With a rich history and a diverse portfolio of products, JNJ has established itself as a leader in the healthcare industry. The company is known for its commitment to innovation, research, and development, which has allowed it to consistently deliver value to its shareholders. In this article, we will delve into the financial stability of JNJ and assess the safety of its dividend.

Before we begin our analysis, let’s understand the concept of dividends and why they are important. Dividends are payments that a company distributes to its shareholders out of its profits or reserves. They are a way for companies to share their success with their investors. Dividends provide a steady income stream for shareholders, making them an attractive feature for income-focused investors. Moreover, consistent and growing dividends are often seen as a sign of financial strength and stability. Reams of academic research have demonstrated that steady dividend growth is critical to the overall returns that a stock provides over time.

The Growth History of JNJ’s Dividend

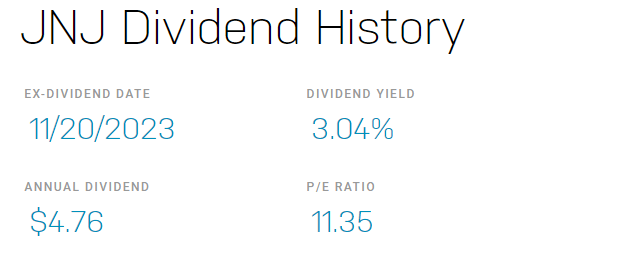

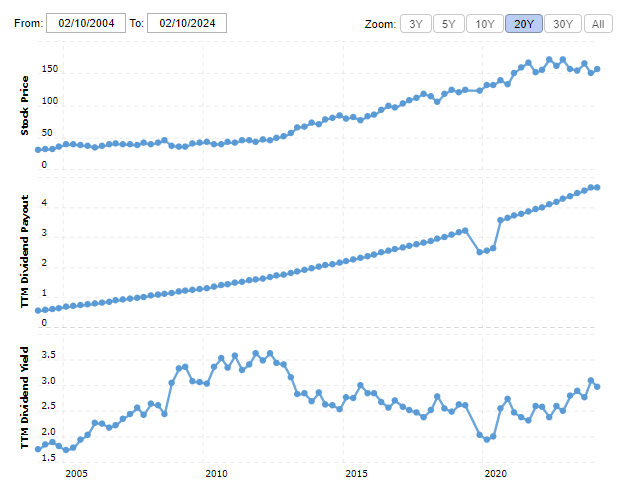

One of the key factors that investors consider when evaluating a company’s dividend is its growth history. JNJ has a remarkable track record of increasing its dividend payout year after year. In fact, the company has achieved an impressive 58 consecutive years of dividend increases. This consistency has made JNJ one of the most reliable dividend-paying companies in the market. The ability to consistently raise dividends demonstrates JNJ’s commitment to returning value to shareholders and its confidence in its future prospects.

JNJ’s dividend growth rate has also been noteworthy. Over the past five years, the company has achieved an average annual dividend growth rate of around 6%. This growth rate indicates that JNJ is not only focused on maintaining its dividend but also on increasing it at a healthy pace. The consistent and gradual growth of JNJ’s dividend reflects the company’s stable financial performance and its ability to generate sustainable cash flows.

Analyzing the Sustainability of JNJ’s Dividend

Now that we have explored the growth history of JNJ’s dividend, let’s analyze the sustainability of this dividend. A sustainable dividend is one that a company can afford to pay consistently without jeopardizing its financial health. To assess the sustainability of JNJ’s dividend, we need to evaluate the company’s financial stability and its ability to generate sufficient cash flows.

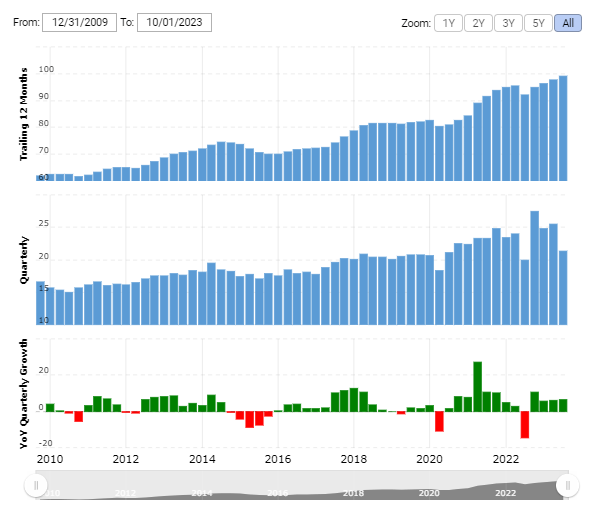

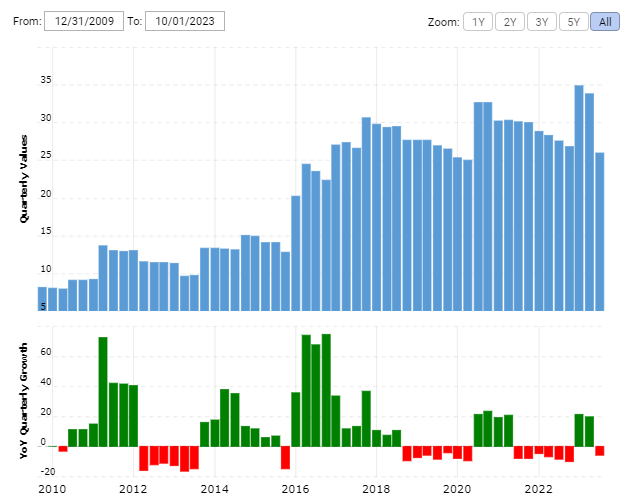

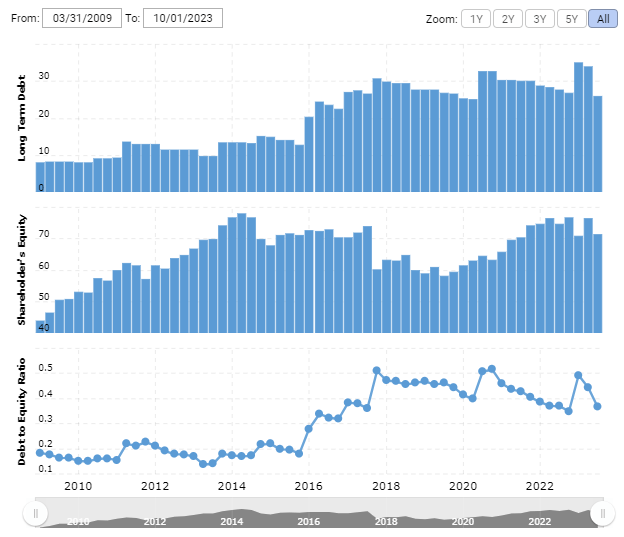

JNJ has a strong financial position, with a solid balance sheet and a healthy cash flow generation. The company has consistently maintained a low debt-to-equity ratio, indicating a conservative approach to financing. This low debt burden reduces the risk of financial distress and ensures that JNJ has the necessary resources to meet its dividend obligations.

Furthermore, JNJ’s diverse business portfolio, which spans pharmaceuticals, consumer goods, and medical devices, provides a stable revenue stream. This diversification not only mitigates the impact of market fluctuations but also allows JNJ to capitalize on growth opportunities in different sectors. The company’s ability to generate consistent and growing revenues enhances the sustainability of its dividend.

Assessing the Growth Prospects for JNJ and Its Dividend

Apart from the sustainability of the dividend, investors are also interested in the growth prospects of the company and its dividend. JNJ has a promising future ahead, driven by several factors that position it for continued growth.

Firstly, the pharmaceutical industry is experiencing robust growth due to an aging population and increasing healthcare needs. 10,000 Baby Boomers per day turn 65. Many could live decades with access to essentially free healthcare. One need not look any further than this year’s presidential race to see that senior citizens are not fading away quietly. Companies like J&J help keep them running, year after year, decade after decade.

JNJ, with its extensive pharmaceutical portfolio, is well-positioned to capitalize on this trend. The company’s focus on research and development ensures a pipeline of innovative drugs, which will contribute to future revenue growth.

Secondly, JNJ’s consumer goods division, which includes popular brands like Neutrogena and Listerine, offers stability and growth potential. The demand for consumer healthcare products is expected to rise, driven by increasing health awareness and changing lifestyles. JNJ’s strong brand presence and established distribution channels give it a competitive advantage in this segment.

Lastly, the medical devices segment is another area of growth for JNJ. The advancements in technology and an increasing focus on healthcare infrastructure are driving demand for medical devices. JNJ’s expertise and wide range of medical devices position the company to benefit from this growing market.

Examining Trends That Could Drive Growth for JNJ

To further assess the growth prospects for JNJ and its dividend, it is crucial to examine the trends that could drive growth in the coming years.

One such trend is the increasing focus on personalized medicine and targeted therapies. The advancements in genetics and molecular biology have opened up new possibilities for more effective treatments. JNJ, with its strong research capabilities, is well-equipped to take advantage of this trend and develop innovative therapies that cater to individual patient needs. This could lead to increased sales and profitability for the company.

Another trend worth mentioning is the growing demand for healthcare products and services in emerging markets. As economies develop and populations grow, the need for quality healthcare rises. JNJ has been expanding its presence in emerging markets, leveraging its global footprint and distribution network. Across the emerging world, there are billions of people who used to die at 60; instead they are more likely to live to 80 today. That’s one giant healthcare opportunity.

This strategic move into these emerging markets allows the company to tap into new markets and benefit from the increasing demand for healthcare products.

Evaluating the Financial Stability of JNJ

Apart from assessing the growth prospects for JNJ, it is essential to evaluate the financial stability of the company. A financially stable company is more likely to sustain and grow its dividend over the long term.

JNJ has a strong balance sheet with ample liquidity and a healthy cash position. The company’s cash flow generation is robust, providing it with the necessary resources to invest in research and development, acquisitions, and capital expenditures. JNJ’s ability to generate consistent cash flows enhances its financial stability and supports its dividend payments.

Furthermore, JNJ’s conservative approach to debt management ensures that it is not overly burdened with liabilities. The company has a low debt-to-equity ratio, indicating a healthy capital structure and a reduced risk of financial distress. This financial stability provides investors with confidence in the safety of JNJ’s dividend.

Assessing the Safety of JNJ’s Dividend

Considering the financial stability and sustainability of JNJ’s dividend, we can conclude that the company’s dividend is safe. JNJ’s consistent dividend growth history, strong financial position, and ability to generate reliable cash flows make it a reliable choice for income-focused investors.

Moreover, JNJ’s commitment to innovation and its diverse business portfolio provide a solid foundation for future growth. The company’s presence in the pharmaceutical, consumer goods, and medical devices sectors positions it well to capitalize on market opportunities and drive further dividend growth.

Comparing JNJ’s Valuation to the Market and Peers

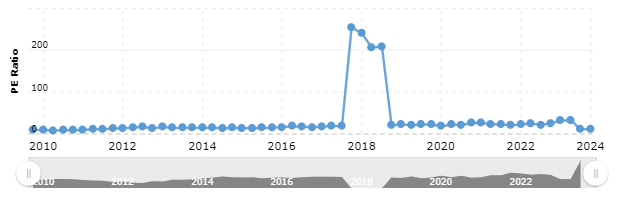

To complete our analysis, let’s compare JNJ’s valuation to the market and its peers. Valuation metrics, such as price-to-earnings ratio (P/E ratio) and dividend yield, can provide insights into whether a stock is overvalued or undervalued.

JNJ’s valuation is generally in line with the market and its industry peers. The company’s P/E ratio is comparable to the industry average, indicating that it is fairly valued. Additionally, JNJ’s dividend yield is competitive, offering investors an attractive return on their investment.

Conclusion

Johnson & Johnson (JNJ) has a strong financial stability and a track record of consistent dividend growth. The company’s commitment to innovation, diverse business portfolio, and solid financial position position it for continued growth. JNJ’s dividend is sustainable, supported by its ability to generate reliable cash flows and its conservative approach to debt management.

Considering JNJ’s valuation, which is in line with the market and its peers, the company presents an attractive opportunity for income-focused investors. With its reliable dividend and “healthy” growth prospects, JNJ is worth considering for those seeking stable and growing income from their investments.

More Stories

INFLATION CRUSHING STOCKS FOR THE TRUMP ERA

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?