By Ryan James, Dividend Analyst Fellow

Concentration of Tech Dominance

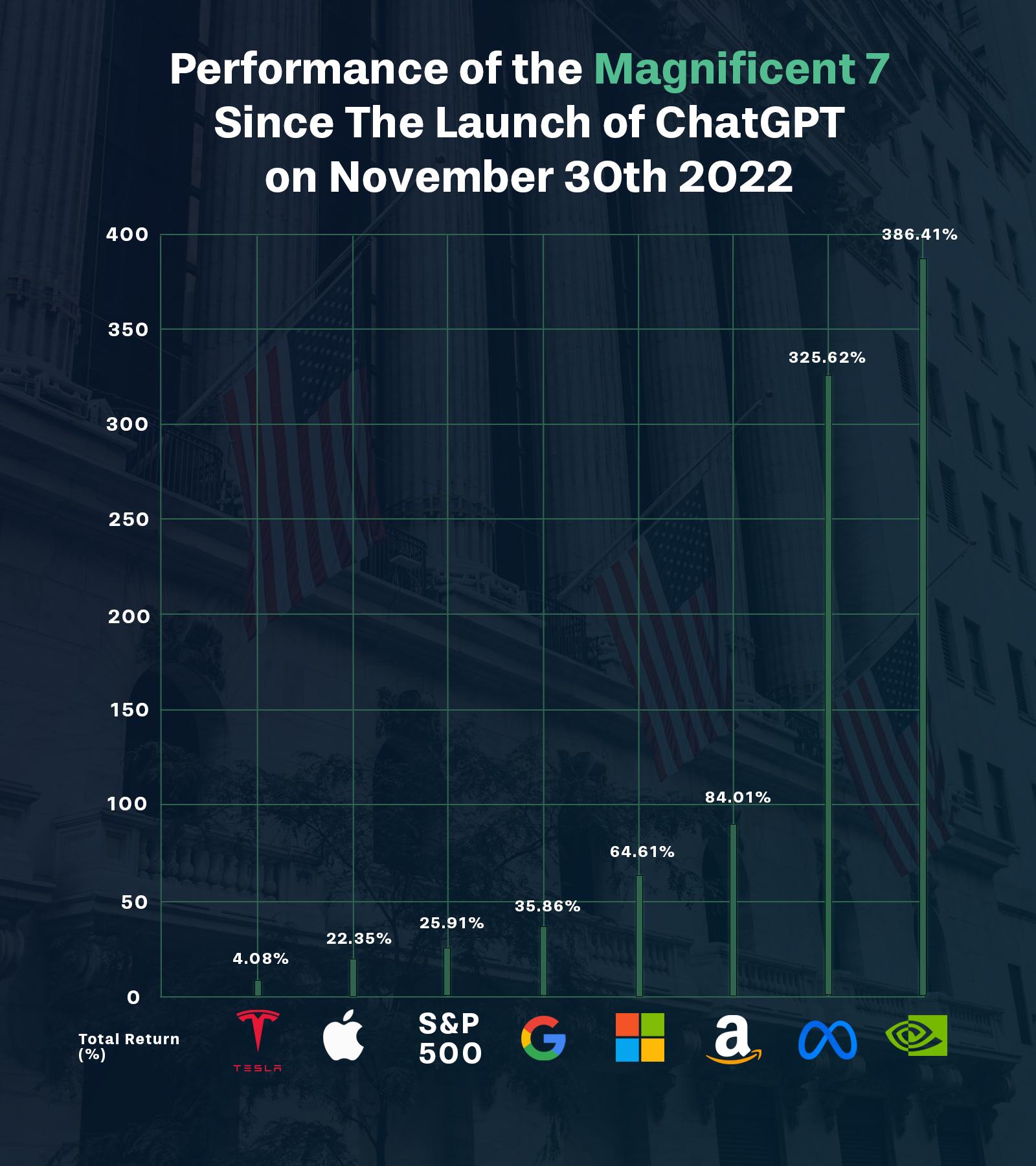

The so-called “Magnificent Seven” stocks—Apple (NASDAQ: AAPL), Alphabet (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), Amazon.com (NASDAQ: AMZN), Meta Platforms (NASDAQ: META), Tesla (NASDAQ: TSLA), and Nvidia (NASDAQ: NVDA)—have been dominating the stock market lately, dragging it in whichever direction they move; however, Tesla has been the laggard relative to the others. The Magnificent 7 are, together, up about 70% since the coining of the term; however, some analysts are saying that the Magnificent 7 is turning into the Magnificent 4, dropping Apple, Alphabet, and Tesla.

The AI boom is still going, though, and many companies stand to benefit. Super Micro Computer (NASDAQ: SMCI) manufactures high-performance servers and storage systems for many rising areas, such as artificial intelligence, enterprise data centers, cloud computing, 5G, and edge computing. It has very close connections with its client semiconductor companies, such as AMD (NASDAQ: AMD), Nvidia (NASDAQ: NVDA), and Intel (NASDAQ: INTC). These companies’ recent strong performance, especially in the AI space, is incredibly beneficial to Super Micro Computer. The question at hand is the same as it is in the semiconductors space: is this high growth sustainable? Goldman Sachs says yes. Bank of America, additionally, raised their S&P 500 2024 price target to $5,400, over 5% higher than the current price.

Super Micro Computer’s Recent Rise

Supermicro has had a meteoric rise recently. The company replaced Whirlpool (NYSE: WHR) on the S&P 500 on March 4, rising 18.65% on the day of the addition to the index.

In Q2 2024, its net sales and EPS rose 103% and 71%, respectively. Its P/S is 6.76—high but not yet astronomical. Also, its forward EV/Sales is a reasonable 3.48. An EV/Sales above 10 can point to conditions indicative of a bubble.

The stock has exploded recently. It is up over 900% since April, compared to about 70% for the Magnificent 7. It is up over 1,000% over the past year and nearly 6,000% over the past five years.

Valuation

Supermicro’s fair value is likely somewhere around $990 per share, implying that the stock is overvalued. Despite this, the stock still has plenty of upside potential. Technical indicators are powerful, and the company appears to be backed by sound fundamentals.

The stock’s oscillators are showing signs of strength, and its moving averages are doing so to an even greater extent. It has robust momentum, and nearly all of its moving averages are positive.

It has a P/E of 87.34. That is high but is much lower than many of its peers in the semiconductors industry. AMD’s P/E ratio is 397, Intel’s is 120, and Nvidia’s is a more similar 73.

The company, fortunately, is profitable currently. It has a profit of $371.46 million, about 11.3% of its $3.29 billion in revenues.

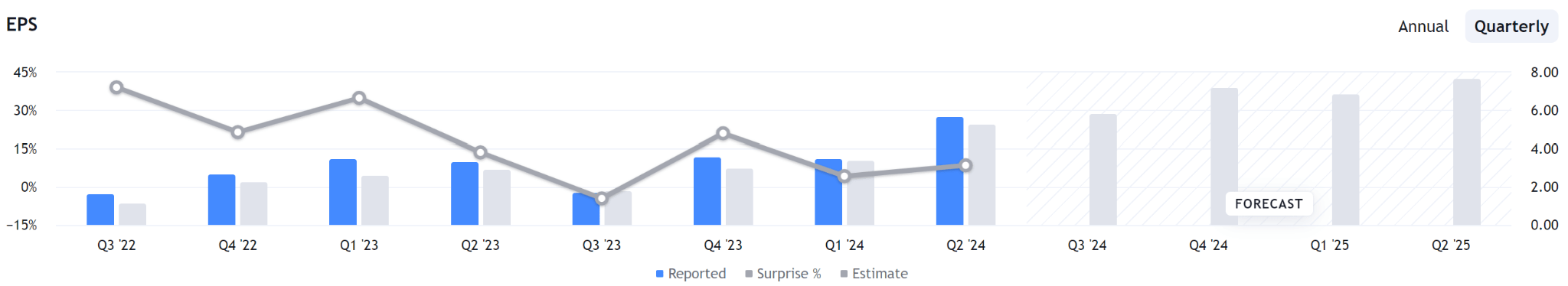

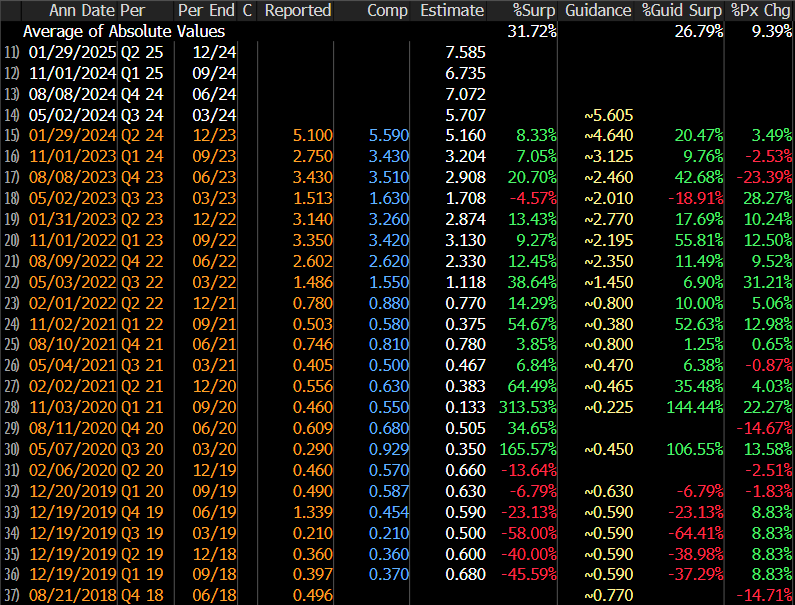

The company reported earnings most recently on January 29, 2024. Its EPS was 5.59, as opposed to the consensus estimate of 3.07, an 82% positive surprise.

In the shown earnings results, the company reported a positive surprise 15 of 22 times, nearly 70% of the time. 11 of 15 of those times, there was a positive change; there was also a positive change 5 of 7 of the times there was a negative surprise. There was an average surprise of 9.39% across all analyzed earnings results (going back to Q3 ‘13), ensuring that earnings results being released generally yield positive results for the stock.

Dividends

Unfortunately, Supermicro does not pay out a dividend. This does make the stock less attractive to investors. The average stock in its sector pays a 0.77% dividend. Unfortunately, Supermicro investors are missing out on that. But sometimes the best play is to identify tomorrow’s super dividend stocks today. For many years, Microsoft did not pay a dividend, despite record profitability. But when it initiated a dividend, that was just the beginning of a hyper growth phase. The company paid its very first dividend in 2003, starting out at a modest $.08 per share. Today, that dividend stands at $.75 per share, a growth factor of almost 1,000% over twenty years. The investors who got in on this early, reaped the biggest benefit. Could Super Micro Computers be on the same growth path?

Future Potential

Growth in the spaces of AI, telecommunications, and cloud computing offers great future potential for the company, especially when reporting earnings. This is especially impactful to its server and storage systems revenue streams, which make up over 92% of the company’s revenue. The other nearly 8% of revenue comes from subsystems and accessories, also standing to benefit. Supermicro does not have very diversified revenue streams, exposing it to a higher concentration of risk and reward.

Supermicro’s beta of 1.33 makes the company 33% more volatile than the overall market. It is high but, by no means, astronomical.

A close peer of Supermicro’s is NetApp (Nasdaq: NTAP). It is more diversified in its revenue streams and has a smaller market cap than Supermicro, in addition to offering a dividend with a yield of 1.90%. The stock has done very well over the past year but has still lagged far behind its Supermicro.

Supermicro stock has had extraordinary performance in the past, and, if it can keep growing at even a fraction of the speed at which it has been growing, the stock would yield an incredible alpha. With its recent inclusion in the S&P 500, hopefully, this is not the end of the line for Supermicro’s gains. As the company expands and gains credibility, it is likely to slow down its momentum slightly in exchange for lower volatility.

More Stories

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?

MCDONALD’S: SERVING UP TASTY DIVIDEND PROSPECTS