By Stanley N Getz, Securities Analyst

As an avid investor, I am always on the lookout for companies that offer sustainable dividends. One such company that has caught my attention is Toyota Motor Corporation. With a rich history and a strong presence in the automotive industry, Toyota has become a household name. In this article, I will delve into the growth history of Toyota’s dividend and explore whether it is sustainable for the long term.

Before we dive into Toyota’s dividend, it is important to understand what dividends are and why they matter to investors. Dividends are a portion of a company’s profits that are distributed to its shareholders. They are a way for companies to reward their shareholders for their investment and can provide a steady stream of income. Dividends are particularly attractive to income-focused investors who rely on regular cash flow from their investments. Some companies succeed in growing their dividend over time, which can turn into a bonanza for the patient investor.

Exploring the Growth History of Toyota’s Dividend

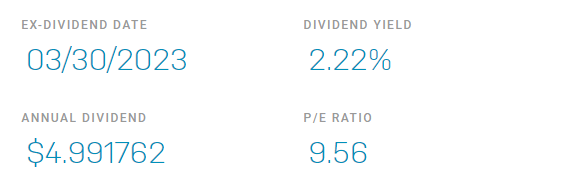

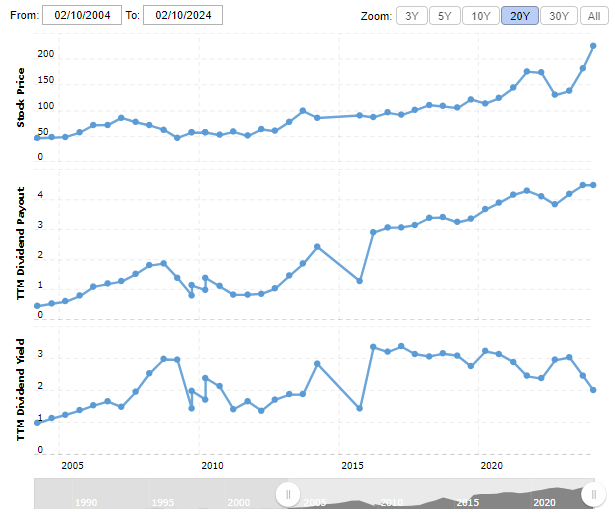

Now that we have a basic understanding of dividends, let’s take a closer look at Toyota’s dividend growth history. Over the years, Toyota has demonstrated consistent growth in its dividend payments. From 2010 to 2020, the company’s dividend per share increased at an impressive rate, showcasing its commitment to rewarding its shareholders. This consistent growth is a positive sign for investors, indicating that Toyota has been able to generate sufficient cash flow and profits to sustain its dividend payments. In 2004, Toyota was paying out about $.89 per share, per year. Today, that number has grown by over 400%, to a whopping $4.99 per share.

Analyzing the Sustainability of Toyota’s Dividend

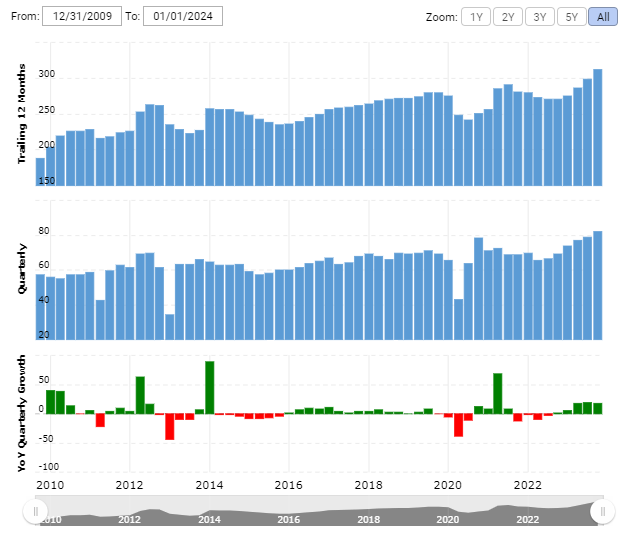

While Toyota’s dividend growth history is undeniably impressive, it is essential to conduct a thorough assessment of its sustainability. Numerous factors contribute to determining the sustainability of a company’s dividend policy. One crucial factor to consider is the company’s capacity to consistently generate profits, which serves as the foundation for dividend payments. Toyota has established a robust track record in this aspect, demonstrating consistent and reliable financial performance over the years. Its ability to weather economic fluctuations and maintain profitability underscores its resilience in sustaining dividend payments.

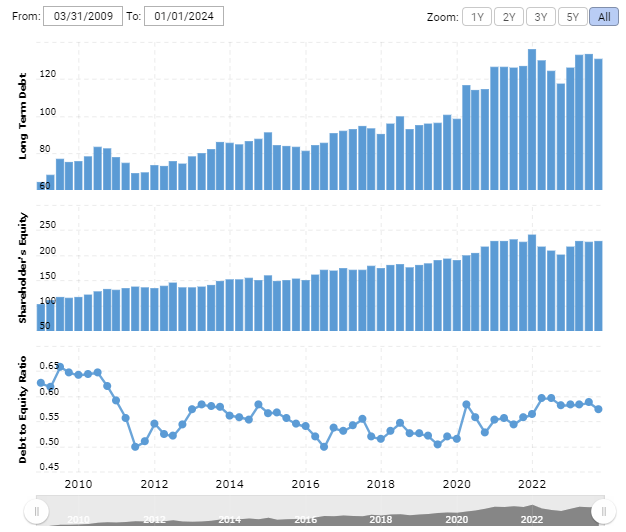

Furthermore, the examination of Toyota’s low dividend payout ratio unveils its prudent financial management practices. A low payout ratio signifies that Toyota retains a significant portion of its earnings, providing ample financial flexibility for future investments, research and development endeavors, and potential dividend increases. This conservative approach not only safeguards the company against unforeseen challenges but also positions it favorably for long-term growth and sustainability.

Beyond financial metrics, Toyota’s commitment to innovation and adaptation to evolving market dynamics bolsters confidence in the sustainability of its dividend policy. As a leading player in the automotive industry, Toyota continually invests in research and development, ensuring its products remain competitive and align with shifting consumer preferences and regulatory requirements. This proactive approach not only sustains the company’s market relevance but also enhances its ability to generate long-term value for shareholders, thereby supporting consistent dividend payouts. Toyota introduced the first hybrid gas/electric vehicle all the way back in 1997, and may well have now perfected that technology.

Moreover, Toyota’s diversified revenue streams and global presence contribute to the resilience of its dividend payments. With operations spanning across various geographical regions and segments, Toyota mitigates risks associated with regional economic downturns or industry-specific challenges. This diversified portfolio enables the company to maintain stable cash flows, providing a solid foundation for sustaining and potentially increasing dividend distributions over time.

Factors Influencing Growth Prospects for the Company and the Dividend

To gauge the growth prospects for Toyota and its dividend, we need to consider various factors. Firstly, the automotive industry’s overall performance and market conditions play a significant role. As the industry evolves with advancements in technology and changing consumer preferences, companies that can adapt and innovate are likely to experience growth. Toyota has shown its ability to stay ahead of the curve by investing in electric and autonomous vehicles, positioning itself for future growth.

Assessing the Safety of Toyota’s Dividend

A crucial aspect of assessing dividend sustainability is evaluating a company’s financial health and its debt levels. Excessive debt can strain a company’s ability to generate cash flow and meet its financial obligations, potentially impacting its ability to pay dividends. However, Toyota has maintained a healthy balance sheet with manageable debt levels. This indicates that the company is in a strong position to continue paying dividends without compromising its financial stability.

Dividend safety is a top concern for investors, especially during uncertain times. Toyota’s dividend safety can be evaluated by analyzing its dividend coverage ratio, which compares the company’s earnings to its dividend payments. A high dividend coverage ratio suggests that the company has sufficient earnings to cover its dividends. In Toyota’s case, the company has consistently maintained a high coverage ratio, indicating that its dividend is safe and well supported by its earnings.

Comparing Toyota’s Valuation to the Market and Peers

When considering an investment, it is crucial to assess the valuation of the company. Comparing Toyota’s valuation to the market and its peers can provide insight into whether the stock is overvalued or undervalued. Toyota’s valuation metrics, such as price-to-earnings ratio and price-to-sales ratio, are in line with industry averages, suggesting that the stock is reasonably valued. This indicates that investors can expect a fair return on their investment while enjoying the benefits of the company’s dividend.

Trends That Could Drive Future Growth for Toyota

Looking ahead, several trends could drive future growth for Toyota. One such trend is the increasing demand for electric vehicles (EVs). Toyota has positioned itself as a leader in hybrid vehicles and is investing heavily in EV technology. Toyota was one of the first companies to launch a hybrid vehicle, starting almost twenty five years ago with the original Toyota Prius. One could say that Toyota has now perfected the mechanics and profitability of the hybrid vehicle. The new Toyota Prius Prime can go up to 40 miles just on the battery, can deliver up to 56 miles a gallon, and is currently selling at a record smashing pace. Toyota also has a Rav 4 small SUV that offers similar specs. Toyota plans to offer most of its vehicle in hybrid form over the next few years, helping to cut carbon emissions while boosting profits at the same time.

As governments worldwide implement stricter emission standards and consumers become more environmentally conscious, Toyota’s focus on hybrid vehicles could provide a significant growth opportunity. Additionally, the company’s strong presence in emerging markets, such as China and India, presents further avenues for expansion and growth.

Conclusion

After a thorough analysis of Toyota’s dividend growth history, sustainability, financial health, and growth prospects, it is evident that the company’s dividend is indeed sustainable. Toyota’s consistent dividend growth, strong financials, manageable debt levels, and future growth potential make it an attractive investment option for income-focused investors. With the automotive industry evolving and Toyota’s commitment to innovation, the company is well-positioned for continued success. Therefore, considering Toyota’s dividend sustainability and growth prospects, it presents a compelling investment opportunity.

More Stories

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?

MCDONALD’S: SERVING UP TASTY DIVIDEND PROSPECTS