By Ryan James, Dividend Analyst Fellow

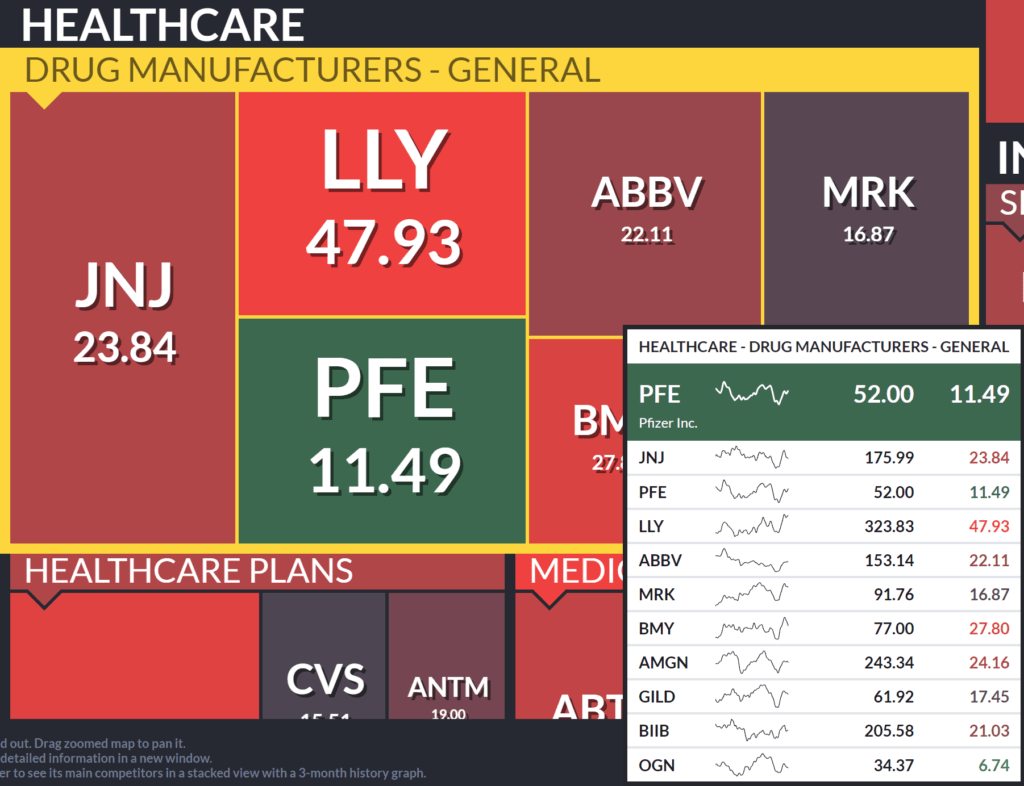

Pfizer (NYSE: PFE) stock has been much talked about since the race to develop a vaccine for COVID-19 began. Despite Pfizer developing the first vaccine—with the help of a small German biopharmaceutical company called BioNTech (NASDAQ: BNTX)—to receive emergency use authorization from the Food and Drug Administration (FDA), its stock has had surprisingly little movement and remains at a far lower price-earnings (P/E) ratio in relation to the broader healthcare sector. Pfizer’s P/E ratio is 11.49, smaller than that of all relatively large companies in the drug manufacturers industry other than Organon & Co. (NYSE: OGN), with a P/E ratio of 6.74. This low P/E ratio insinuates undervaluation for the stock relative to the rest of its industry and even the broader market. The healthcare sector has an average P/E ratio of 18.7, nearly 50% higher than Pfizer’s.

Pfizer’s foremost revenue generator is its COVID-19 vaccine, comirnaty, has been administered to over 350 million people globally thus far. The COVID-19 pandemic has ushered in a new era for Pfizer. Along with its vaccine, Pfizer has developed the preeminent COVID treatment, paxlovid, which has received an emergency use authorization (EUA) from the FDA that favors it over that treatment developed by Merck (NYSE: MRK). Pfizer changed its logo in 2021, its fifth logo since its founding in 1849 and the second extensive alteration to the Pfizer logo in company history.

The mRNA technology utilized in the comirnaty vaccine has been in the development stage for numerous pharmaceutical companies for over three decades, but, with government assistance, a gathering of the scientific community, and the urgency of the COVID-19 pandemic, Pfizer and Moderna (NASDAQ: MRNA) were able to achieve the creation of successful mRNA vaccines in that respective order.

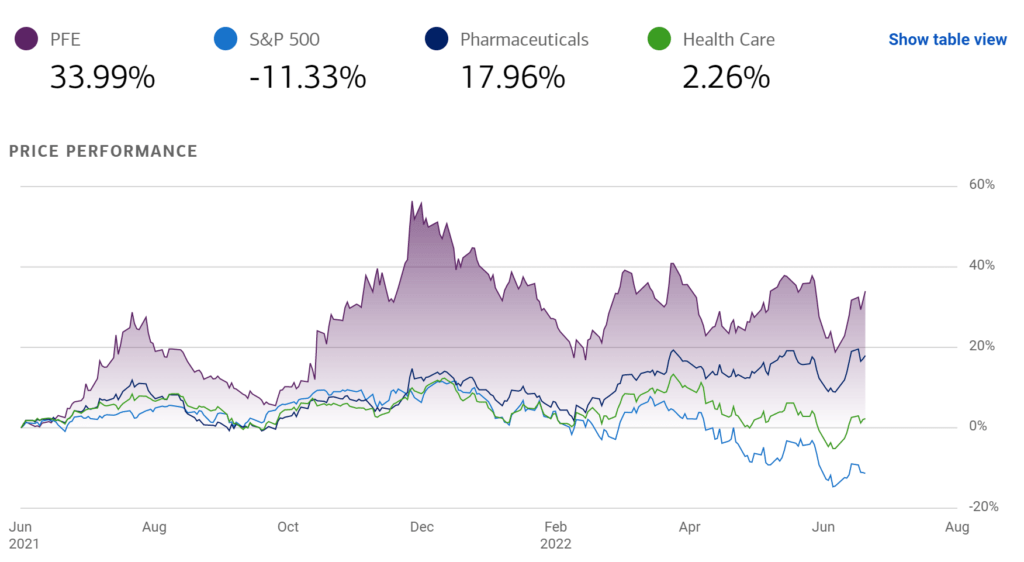

While Moderna depends on its vaccine to maintain its revenue, Pfizer has a large portfolio of pharmaceutical products upon which it can rely. Even though vaccination rates have drastically slowed, it will continue to sell vaccines to many developing countries. The FDA has recently authorized the vaccine for children as young as six months, freeing a new age group to receive the vaccine. Despite the massive success of the COVID-19 vaccine for Pfizer, its stock price has surprisingly decreased 9.08% since the first vaccination outside of clinical trials on December 28, 2021. Conversely, Pfizer’s stock had risen 116.45% between March 20, 2020, and December 17, 2021, as investors aimed to “buy the rumor, sell the news” and the market recovered from the onset of the pandemic.

As new variants appear, often more dangerous, contagious, and evasive of the vaccine than their predecessors, they become increasingly more likely that Pfizer will develop new vaccines. About half of the new COVID-19 cases in the United States are from the BA.4 and BA.5 subvariants of the omicron variant; in response, the FDA has recommended new COVID-19 booster shots to target these variants specifically instead of the substantially dissimilar to the original strain. These future opportunities provide an ongoing revenue pipeline from Pfizer’s COVID-19 vaccine(s). If Pfizer makes additional vaccines to more adeptly target variants and subvariants and/or an annual booster shot similar to the flu shot is instituted, the revenue stream originating from the vaccine will not wane when COVID-19 becomes endemic.

The mRNA technology used in Pfizer’s vaccines can be adopted in future products, allowing for further implications in healthcare and potential revenue-generating products. Pfizer has the potential to create additional mRNA vaccines, oncological medications, and many other treatments, incurring long-term revenue sustainability and growth.

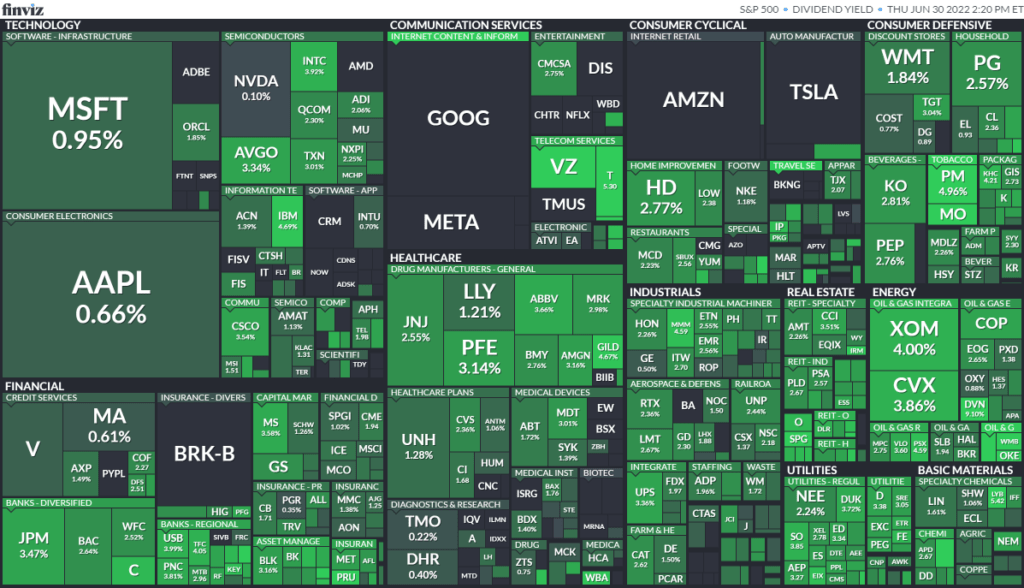

Pfizer has outperformed the S&P 500, pharmaceutical stocks, and health care stocks over the past year. Its dividend is also higher than the drug manufacturers industry. Pfizer’s 3.14% dividend is about 36% higher than its industry average of 2.30%. Its dividend growth history is about average. Pfizer’s five-year dividend growth rate is 6.11%, beating the average annual inflation rate over the past five years; however, its one-year dividend growth rate is 2.61%, far lower than the former and the current annualized inflation rate of 8.6%. Both rates are slightly lower than the industry averages.

As aforementioned, Pfizer has had a long history, having been founded in 1849, 173 years ago. The company has survived every hardship since then, illustrating the level of longevity and stability the company exudes. The company survived the Great Depression, World War I, World War II and the economic instability following it, the 1949 recession caused by the Federal Reserve raising rates too quickly (similar to what many investors fear will happen within the next few years), the stagflation of the 1970s, Black Monday of 1987, the Great Recession of 2008-2009, and the 2020 recession caused by the COVID-19 pandemic.

Pfizer’s comparably low P/E ratio, price stability, longevity, fundamentals, and possible future products make the stock attractive at this price. In the current market conditions of extreme fear and high volatility, an undervalued but attractive stock, such as Pfizer, is an excellent option.

More Stories

J&J: THE NEXT ELI LILLY?

PFIZER, INC: A MISUNDERSTOOD STOCK?

ELI LILLY GOES BEAST MODE!