Over the past year, staid, reliable, corporate stalwart Eli Lilly has unleashed a massive attack of powerful new science upon the business world. The result? A stock price that has almost doubled in just 360 days. A rare feat indeed for a corporate giant that has been in business since 1876. After this impressive growth spurt, how much more growth could possibly lay ahead? Equity Analyst Mackenzie Deming investigates……

So let’s talk about Eli Lilly: this pharmaceutical company has made a name for itself over the past few years in its breakthrough medicines and trials for weight loss, diabetes, cancer, and neurological reasons. Eli Lilly was founded in 1876 by Colonel Eli Lilly, who made it the company’s mission to produce better quality medicines for people in a time of unreliable elixirs. The company prides itself in its three core values of integrity, excellence, and respect for people. In 2022, Eli Lilly’s medicines helped about 51 million people, and there were instrumental breakthroughs in the company’s launch of Mounjaro for type 2 diabetes. Looking forward to this year in 2023, Eli Lilly intends on launching up to four new medicines. Just within the past few days, they have pushed out data from a new weight loss oral pill drug trial. Additionally, in a late stage trial, LLY’s new Alzheimer’s drug, Donanemab, slowed cognitive decline by 35%; this is the strongest result anyone has seen in a search for the cure to Alzheimer’s. Back in May 2023, this drove LLY shares up by 6%, and there is predicted to be jumbo sized revenue growth over the next few years.

Focusing in on Eli Lilly’s launch of Mounjaro, the drug brought in about $568.5 million in sales the first quarter of 2023, and has shown unrelenting promise for different uses aside from diabetes such as obesity treatment. Additionally, in the first quarter of 2023, the company had sales of $6.96 billion and reported growth of 10% after Lilly removed Covid-19 related products from their balance sheet. As more trial data and drugs start showing success after launch, Eli Lilly has attracted buzz and investors are becoming more excited about the company.

Growth: Past, Present and Future

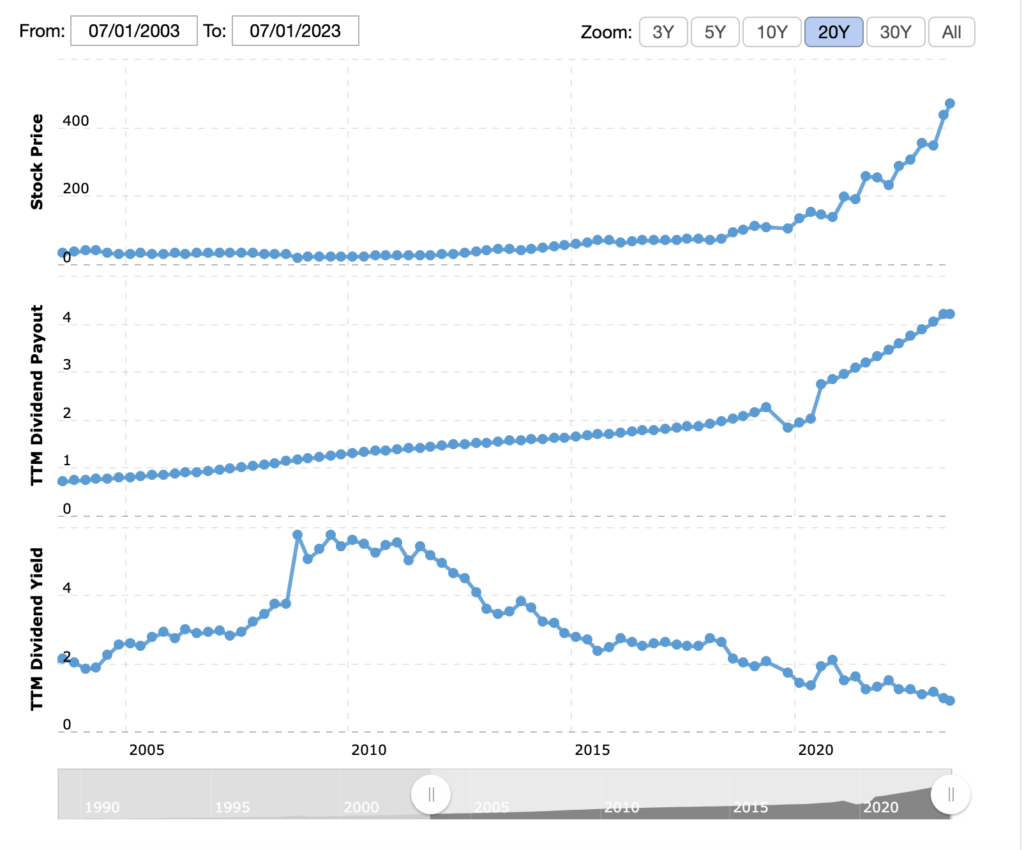

With such up and coming success, it is worth noting the dividend growth potential that Eli Lilly has. Over the past 20 years, the company has steadily increased its dividend. For example, in 1997, the company was giving out a dividend of $.20 a quarter and currently in 2023, the dividend is now $1.13 a quarter for an annual dividend of $4.52. Eli Lilly has a dividend yield of 0.96%, indicating that the stock price has been driven up at a significant pace as the company increases in potential to investors. This is notably a good problem to have seeing as the company continues to grow in revenue with its groundbreaking trials. This paired with the high potential for dividend growth, investors can find peace of mind knowing that this could be an excellent source of long-term sustained income.

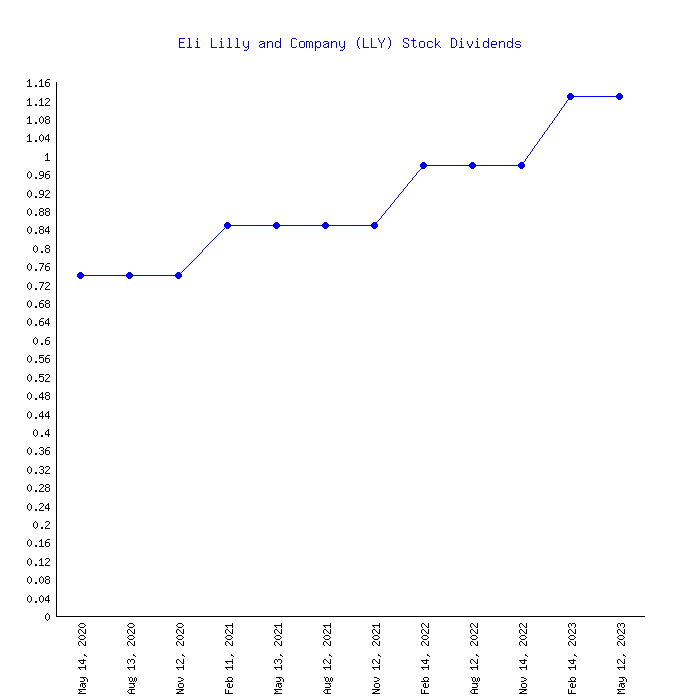

As shown above, Eli Lilly has shown substantial dividend growth over just the past 3 years post Covid-19 era.

Over the past year, the company’s dividends per share growth rate was about 15.30% per year, and over the past three years, this number was about 15% per year. Over the past 13 years, the median dividends per share growth rate was calculated to be about 7.70%.

Over the past 20 years, Eli Lilly’s stock price has increased exponentially, with a larger increase starting around 2019 with its production of Covid-19 related products. Around this time, it is obvious that its dividend payments took a hit in light of the economic crisis. However, immediately after the Covid-19 era, it is apparent that the dividend growth continued to increase. In accordance with the promising new drugs and trials, investors have driven the stock price up, which caused the dividend yield to fall.

In considering the dividend safety of Eli Lilly, LLY has increased its dividend payout for the past 9 consecutive years. However, the dividend payout ratio of about 64.49% is a tad high. Typically, a dividend payout ratio of about 50% or lower is considered a good number, seeing as the company will have enough money to reward the shareholders but a bit of extra cash to reinvest (thus, bringing in more revenue for the company). The key question for new potential shareholders would be: can Lilly grow income fast enough to bring down it’s dividend payout ratio? In other words, if sales and profits grow at an accelerated rate, then today’s relatively high payout ratio will not be something to worry about. The more cash that comes in, the more that can be paid out to shareholders without damaging any of the company’s core functions.

Looking towards the future, Eli Lilly has shown immense promise in driving business for itself with its new and innovative drug products. The Lilly bull thesis explains the idea that all of these new groundbreaking drugs being developed will cause revenue and cash flow to grow so quickly that LLY will not have an issue paying off debt with room to grow the dividend. Eli Lilly expects that four new drug launches this year will drive up 2023 annual revenue beyond $30.3-$30.8 billion. Diving deeper into new data from its oral weight loss pill trial of Orfoglipron, the phase 2 trial showed that the pill achieved up to 14.7% mean weight reduction in 36 weeks. Also, as mentioned before, the release of Mounjaro continues and has shown unrelenting promise as well. LLY has a very competitive edge with the works of donanemab this year, as there hasn’t been such promise in the research and cure of Alzheimer’s with any other drug company yet. Something else worth noting is the new $2.4 billion acquisition Dice Therapeutics by LLY; this acquisition boosts LLY’s immunology portfolio and gives them ownership over Dice’s new psoriasis drug in a mid-stage trial (Reuters.com). The psoriasis drug, DC-806, is targeting a market worth $40 billion right now, with high potential to be another groundbreaking drug in the market. This catches the eyes of many because the more promise that the company shows allows for investors to strike while the iron is hot. LLY shares could continue to rise in the coming weeks/months as production of these new innovative drugs increase, thus in turn allowing for LLY to continue to generate revenue and increase dividends to its shareholders. This aggressive growth pipeline serves as a nice buffer for those who look at the high dividend payout ratio, indicating that this number is likely to drop in the coming months/years.

With surging dividends and a monstrous pipeline of growing drugs, Eli Lilly is on the rise and is catching the attention of many investors. As time continues, the release of its new and innovative drug products will continue to drive value and revenue for the company. Investors should note the powerful promise of LLY’s dividends and the potential growth that still lies ahead.

More Stories

J&J: THE NEXT ELI LILLY?

PFIZER, INC: A MISUNDERSTOOD STOCK?

IS PFIZER’S STOCK ON SALE?