By Jiayi Liang, Equity Analyst

Introduction

In 2013, Abbott Laboratories officially split into two independent, publicly-traded companies. The legacy company Abbott retains its name and specializes in diversified medical products and services, while the new research-based company AbbVie focuses on biopharmaceutical drugs. At first, most investors took a dim view of the spinoff, regarding it as unsecure, withdrawing their investments and seeking other stocks. However, as the years go by, it is evident that those who have been long-term oriented have been the biggest beneficiaries. From 2013 to 2021, ABT has increased its dividend from $0.56 to $1.80, and ABBV has raised its dividend from $1.60 to $5.20.

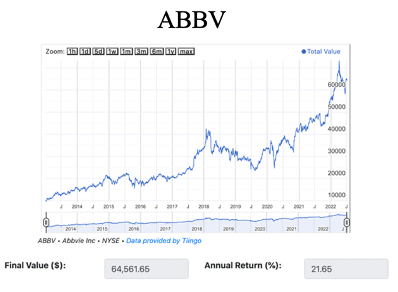

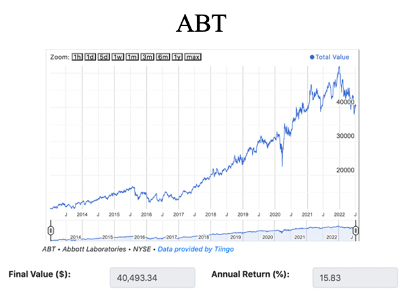

In order to quantify the success in real terms, we are going to make up three scenarios of investment over 10 years, comparing the total returns on those situations. To keep things simple, we will assume the initial investment is $10,000 for both Abbott and AbbVie.

Scenario 1: in the 2013 spinoff, the investor did nothing but just took dividends and reinvested them.

As shown in the two tables above, both stocks have delivered strong performances over the last ten years. The $10,000 investment in ABBV achieves a final value of $64,561.65 today, with a compounded annual return of 21.65%; the $10,000 investment in ABT ends up with a total return of $40,493.34 today, with a compounded annual return of 15.83%. In other words, if you choose to keep both stocks and reinvest the dividends in 2013, you would have over $105,000 today!

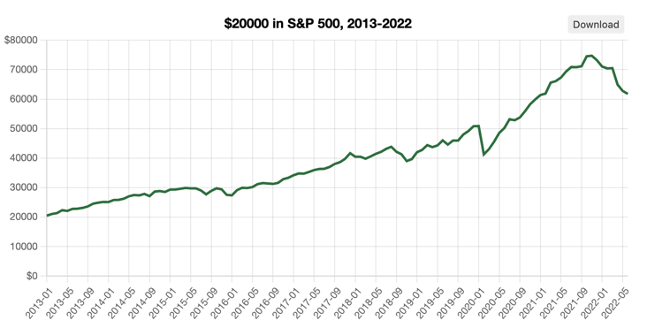

Scenario 2: in the 2013 spinoff, the investor sold everything and put it into S&P 500.

In this case, you invested $20,000 in S&P 500 in 2013. Assuming you reinvested all dividends, you would have about $61,775.98 today. The return on investment is 208.88%, or 12.60% per year, which is far below that of ABBV and ABT.

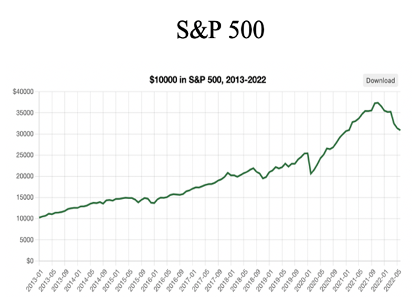

Scenario 3: in the 2013 spinoff, the investor kept ABT but put ABBV into S&P 500.

In this situation, your portfolio at the beginning of 2013 had $10,000 in Abbott and $10,000 in the S&P 500. Today, you would receive an Abbott total return of $40,493.34 with a compounded annual return of 15.83% and a S&P 500 total return of $30,887.99 with a compounded annual return of 12.60%. Simply put, you would hold over $71,300 in total today.

The result is very straightforward: under the first scenario, you would earn far more than you would under the other two. Specifically, if you chose to transfer half of your portfolio into S&P 500 in 2013, you would receive roughly $33,000 less today, and if you transferred all of your investment into S&P 500 ten years ago, you would receive $43,000 less today. Not surprisingly, it would be best to keep having confidence in the spinoff of Abbott and AbbVie and to look to the long term.

It is worth mentioning that the overwhelming success of the first scenario does not merely come from the strong performances of Abbott and AbbVie. By reinvesting dividends over years, the investor could build wealth much faster than simply taking the cash, including buying more shares, getting discounted prices, and purchasing fractional shares. In addition, dividend reinvestment offers the shareholders certain convenience and privileges. It is cheap since the investor will not owe any commissions or other brokerage fees when buying more shares. It is also easier because the dividend reinvestment is automatic whenever it has been set up. Lastly, since the investor buys shares immediately after getting dividends, this regular investment, also known as dollar-cost averaging (DCA), effectively guarantees the investment results and lowers the risks. All of these benefits, which are inaccessible to investors who are not reinvesting dividends over years, contribute to the large returns on investment.

Qualitative Analysis

We have already seen the success of Abbott and AbbVie based on the quantitative analysis above. In the following, we are going to examine why the spinoff happened and why it has performed so well.

Before 2013, Abbott was a conglomerate focusing on a wide variety of health care products. Although it had already achieved world-leading business performance, the company still needed a higher growth rate, mainly because Humira had been weighed down by other sectors for a long time. Therefore, as Abbott Laboratories CFO Tom Freyman said that “Separate, we were valued more than together”, both companies have benefited from the spin-off. Abbott has had more energy concentrating on medical devices such as heart stents while AbbVie specifically focuses on research-based pharmaceuticals.

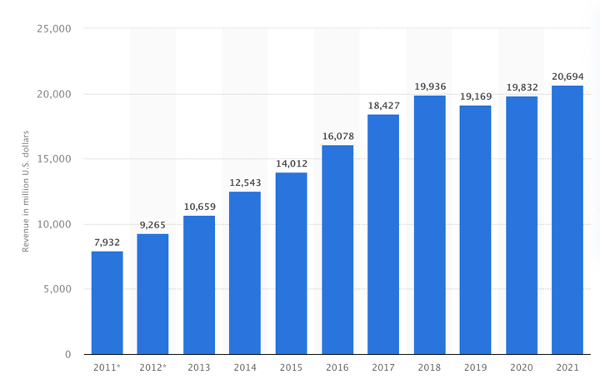

The spin-off was an immediate success, allowing AbbVie to achieve $18.8 billion in sales in its first year. This was largely due to the strength of its blockbuster drug Humira. In April 2013, AbbVie released its first branded product Humira; in September 2015, Humira became the first and only approved treatment of hidradenitis suppurativa, a chronic inflammatory skin disease; In June 2017, Reputation Institute named AbbVie 2017’s most reputable pharmaceutical company. Humira has been the world’s best selling drug, achieving dominance in a wide variety of therapeutic categories. In addition to Humira, the company has successfully diversified into other, high growth pharmaceutical products.

As shown in the table above, Humira has delivered constant sales growth for AbbVie, reaching $20.7 billion in 2021. The success of Humira is expected to continue at least to 2026, with similarly high revenues. Such a sky-high growth rate by AbbVie would not have been achieved if Abbott chose to continue offering a wide range of products. On the other side, Abbott has also had more room to expand its margins. Its market capitalization has grown from roughly $50 billion in 2013 to $190.66 billion now. Thanks to breaking its healthcare business into smaller pieces, Abbott now has a better focus on four segments: nutrition, medical devices, diagnostics, and established pharma products. In addition, with a more efficient resource allocation, the company has expanded its market in emerging countries rapidly, such as China and India. Due to the significant potential for growth and innovation in medical products, these emerging markets have paved the way for Abbott’s further expansion and success.

This strategy of multiple expansion is like a magic wand. A smaller company is growing from a lower base, and thus can achieve higher growth rates. The market then awards the smaller company a higher p/e ratio based on those higher growth rates. Abbvie currently trades at 24 times its annual profit. Many less focused conglomerates trade for as little as ten times current profit.

A smaller, more concentrated company usually has lower financial and operational risks as well as better capital and resource allocations. Shrinking the business with a specific focus allows the company’s sales to surge, which then drives the investors’ confidence in the stock’s prospects. When the valuation expansion far exceeds the company’s fundamental growth, it is a sign of multiple expansion as the investors go wildly optimistic about the company’s future. Taking advantage of this mechanism, Abbott made a wise choice to split into two separate, smaller companies.

Conclusion

Abbott and AbbVie did one of the most successful spinoffs in stock market history. The strong performances of both companies over the last decade allowed the investors to reap a profit even eclipsing the return on S&P 500 index. Incredibly, if you invested $20,000 in Abbott and AbbVie in total at the beginning of 2013, you would hold five times that wealth now. This success is largely due to the multiple expansion taken by the legacy company Abbott, which unleashed the full potential of AbbVie in the world of pharmaceuticals.

More Stories

MASTERING THE PROXY STATEMENT PART IV: PAY FOR PERFORMANCE…?

MASTERING THE PROXY STATEMENT, PART III: Q&A

MASTERING THE PROXY STATEMENT, PART II: CLARITY