By Ryan James

Monetary Policy

The government has two types of policy to control the economy: fiscal policy and monetary policy. While fiscal policy is the use of government spending and tax policies to influence economic conditions, monetary policy is controlled by the Federal Reserve System (the “Fed”). Monetary Policy is a set of actions that can be undertaken by a nation’s central bank (i.e. the Fed) to control the overall money supply and achieve sustainable economic growth.

The Federal Reserve can change interest rates, engage in the open market, and change the Required Reserve Ratio (RRR) and discount rate for banks.

Interest rates, represented by benchmarks such as the 10-Year Treasury Yield, impact the overall economy and, even more significantly, investment spending. Investors, especially in recent years, have paid close attention to these interest rates and the Fed’s actions relating to them. As of the writing of this issue, the 10-Year Yield is at a historically low level but will soon be on the rise. The Fed plans to hike interest rates by 25 bps (25 “basis points,” or 0.25%) four or five times in 2022, starting in March. Higher rates make riskier investments less likely to be as profitable, causing investors to become nervous whenever monetary policy announcements are made.

The Required Reserve Ratio is the minimum amount of funds that must be held by a bank available to consumers.

The discount rate is the interest rate paid by banks on short-term loans from the Federal Reserve. This affects banks’ ability to borrow, in turn, compelling the banks to raise interest rates for businesses and consumers. When the discount rate increases or decreases, other interest rates tend to follow.

“I heard Jeff Bezos say one time [that] he makes his investments based on if it’s going to change people’s lives, and once I started doing that strategy, I think I probably quadrupled what I’m worth now.” — Shaquille “Shaq” O’Neil, a former professional basketball player, on his investment strategy in a 2019 interview with the Wall Street Journal

Market Behaviors

Corrections – A market correction is when the market, an index, a sector, or even an individual security falls by at least 10%. As of the writing of this issue, the three main American indices are in correction territory. Recently, tech stocks and the tech-heavy Nasdaq Composite index have fallen victim to corrections more quickly and more severely.

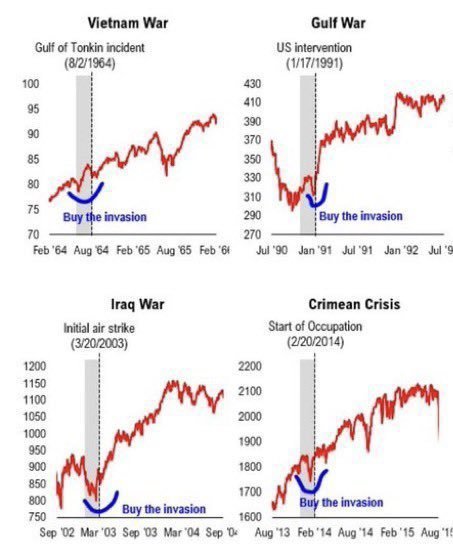

This is a negative development, but there are some upsides. A correction is a good time to get into the market or “buy the dip.” This is when investors pour additional money into the market to capitalize off losses, betting that the market will go back up. This dip can also correct overvalued stocks and make them more affordable. Despite more recent volatility after falling into correction territory, markets typically perform better than average after corrections, assuming a recession does not occur.

Rally – A market rally more broadly means that stock prices are increasing, but, more specifically, it means that they are increasing by at least 10%. The market has rallied following the February-March 2020 recession. Rallies can cause stocks to be more overvalued, meaning that they are more expensive than they should be based on the companies’ earnings. A market undergoing a rally is more difficult to enter into because of expensive stock prices.

Bull Market – A bull market occurs when investor sentiment is greedy. Stocks are doing very well; the market is up at least 20%. A bull is an investor who thinks that stocks will go up.

Bear Market – A bear market occurs when investor sentiment is in a place of fear. Stocks, at this point, are down by at least 20%. A bear investor predicts that stocks will go down.

News Affecting The Market

The Russian invasion of Ukraine is frightening investors. Russia has declared two new “independent states” that are, in actuality, parts of Ukraine: Donetsk and Luhansk. Soon thereafter, Russia began an offensive military operation, an illegal war. This is a full-fledged invasion of a sovereign country. While the Kremlin is unclear about its objectives, this appears to be an attempt to demilitarize Ukraine and destabilize the region; the government has stated that this is a “peacekeeping” operation.

Sanctions on Russia and Belarus from the United States, the United Kingdom, the European Union, Australia, Japan, and others, along with the volatility and violence, are the roots of the market backlash.

Russia is the second largest oil exporter globally, thus causing a downturn in the overall stock market and a spike in oil prices. The Brent Crude Futures, the global benchmark for oil prices, have spiked above $105 as of the twenty-fourth of February, thus causing gas and energy prices to significantly increase.

Uncertainty and volatility in Eastern Europe decrease the likelihood of interest rate hikes in the United States occurring at fifty bps; it is now more likely that they occur at twenty-five bps. The events in Ukraine could negatively affect inflation here in the United States.

The American market has increased in volatility, and stocks have turned lower because of the conflict in Ukraine and the uncertainty leading up to it. Other markets in Asia and Europe have done the same. As of the writing of this issue, the market is in a state of “Extreme Fear,” according to CNN’s Fear & Greed Index.

Russia’s MOEX index turned significantly lower on the day of the invasion, falling as much as (-45%) before eventually closing down (-33%). Russia’s central bank, the Bank of Russia, halted all short selling and much trading, but stocks plummeted when trading resumed.

Russia’s currency, the ruble, fell to an all-time low against the United States dollar. The Ukrainian hryvnia is also down because of the attack. European currencies are underperforming compared to the United States dollar, the euro included; the bloc of 19 member countries using the euro is called the eurozone or euro area.

The crypto market, especially Bitcoin, was originally seen as a “safe haven” asset that was impervious from factors such as inflation, but investors are beginning to rethink that. Major cryptocurrencies fell while gold rose to its highest level since mid-2020.

The VIX (Chicago Board Options Exchange’s CBOE Volatility Index), which tracks market volatility, spiked about 20% at market open on the twenty-fourth of February. However, it did dissipate over the course of the day.

Because Russia and Ukraine make up nearly one-third and one-fifth of the world’s corn and wheat exports, respectively, the prices of the commodities rose 6% and 5%, respectively, on the day of the invasion.

Major conflicts have historically caused downturns in the stock market, superseded by a sharp increase, as shown below. The same may hold for this conflict, assuming other parties do not directly get involved militarily.

Bottom Line

We talked about monetary policy and how it differs from fiscal policy; different market movements and their impacts; and Russia’s invasion of Ukraine, its impact, and what it means for markets.

Disclosure: All statements and opinions expressed in this article are objective and my own. I am not a financial advisor. I do not recommend the trade or use of any particular stocks or services. I acknowledge the risks of investing.

More Stories

APPLE: A FUTURE AI POWERHOUSE?

WHICH SEMICONDUCTOR STOCK WILL END UP ON TOP?

3M: IS THIS DIVIDEND KING LANGUISHING?