By Ryan James

Securities

A security is a publicly-traded financial asset that holds monetary value with the possibility of fluctuation. Most signify ownership of an entity, most notably, one or more companies. The owner of a security is called a stockholder, shareholder, or stakeholder. The former is because they own stock, or stake, in a company. This form of an investment security is known as an equity stake. The primary tradable assets are stocks, exchange-traded funds (more commonly referred to as ETFs), mutual funds, commodities, and bonds. They trade on stock exchanges via electronic trading platforms or stockbrokers. Transactional and company activity controls price variations.

Indexes

Indexes, alternatively indices, are benchmarks used to track the overall stock market. In American markets, the Dow Jones Industrial Average, S&P 500, Nasdaq Composite, Russell 2000 Index, and CBOE Volatility Index represent the broader activity. Other international indexes are the FTSE 100 Index and EURO STOXX 50 of Europe and the Nikkei 225 and NIFTY 50 of Tokyo and India, respectively.

“You don’t need to be an expert in order to achieve satisfactory investment returns. But if you aren’t, you must recognize your limitations and follow a course certain to work reasonably well. Keep things simple and don’t swing for the fences. When promised quick profits, respond with a quick ‘no.’” — Warren Buffet

Stocks

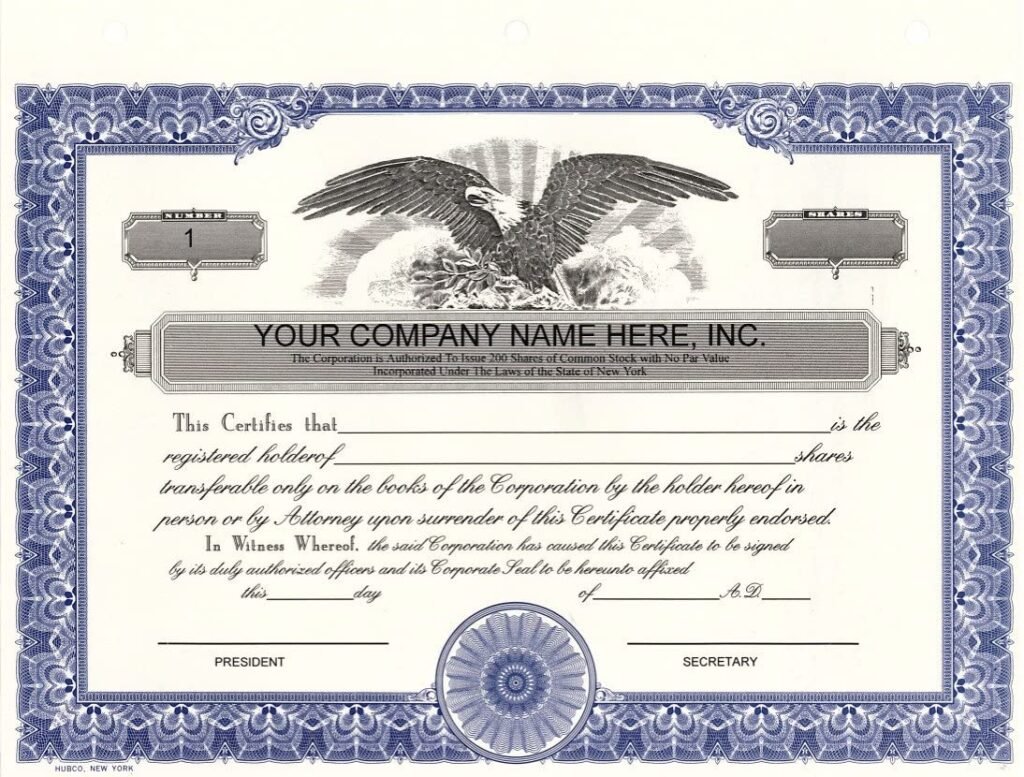

Stock is capital ownership of a publicly-traded corporation. A single piece of stock is called a share. Companies with stocks listed on stock markets do not have one singular owner. The ownership is composed of a multitude of individual and institutional investors. The majority stakeholder of a company, public or private, maintains control. Because most shareholders own less than the majority owner, they are considered minority stakeholders and have no control over decisions for the company. Albeit, votes between shareholders may transpire to determine the fate of a decision such as a merger and acquisition.

ETFs

Exchange-traded funds sell like stocks, as they are bought and sold via exchanges throughout the day. The stock market is open on trading days, weekdays except for stock market holidays, from 9:30 am through 4:00 pm. Stock is a piece of ownership in a single company, controlled by the said company. Conversely, an ETF is an amalgamation. Moreover, a company procures different companies’ stocks that follow the same suit into this single security. Financial companies such as ARK Invest, The Vanguard Group, BlackRock, and S&P Global form the exchange-traded funds. ETFs follow specific patterns. One may track a sector, industry, market, et cetera; alternatively, it may follow a characteristic such as innovation or dividends. They may be a method to own less than a share of many different companies whose stocks may be too expensive. Fees, though, may incur. These fees are the driving force motivating companies to create ETFs. Some companies that make ETFs manage them actively, while others are passive. Holders may have to pay additional fees, including one for management. They are typically safe investments that require far less comprehensive research and are less volatile than stocks but rarely have such swift, extensive upswings because of their diversification. Diversification refers to a security or portfolio that pulls from many different assets.

Mutual Funds

A mutual fund is much like an ETF but functions and trades differently. While exchange-traded funds are bought and sold during the day, mutual funds are exchanged after-hours. The price at the close is the premium paid for that day in particular. They operate by pooling funds from investors to purchase assets. Mutual funds typically consist of a variety of other media. Subsisting off manageable fees called expense ratios, they are an excellent source for small and individual traders.

Miscellaneous

These can be trickier to buy and sell than the typical securities above. Other tradable assets include commodities, precious metals, bonds, cryptocurrencies, and currencies. The former are economic goods such as corn and oil. They tend to be incredibly volatile and insecure but have considerable potential upsides. Metals are naturally occurring industrially-mined goods such as gold, silver, copper, platinum, palladium, and aluminum. They are similar to commodities, though the terms are not synonymous or interchangeable. Some are precious metals, and others are industrial. The transaction of metals exists in many media. Many companies’ stocks closely follow an individual metals’ price, and exchange-traded funds form to track a metal. APMEX is a company that sells gold and silver coins and bars. It is a popular way to invest in the two securities, and many similar companies do the same. A bond is the issuance of debt, similar to a loan. Cryptocurrencies are electronic funds lacking national affiliation, and computers mine them. Because they have a limited capacity, inflation is a substantially minute risk factor. Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ripple, and Dogecoin are prime examples. Currencies, on the other hand, are traded using other currencies. Political events, inflation, and legislation typically regulate prices.

American Indexes

The Dow Jones Industrial Average, S&P 500, Nasdaq Composite, Russell 2000 Index, and CBOE Volatility Index are the foremost resources used to adjudicate the state of American markets at any given point. Referred to colloquially as the Dow, this index tracks the movement of the thirty largest public companies listed on United States markets. The implications of the shifts of each of these stocks have large effects on the broader overall market. Because of its relative restrictedness, other indexes operate in conjunction with the Dow. The S&P 500 is similar to the Dow but is far more expansive, covering five hundred corporations on the NYSE and NASDAQ. It contains a vast constituency relative to the Dow, enabling a different perspective while working alongside one another. S&P is acronymous for Standard and Poor’s, the company that formed the index. S&P Global created the Dow Jones Industrial Average. They also make less commonly used indexes that measure small and medium-sized companies, such as the S&P 400, 600, and 1500. The Nasdaq Composite is composed of many companies listed on the Nasdaq Stock Market. It is said to be “tech-heavy” because many new, large companies in the information technology sector have been listed on the NASDAQ and subsequently on this index. Many investors who own stock in internet and technology companies have portfolios that ebb and flow somewhat synchronously with this index. The Russell 2000 Index is home to many small-cap stocks, meaning that each company’s market capitalization is between $300 million and $2 billion. Market cap is the overall value of a company. Calculate it by multiplying the current stock price by the total number of outstanding shares. It is the predominant index for less represented smaller companies. Universally referred to as the VIX, the Chicago Board Options Exchange created the CBOE Volatility Index. Unlike the other indexes that increase with the market, the VIX declines as the market rallies. It measures the volatility, stress, and fear in the market. All being negative factors, it is beneficial to investors for this index to recede.

International Indexes

The FTSE 100 Index, wholly the Financial Times Stock Exchange 100 Index, follows the 100 largest securities listed on the London Stock Exchange. The FTSE Group, a subsidiary of the London Stock Exchange Group, maintains the index. The Euro STOXX 50 represents the Eurozone, the region of states within the European Union that use the Euro. The Nikkei 225 acts as a depiction of the Tokyo Stock Exchange in Japan. It operates under the Japanese Yen. The NIFTY 50 exemplifies Indian corporations listed on the National Stock Exchange (NSE). Because India is an emerging market, it is an excellent indicator of the country’s performance. The SSE Composite Index embodies the Shanghai Stock Exchange of China. These indexes, among others, are essential for international investors and those of these countries.

Summary and Bottom Line

We discussed securities and the different types. We also mentioned the major indexes and their significance. The understanding of the former and the latter are essential to invest successfully. The third issue will introduce stock market signals and terms imperative to the comprehension of Wall Street.

Disclosure: All statements and opinions expressed in this article are objective and my own. I am not a financial advisor. I do not recommend the trade or use of any particular stocks or services. I acknowledge the risks of investing.

More Stories

APPLE: A FUTURE AI POWERHOUSE?

WHICH SEMICONDUCTOR STOCK WILL END UP ON TOP?

3M: IS THIS DIVIDEND KING LANGUISHING?