By Gus Negro, Securities Analyst

Medtronic (MDT) is a global leader in medical technology, specializing in the development and manufacture of innovative healthcare solutions. With a rich history spanning over several decades, Medtronic has established itself as a trusted name in the healthcare industry. The company is known for its diverse portfolio of products, which includes medical devices, surgical instruments, and advanced therapies. It’s very likely that someone you know has a Medtronic device implanted into their body, right now.

Dividend sustainability refers to a company’s ability to maintain and grow its dividend payouts over a long period of time. It is an important factor for investors seeking stable income from their investments. When evaluating the sustainability of a dividend, several factors need to be considered, such as cash flow generation, financial health, and growth prospects of the company.

Analyzing the Growth History of Medtronic’s Dividend

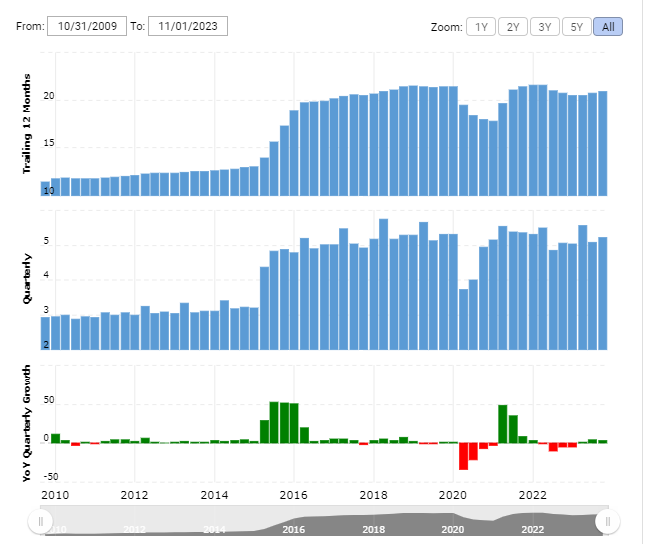

Medtronic has a strong track record of dividend growth. Over the years, the company has consistently increased its dividend payouts, reflecting its commitment to rewarding shareholders. This growth can be attributed to the company’s robust financial performance and its ability to generate strong cash flows. Medtronic has a history of delivering solid revenue growth and profitability, which has enabled it to increase its dividend payments to shareholders.

Furthermore, Medtronic’s dividend growth has outpaced inflation, ensuring that shareholders receive a real return on their investment. This demonstrates the company’s commitment to providing consistent and attractive dividends to its shareholders.

Assessing the Factors that Contribute to the Sustainability of Medtronic’s Dividend

Several factors contribute to the sustainability of Medtronic’s dividend. Firstly, the company operates in a stable and growing industry. The healthcare sector is expected to experience sustained growth due to factors such as an aging population and increasing healthcare expenditure. 10,000 Baby Boomers per day get a Medicare card, and many of those will live to age 90, or beyond! This ensures a stable demand for Medtronic’s products and services, providing a solid foundation for dividend sustainability.

Additionally, Medtronic has a diversified product portfolio and a global presence, which allows it to capture opportunities across different markets. This diversification reduces the company’s exposure to any single market or product, enhancing its resilience and ability to weather economic fluctuations.

Furthermore, Medtronic has a strong focus on innovation and research and development. The company invests heavily in developing new technologies and therapies, which not only drives future growth but also ensures its competitive advantage in the market. This focus on innovation positions Medtronic well for sustained dividend growth.

Exploring the Future Growth Prospects of Medtronic

Medtronic’s future growth prospects look promising. The company is well-positioned to benefit from several trends that are expected to drive growth in the healthcare industry. One such trend is the increasing demand for minimally invasive procedures and advanced therapies. Medtronic’s strong portfolio of minimally invasive medical devices and therapies positions it as a key player in this growing market segment.

Another growth driver for Medtronic is the rise in chronic diseases, such as diabetes and cardiovascular disorders. As the prevalence of these diseases continues to increase globally, the demand for Medtronic’s innovative treatment solutions is expected to grow significantly.

Moreover, Medtronic has been actively expanding its presence in emerging markets, which offer substantial growth opportunities. These markets have a large underserved population and increasing healthcare spending, providing a fertile ground for Medtronic to expand its customer base and drive revenue growth.

Identifying Trends that Could Drive Growth for Medtronic

Several trends could drive growth for Medtronic in the coming years. One such trend is the increasing adoption of digital health technologies. Medtronic has been investing in digital health solutions, such as remote patient monitoring and data analytics, to improve patient outcomes and enhance the efficiency of healthcare delivery. This focus on digital health positions Medtronic to capitalize on the growing demand for connected healthcare solutions. Imagine you wake up in the middle of night with a pain in your chest, and shortness of breath. Well, if you have a Medtronic implant, the 9/11 dispatcher and your healthcare team will soon be able to read all of your vital statistics right from an app on their computers. If your heart feels like a runaway train, you may not be able to speak well, but the data will beam, uninterrupted, to your medical providers. They will already know your story before you even open your mouth.

Another trend that could drive growth for Medtronic is the shift towards value-based healthcare. With healthcare systems worldwide looking to improve patient outcomes while reducing costs, Medtronic’s innovative therapies and solutions that deliver better outcomes at a lower cost are well-positioned to gain traction.

Furthermore, Medtronic is actively exploring opportunities in the field of personalized medicine. The ability to tailor treatments to individual patients based on their genetic makeup and other factors holds great promise in improving patient outcomes. Medtronic’s efforts in this area could open up new avenues for growth in the future.

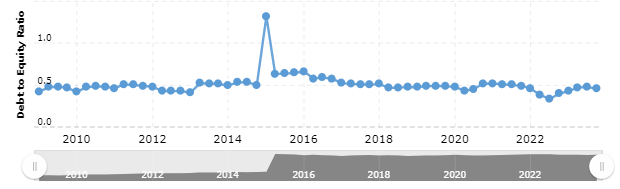

Evaluating the Financial Health of Medtronic – Debt Levels and Stability

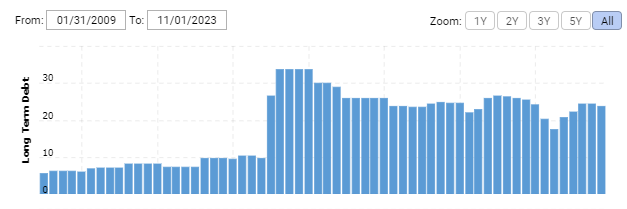

When assessing the sustainability of Medtronic’s dividend, it is crucial to evaluate the company’s financial health, particularly its debt levels and stability. Medtronic has maintained a conservative approach to debt management, with a manageable level of long-term debt on its balance sheet.

The company’s strong cash flow generation and profitability provide it with ample financial flexibility to service its debt obligations. Medtronic’s stable financial position, combined with its robust cash flow generation, enhances the sustainability of its dividend.

Assessing the Safety of Medtronic’s Dividend

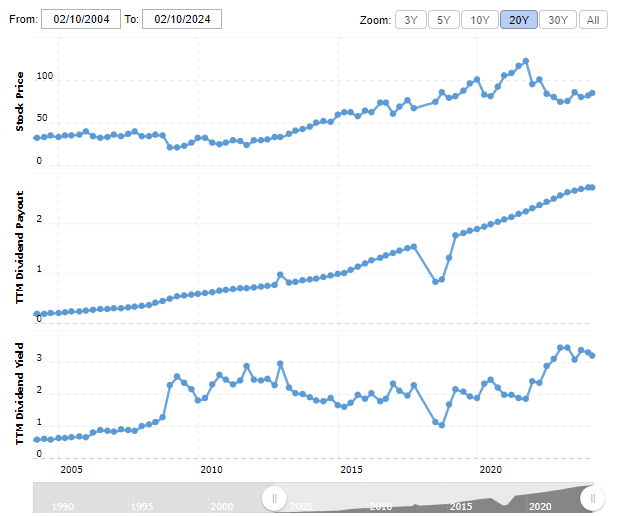

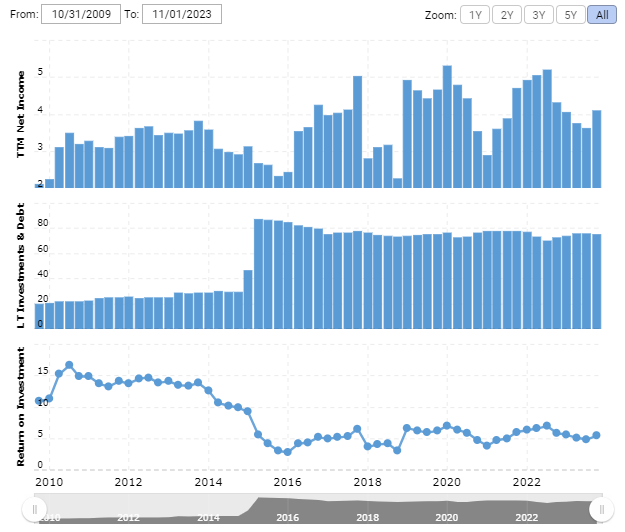

The safety of Medtronic’s dividend can be evaluated by analyzing its dividend payout ratio and dividend coverage ratio. The dividend payout ratio measures the proportion of earnings paid out as dividends, while the dividend coverage ratio assesses the company’s ability to cover its dividend payments with its earnings.

Medtronic has maintained a prudent dividend payout ratio, which indicates that it retains a significant portion of its earnings to reinvest in the business. This conservative approach ensures that the company has sufficient funds to support its operations and future growth initiatives, enhancing the safety of its dividend.

Furthermore, Medtronic’s strong earnings growth and cash flow generation provide a solid foundation for dividend safety. The company’s consistent revenue growth, profitability, and cash flow generation indicate its ability to sustain and grow its dividend payments to shareholders.

Comparing Medtronic’s Valuation to the Market and Peers

In assessing Medtronic’s growth prospects and dividend sustainability, it is essential to compare its valuation to the market and its peers. This comparison helps determine whether the company is undervalued, overvalued, or fairly valued relative to its industry peers.

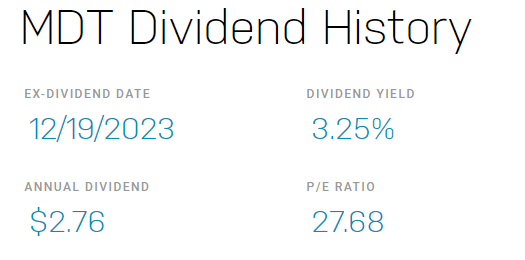

Medtronic’s valuation can be assessed using various metrics, such as price-to-earnings ratio, price-to-sales ratio, and dividend yield. By comparing these metrics to those of its peers and the broader market, investors can gain insights into Medtronic’s valuation relative to its industry. Currently the the company sports a trailing 12 month p/e ratio of 27, which is about the midpoint of where the company has traded over the last decade or so. Some companies in the healthtech industry trade as high as 60 times annual earnings, so as Warren Buffet would say, Medtronic currently looks like a “great company at a fair price.”

Conclusion

In conclusion, Medtronic’s growth history of its dividend reflects its commitment to delivering value to shareholders. The company’s strong financial performance, diverse product portfolio, and global presence contribute to the sustainability of its dividend. Moreover, Medtronic is well-positioned to capitalize on trends that are expected to drive growth in the healthcare industry.

The company’s focus on innovation, digital health, and personalized medicine positions it for future growth. Medtronic’s conservative debt management and strong financial health enhance the safety of its dividend. Furthermore, its valuation relative to the market and peers suggests that the company offers attractive investment opportunities.

Overall, Medtronic’s growth prospects and dividend sustainability make it an appealing choice for investors seeking stable income and long-term growth potential in the healthcare sector.

More Stories

INFLATION CRUSHING STOCKS FOR THE TRUMP ERA

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?