By Matthew Kerr, Equity Analyst

The Importance of Dividends

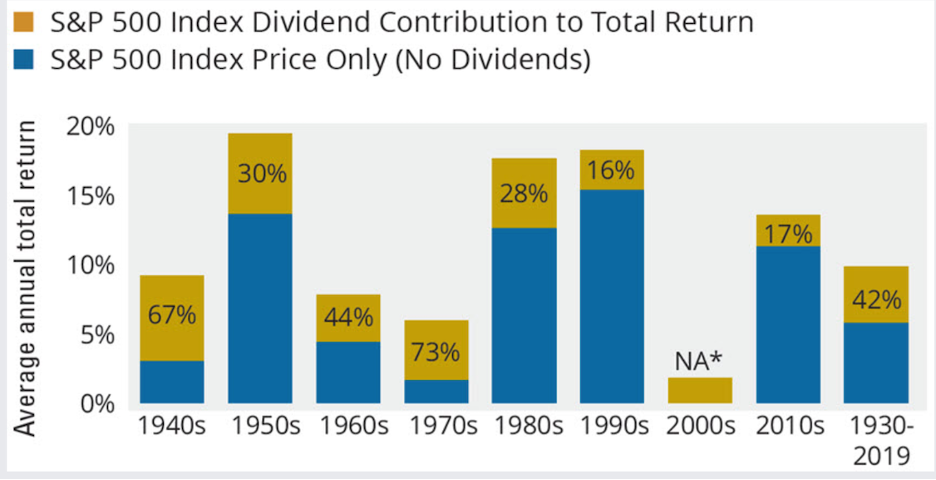

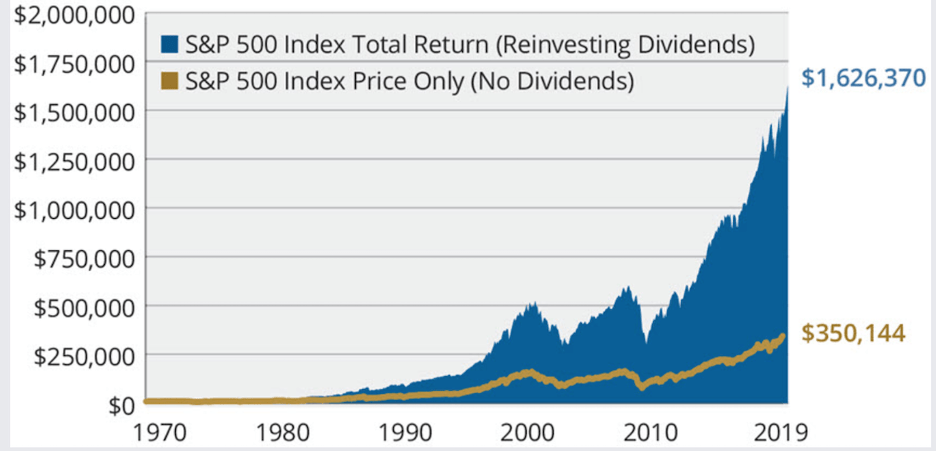

With recession fears, hot CPI numbers, interest rate hikes, supply chain woes and other global tumult affecting the financial markets lately, dividend stocks have historically been the place to turn for investors during arduous economic circumstances. Even so, taking advantage of dividends is a sound strategy no matter what direction the capital markets are moving. The numbers support this– when looking at the contributions to total return of dividends over time, they become extremely significant as time goes on – due to the power of compounding. Dividends, along with the stock price appreciation of the dividend stocks themselves, account for more than half of all returns for the S&P 500 during the period 1930-2019. Finally, reinvesting the dividend income (called a dividend reinvestment plan or DRIP) is a time-tested way to accumulate wealth. The charts below show the effect of dividend contributions to total returns using the S&P 500 as a benchmark.

Source: Hartford Funds, Quantigence (* Total return for the S&P 500 Index was negative for the 2000s.)

(Growth of $10,000)

Source: Hartford Funds, Morningstar, Quantigence

Dividend Stock Selection: First Princples

When looking for a dividend stock, there are around seven factors (some investors may have more or less) to keep in mind when doing research; a good start is to look at companies that have increased their dividends every year for at least 25 years- “dividend champions” as they are known by investors. Companies that have achieved this remarkable feat will typically do everything they can to preserve that track record.

Then, consider the company’s market capitalization– preferably, a firm with a market cap over $10 billion. Large companies are more stable, typically have a diverse range of products, enjoy more repeat business, have greater access to outside financing, and tend to weather economic downturns better. International sales should also be taken into account; a company that does business in a single country is riskier than a company with a geographically diversified revenue stream. The next factor to consider is dividend yield; it is the ratio of a company’s annual dividend compared to its share price. It approximates the return an investor can expect from the payouts over the next year assuming the dividends and share price remain the same. Even with a high dividend growth rate, a low yield can take a long time to grow. On the other hand, while a high dividend yield seems attractive, it is no guarantee that dividend payouts will continue to increase. The 5 and 10-year dividend growth rate are also extremely important; even if a company does increase its dividend every year, a company with low dividend growth is not ideal.

Arguably the most important factor when evaluating dividend stocks is the dividend payout ratio. This ratio reflects the ability for a company to continue raising dividends, even if earnings are not up to par. Ideally, a company that has a payout ratio of less than 50% historically. Dividend growth investors do not care as much if stocks rise or fall; what is of the utmost importance is receiving increasing dividend checks every year, and if the company is able to continue doing so. A concept also worth understanding when delving into the world of dividend investing is yield on cost (YOC). YOC is a measure of dividend yield calculated by dividing a stock’s current dividend by the price initially paid for that stock. For example, if an investor purchased a stock five years ago for $20, and its current dividend is $1.50 per share, then the YOC for that stock would be 7.5%.

T. Rowe Price: First Principles in Action

The dividend stock being covered in this article is T. Rowe Price Group (NASDAQ:TROW), a financial service holding company which provides global investment management services through its subsidiaries to investors worldwide. It provides a range of mutual funds, sub advised funds, separately managed accounts, collective investment trusts and other products, which include open-ended investment products offered to investors outside the United States and products offered through variable annuity life insurance plans in the United States. It also provides investment advisory clients with related administrative services, including distribution, mutual fund transfer agent, accounting, and shareholder services; participant recordkeeping and transfer agent services for defined contribution retirement plans; brokerage; trust services; and non-discretionary advisory services through model delivery. From humble beginnings in Baltimore in 1937, it now operates in the Americas, Europe, the Middle East, Africa, and Asia; serving clients in approximately 50 countries across the world. Since its IPO in 1986, TROW has grown into one of the largest asset management companies, with a market cap of $25.4 billion. The company is a very asset-light company, and the only capital it generally needs to invest in is human capital. Operating expenses are minimal which makes margins strong. Combine thick margins with its capital efficiency and T. Rowe Price generates lots of free cash flow.

Dividend Information

TROW has been paying and increasing dividends for thirty-six consecutive years and it pays its dividend quarterly. Historically, the dividend yield has floated between 1.0% and 3.0% with an average of 1.9%, with the current dividend yield being around 4.30%, based on an annual dividend rate of $4.80 per share. 2022 has been a difficult year for financial stocks, and TROW and other asset managers have been hit particularly hard; if a company’s dividend yield has been increasing, this could be because they are increasing their dividend, because their share price is declining, or both. TROW has managed to grow its dividend payout by an average of 12.8% every year for the past 10 years. That growth seems to be slightly slowing lately with the annual dividend increase averaging 11.6% over the last five years, a number that is still excellent. The company’s payout ratio has been quite stable over the past 20 years, with the exception being the 2008-2009 financial crisis. Presently, the payout ratio sits at a conservative 33%, which indicates a high likelihood of double-digit increases in the future. TROW’s share price has swooned along with the bear market of 2022, which has made the dividend yield look high. But this may well represent an buying opportunity rather than a red flag.

Growth and Resilience

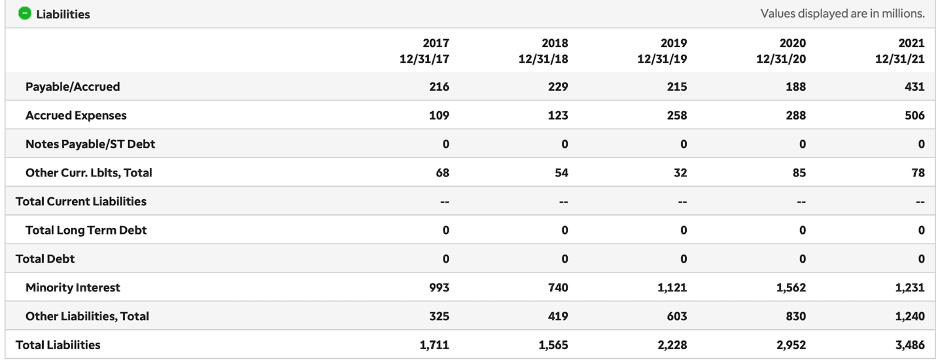

The company is not only geographically well diversified but also manages assets across a wide range of market platforms, from typical equities and fixed income to more niche areas like distressed credit and leveraged loans, and investments in late-stage venture capital transactions. TROW has about $1.4 trillion in assets under management (AUM) at the end of May 2022. For the past 5 years, the company’s EPS is up 22.52%, revenue is up 12.36%, and the dividend has increased by 14.87%. Going back even further to the ten-year growth, the superb historical trend continues- revenue has more than doubled from about $3.02 billion to around $7.71 billion, while diluted adjusted EPS increased more than three times from $3.20 in 2012 to $12.75 in 2021. TROW currently has a price-to-earnings ratio of 9.02, below its 10-year PE average; while also having an enterprise value to EBITDA of six– nearly half of what it has averaged since 2016. While it is not quite undervalued, these numbers make it even more attractive than usual. Lastly, the company is famous for its outstanding balance sheet. It is one of the few companies in existence that has no debt. Here is a portion of the liabilities section of TROW’s balance sheet showing the lack of debt.

Source: TD Ameritrade

The Full Picture

T Rowe Price is an excellent and robust company fit for any dividend growth portfolio. Historically, the firm has been easily able to weather volatile market conditions and economic woes, while at the same time demonstrating the ability to have significant growth as a company and more specifically its dividend year in and year out. Management continues to be committed to growing the dividend, and has a history of repurchasing a considerable number of shares; This has a positive impact on long-term earnings per share because there are fewer shares outstanding to spread the dividend and the EPS around to. Fewer shares will limit the impact of dividend increases to the company’s bottom line, and it will increase the relative ownership position of current shareholders. It fulfills all of the fundamental factors one would look for in a dividend stock, and as of this writing seems to be fairly valued.

More Stories

3 DIVIDEND STOCKS THAT MIGHT BE SAFER THAN TREASURY BONDS, PART II

3 DIVIDEND STOCKS THAT MIGHT BE SAFER THAN TREASURY BONDS, PART I

MASTERING THE PROXY STATEMENT, PART V (THE ELECTRIC BOOGALOO)