By Jiayi Liang, Equity Analyst

As a multinational company which manufactures and sells products in more than 180 countries, Kellogg’s is well-known for its breakfast food, cereals, and convenience food. One of the largest food companies in North America, it owns up to 30 brands, including Corn Flakes, Eggo, MorningStar Farms, and Pringles. Rated as the fourth most valuable food brands worldwide in 2021, Kellogg has achieved a market capitalization of $23.95 billion as of June 28, 2022.

On June 21, 2022, Kellogg announced a bold step: its Board of Directors has approved spin-offs into three independent public companies, with the temporary names: Global Snacking Co., North America Cereal Co., and Plant Co.

This plan, even though it sounds audacious and risky, is very likely to foster incredible growth potential for Kellogg. In recent years, the lopsidedness of development among different sectors has been more and more pronounced as the snacking market has gained explosive growth. With estimated net sales of 11.4 billion dollars, Kellogg’s snacking sector’s growth has long been weighed down by the other two with net sales of $2.4 billion and $340 million respectively. The new strategy of breaking up into three standalone companies aims to unlock their full potential with distinct financial targets that best fit their own markets and opportunities. What’s more, without any concern for other sectors, each of these three will allocate capital and resources and compete for customers much more effectively.

1. Global Snacking Co.

Global Snacking Co. is the most promising of the three companies, focusing on the global snacking business. Anchored by world-class brands such as Pringles, Nutri-Grain, and Pop-Tarts, global snacks account for almost 60% of Kellogg’s net sales. In addition, the company also sells international cereal and noodles as well as North America frozen breakfast categories. Though they are inconsequential compared with global snacks, all these smaller sectors will also contribute to the company to some degree. Nearly 25% of the company’s net sales come from cereal in international markets, led by iconic brands including Coco-Pops, Crunchy Nut, and Special K. Only about 10% of its net sales come from noodles in Africa and frozen breakfast in North America respectively, but both are expanding business which have great growth potential. What’s more, as a part of Global Snacking Co, the international cereal business could further benefit from the regions other than North America. In other words, the company can pay more attention to the expansion and growth opportunities in Europe, Latin America, Asia Pacific, Middle East, and Africa.

As a standalone company, Global Snacking Co. is expected to enjoy much more success than the current Kellogg, with a better focus on innovation, resource allocation, brand building, and customer attraction.

2. North America Cereal Co.

Separated from Kellogg, North America Cereal Co. expects to focus on its own leading regions: the United States, Canada, and Caribbean. Thanks to its iconic brands, well-known reputation, and continuous operational success over a hundred years, the company is forecasted to earn more value for its shareholders.

Due to the Covid-19, supply chains of Kellogg had been severely impacted. Hit by a series of shutdown of more than 50 factories in Malaysia and a civil unrest in South Africa, the cereal supply of Kellogg had suffered a great shortage. Therefore, the first and most urgent goal of North America Cereal Co. is to restore its inventory, making a greater profit margin to make up for the previous disruptions. After that, in terms of the long-term outlook, the company plans to focus on raising productivity, allocating resources efficiently, and enhancing its portfolio.

Without any distraction from other sectors, this new independent company will have much room for growth in revenues, profit margins, scale, as well as investment returns.

3. Plant Co.

With a similar focus on regions including the United States, Canada, and Caribbean, Plant Co. will also have the potential to further expand its scale from the tax-free spin-off. Since the acquisition of vegetarian manufacturer MorningStar Farms in 1999, Kellogg has significantly benefited from this leading brand, which boasts leading popularity and household penetration. Aided by the break-up, Plant Co. will be unchained to expand its scale across more countries through a more targeted resource allocation and capital investment. In addition, based on the existing portfolio-segment assumptions, the company is very likely to boost its net sales over years.

Simply put: the bold and innovative plan of breaking up Kellogg will allow all of the three new businesses to better leverage their distinctive advantages with a more strategic focus on resources and a more flexible operational management.

Shareholders: Final Winners

However, the most noteworthy is that not only Kellogg will achieve the goal, making the sum of parts greater than the whole, but also the shareholders could benefit a lot, winding up with three growing dividends instead of one.

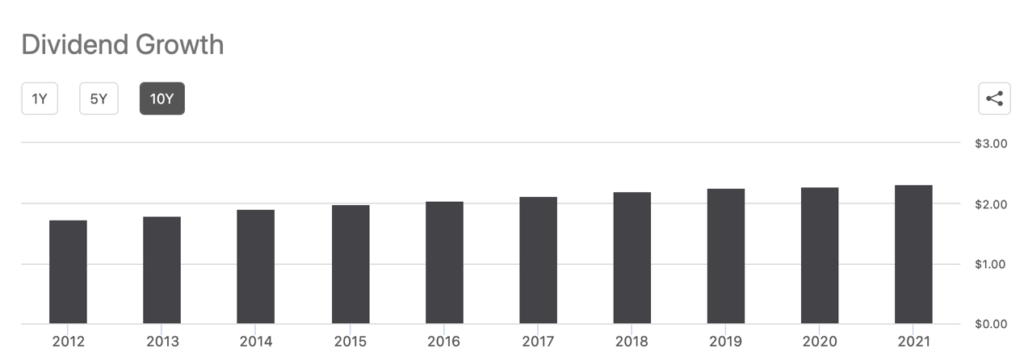

As shown in the chart above, Kellogg has kept a growing dividend over at least ten years. However, the compounded 10-year growth rate is only 3.04%, 55% lower than the sector median. Even though the investors could receive stable and rising payouts from Kellogg, their returns are far lower than those from its competitors: Ingredion has achieved a dividend growth rate of 13.09% (93.80% higher than the sector median) and reached $2.58 in 2021; J.M. Smucker’s dividend growth has been 7.51% with a $3.78 payout in 2021.

This low-paced growth will be overcome in the near future, when Kellogg officially launches the plan, which is proposed to be completed by the end of 2023. All the three companies, with Global Snacking Co. as the bellwether, are expected to achieve very promising dividend growth. According to the press release, shareholders would receive shares in the two spinoff entities on a pro rata basis relative to their Kellogg holdings at the record date for each spin-off. Therefore, the breakup plan will be a lucrative accelerator for investors. Even if North American Cereal Co. and Plant Co. may not be as profitable as Global Snacking Co, investors still have much more autonomy: in the end, they could choose to spurn part of their Kellogg’s portfolio in which they do not have high expectations and hold onto those on which they are bullish.

Conclusion

Admittedly, as Morgan Stanley analyst Pamela Kaufman said, “Given the three businesses currently share corporate, overhead, and operational costs, we expect some cost dyssynergies stemming from their separation.” Nevertheless, growth-oriented investors should not worry too much but wait for the long-term returns. One role model to look towards is the Abbvie success story: AbbVie separated from Abbott in January 2013, resulting in shareholders winding up with 2 growing dividends rather than 1. Therefore, with a very high probability of following the same path, the breakup of Kellogg is expected to be a wise choice to unlock the potential for each of the three businesses and earn more value for shareholders.

More Stories

INFLATION CRUSHING STOCKS FOR THE TRUMP ERA

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?