After many decades gestating as a division of General Electric, in early 2023 GE Healthcare was born into the world as an independent publicly traded corporation. The stalwart of hospitals and clinics everywhere is currently a “slow but steady” bet on an ever expanding healthcare market. But several changes in the world of healthcare represent opportunities for exponential growth. Is now the time to get on board with this new publicly traded corporation?

By Mackenzie Deming, Equity Analyst

GE Healthcare, a well known name and a nationwide healthcare powerhouse, is breaking into some serious potential technological advancements– let’s talk about it. It was originally founded as Victor Electric Company in Chicago in 1892, and then transitioned into the name of General Electric. The patent for Thomas Edison’s famous invention of the lightbulb was only 16 years old when his peer, Elihu Thompson (GE co-founder), modified his creation into an early X-ray machine (GE). This infamous invention now allowed doctors to look at bone fractures and see foreign objects in the human body. This X-ray machine was essentially the initiating factor that propelled GE Healthcare into business. They have been commercializing new medical imagining technologies ever since.

Looking forward to today, GE Healthcare manufacturers an array of medical devices including the magnetic resonance imaging machine (MRI), “4D” ultrasound scanners, super resolution microscopes, and bioreactors (GE). This healthcare powerhouse doesn’t stop there, however. In 2014, the company started producing their new 3D mammography system, SenoClaire (GE). An additional, yet extremely fascinating medical device they started producing was their fast Revolution CT machine, which quite literally images the human heart in just one heartbeat (GE). GE seems to take what appears to be impossible and makes it possible, efficient, and effective.

To put some things into perspective, the Revolution CT machine has been noted to cost about $350,000, the “normal” 16-slice CT machine costing around $80,000-$110,000. As you can see, these are some pricey pieces of equipment. However, as technology and modern day medicine continues to advance, doctors, diagnosticians,hospitals and/or clinics as a whole find these machines necessary.

GE Healthcare is said to drive profit growth via its aggressive acquisition tendencies and strong partnerships with other healthcare leaders to assert itself in emerging markets and in turn build up its portfolio (PitchBook). The company has made 31 acquisitions of companies and 21 investments, with 5 of these acquisitions occurring over the past 5 years. Some of the key events are its acquisition of BK Medical for $1.45 billion in September 2021, CHCA Computer Systems Inc. in April 2014, and the newest announcement of IMACTIS (French medical technology manufacturer) this year. CEO, Kieran Murphy, was tasked with making GE Healthcare its own spinoff company of General Electric in 2019, which seemed to make sense. It is known to be a bit of a “cash cow”, or a company that is known to generate a steady amount of cash flow over time. GE Healthcare accounted for about 15.8% of General Electric’s total sales, and has earned a steady $3 billion since 2011 (CNBC).

The Big Business of Imaging

Now, let’s talk about the scanning portion– GE Healthcare is famous for its X-ray invention that essentially put them in business. Despite a public perception to the contrary, hospitals are businesses, and they are attracted to profitable activities. A huge tactic for how they drive their revenue is through scanning people. Let’s say that you get in a very minor car crash– you call 911 and they arrive at the scene. Nothing even happened to you, and you know you don’t have any head injuries or broken bones. However, they want to take you to the hospital for “precautionary measures” and give you an MRI or CT scan to make sure that you are fine. This is a prime example of hospitals just attempting to make money. Hospitals will charge on average about $300-$6,750 for a CT scan depending on what part of the body it is. A brain MRI would cost about $1,600-$8,400. Your average hospital could run dozens of these tests per day. Meaning that they could potentially bring in $50,000 in revenue PER DAY, while the machine itself only cost a few hundred thousand dollars to acquire. To put it bluntly, the imaging center of your local hospital is more like a printing press that churns out millions in profit annually, with very little effort or risk.

This phenomenon has been around for quite some time. In 2008, statistics show that about 75,000 people received double scans. It is common practice for hospitals to target younger patients who are privately insured; in 2008, Medicare claimed to have paid hospitals approximately $25 million for double scans themselves. This has brought up a nationwide question of whether or not hospitals are actually scanning or scamming its patients.

And the economics of scanning are about to get a whole lot better. A recent breakthrough in the treatment of Alzheimer’s disease depends heavily brain scans. This could result in millions upon millions of seniors getting their brains scanned with GE equipment, early and often.

On July 25, GE Healthcare noted that they are scheduled to have a launch of a new Alzheimer’s treatment, and that in turn this would drive the demand for increased imaging equipment at medical facilities and hospitals over the next year (Reuters). Through the company’s up and coming Alzheimer’s research, GE Healthcare has been able to increase its estimated sales growth range from 5%-7% to 6%-8%. CEO Peter Arduini claims that through this “profound growth opportunity” the Alzheimer’s treatment offers a way to indicate the amount of plaque in a patient’s brain. This is a new imaging machine that incorporates the use of AI, and the U.S. Centers for Medicare and Medicaid Services proposed broader coverage for this type of brain scan (Reuters). The offerings of this new treatment include MRI, PET, and CT scans as well as injectable tracers that will aid in tracking the Alzheimer’s plaques in the brain.

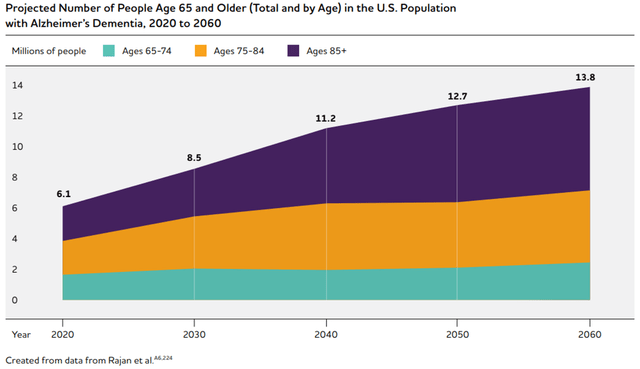

As seen below, the projections for people to be diagnosed with Alzheimer’s Disease over the next few decades are increasing rapidly. Many more scans could mean many more sales of GE’s expensive imaging equipment.

An Evolving Revenue Mix

With GE Healthcare’s value lying within its medical devices and scanning inventions, the company could be said to currently be valued as an “equipment” company. Equipment companies typically sell big ticket items with relatively low profit margins, and the market has a specific way of valuing those kinds of companies. However, big changes are afoot that could transform GE Healthcare’s product mix, and, potentially, transform the company’s valuation.

Let’s dive deeper into the financials.

As GE Healthcare finalized their spinoff from General Electric earlier this year, the company saw organic revenue growth from 5% to 7%, as well as an increase in their earnings per share, from $3.60 to $3.75 (GE Healthcare). The quarterly revenue growth sits at about 7.40% The company offers a profit margin of 9.62% , which, while standard in the capital equipment industry, is nothing to write home about. The market has valued the company accordingly, with a price to earnings ratio of 17.5.

But GE Healthcare is looking to the future where it may reap the rewards of a different kind of product. With a massive free cash flow of $2.24 billion, the company has an outstanding amount of money on hand to invest into technological improvements, such as Artificial Intelligence Software. The company is always looking to improve efficiency and productivity, and due to the sheer volume of data they have decided to turn to the use of artificial intelligence. For example, GE has implemented something called the AIR Recon DL, which is a reconstruction algorithm that allows for radiologists to receive pin-sharp images quicker and scan times to be cut up to 50% (GE Healthcare). The “Critical Care Suite” is an AI technology algorithm that has been implemented to quickly analyze scans and point out important findings. The University Hospital Cleveland has reported that this AI algorithm has decreased reporting time by a whopping 78%. The thing is– this is just the beginning for GE Healthcare and AI. The company claims that AI will play an even larger role in healthcare, and will allow them to truly provide patient-focused care (GE Healthcare). AI is a kind of software. And software typically has much, much higher profit margins than hardware. It is not uncommon to find SAAS (Software as a Service) companies with gross profit margins of 60, 70, or even 80%.

With the implementation of AI across the entire ecosystem of it’s hardware, there is the possibility that GE Healthcare will soon transition into being valued more as a software as a service type company (SAAS). Revisiting its 9.62% profit margin, this is a financial metric that seems to be on par with how GE Healthcare is operating right now– a hardware company. However, as we dive deeper into this, we can note that software companies are notorious for having higher profit margins– this is exactly the route GE Healthcare wants to head down. Investors may be concerned with the fact that software companies are now a dime a dozen– so let’s look at some competitors.

For example, Oracle Corporation is a huge software platform that has chosen to implement AI. It also has a PE ratio of 36.94, which is extremely high in comparison to market standards. For an additional example, we look towards Microsoft, another massive software company greatly investing in AI. Microsoft’s PE ratio sits at 33.24, again, which is higher than the market standard. The answer to the original question is GE Healthcare could equal the value of these software competitors. In 2022, the company held a PE ratio of 15.97 , and a predicted ratio of 19.45 for 2023. This indicates that GE Healthcare may even be undervalued. If GE Healthcare can shift more and more of it’s revenue into high margin software services linked to AI, it may be able to change the market’s perception of the company, which could easily double the market valuation of the company. Additionally, if GE Health succeeds in adding more and more high margin software revenue, it could easily grow its dividend. Right now the fledgling company offers less than a 1% dividend yield. However SAAS companies like Microsoft have been some of the biggest dividend growers of all time. If GE sells more and more products at 80% gross margins, we can expect the company’s dividend to grow accordingly.

The fact that GE Healthcare shows so much financial promise in its transition to be valued more as a software company paired with its huge presence in hospitals truly gives the company a unique advantage. With the potential to be undervalued, investors should strike while the iron is hot. There are no other competitors that are so well established in medical facilities and hospitals throughout the country like GE Healthcare. Implementing AI practices and algorithms only increases the promise of the company, and could leave investors comforted in the fact that GE Healthcare is truly one of a kind.

More Stories

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?

MCDONALD’S: SERVING UP TASTY DIVIDEND PROSPECTS