By Jiayi Liang, Equity Analyst

Taxation is an indispensable source of funding for the government. However, exorbitant taxes have made a large number of people resent the financial pressure that can come to bear. Therefore, it is wise to think about ways to save as much money as possible within the law. No matter what stage of life you are in, it is never too soon to start planning for saving money, as even the trivial decisions you make today can have a significant impact on your future. Fortunately, the Roth IRA – Roth Individual Retirement Account – can relieve a lot of people from the burden of taxation. Specifically, the Roth IRA enables people to avoid taxation tactfully by paying the taxes up front. Once you pay taxes on money put into a Roth IRA, the earnings will grow tax-free over years.

As long as your account has been open for at least 5 years and you are over age 59.5, you will enjoy a penalty-and tax-free retirement when you start taking withdrawals.

Many people like the sound of the phrase “tax free growth,” but few understand the true power of tax free compounding. This post will explore that benefit.

In the following examples, we will assume three scenarios to get a deeper and more direct understanding of the power of taxes. To put it simply and better focus on the effects of taxes, we will assume the annual contribution is $6,000 and the rate of return on investment is 10%. In Scenario 2 and 3, we expect a 7% annual growth in share price and a 3% annual dividend. Moreover, we will assume the starting year is 2022, the ending year is 2060, and the starting balance is $0.

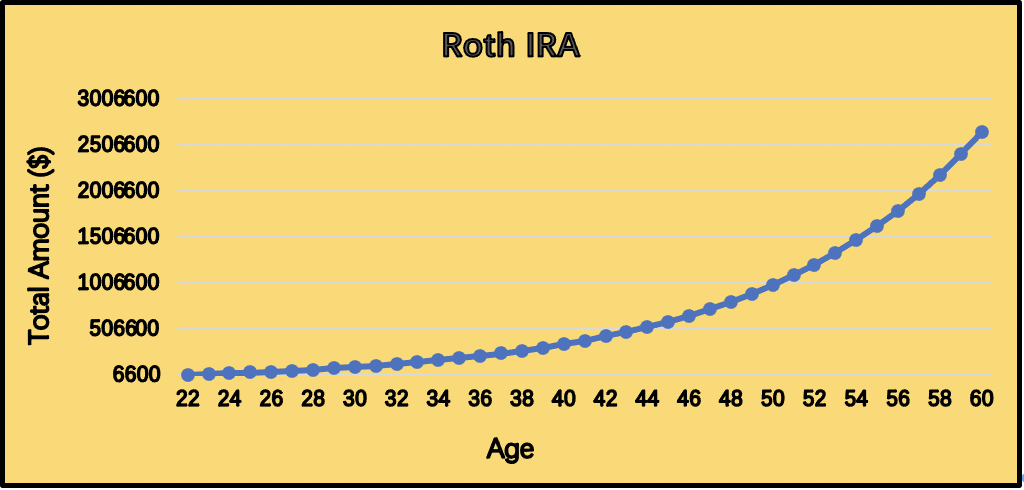

Scenario 1: You make the maximum contribution ($6,000) to a Roth IRA each year for 38 years.

If you take advantage of this scenario, you have made the wisest choice. The money compounds tax-free inside the Roth, and at retirement you will get a tax-free income stream. You start saving money at the age of 22, and each year you make a $6,000 contribution in the account. 38 years later when you are at 60, as shown in the chart below, you will receive an incredible amount of $2,649,555 in total. Put it another way, over 38 years, the total amount you have contributed to this IRA is only $234,000, while you generate $2,415,555 just by keeping a regular contribution and nothing more!

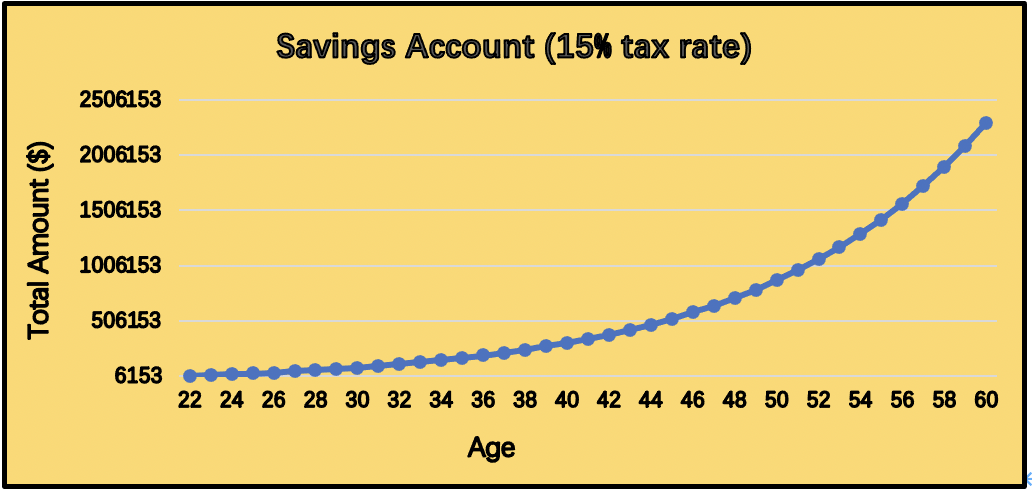

Scenario 2: You save $6,000 each year without a Roth IRA, so you must pay the standard capital gains tax every year on your dividends (15%). Not that bad, because you live in Florida without additional state tax

Under this scenario, you lose the golden opportunity to make money through tax free compounding, but you are clever to take advantage of different capital gain tax rates by state. In this way, you are only subject to a federal tax of 15% each year on your dividends and a final 15% tax on profits when you start taking a withdrawal from your savings account. As shown in the chart below, at age 60, you will accumulate $2,299,946.353 in your savings account. This amount, even though it still looks very promising, is far below that under Scenario 1.

Worse still, this amount just represents how much you have in bank, not how much you have in hand. When you start taking a withdrawal, you have to pay another 15% taxes on the gain, which is $309,891.9529, since right now the capital gains are realized. Therefore, what you would have at the end is only $1,990,054.4. This is roughly $659,500 less than you would earn in a Roth IRA!

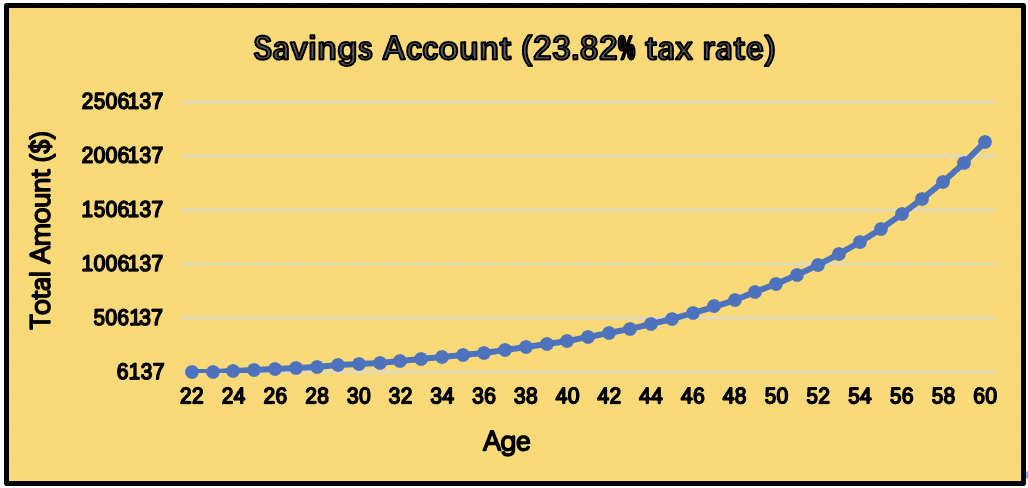

Scenario 3: You save $6,000 each year without a Roth IRA, so you must pay the standard capital gains tax every year (15%). Unfortunately, you live in high-tax New York with an additional 8.82% state tax.

Under this scenario, not only do you miss the opportunity of using a Roth IRA to shield from taxes, but you also suffer a high 8.82% state tax in addition to the 15% federal tax because you live in New York. Likewise, you are subject to 23.82% tax in total on your income stream since you are in a high tax bracket.

As shown in the chart above, at the end of 38 years, you receive $2,130,078.823 in your bank account, which is $519,476.177 less than you have if put into a Roth IRA. Even so, this is not the end result. When you start taking a withdrawal after retirement, you have to pay another 23.82% tax on the gain. Ultimately, you will only get $1,678,432.847, which is $971,122 less than under a Roth IRA. To put it more straightforward, if you choose a Roth IRA to save your money, you will get over 1.5 times what you wind up with in this example.

Implications

The result is self-evident. Taxes are far more powerful than you think. They don’t just sting at the time of payment, but they interrupt and impede your compounding process.

The key is to recognize the significant benefits you could get from Roth IRA and then exploit its advantages in the best way. Admittedly, the American retirement plans as well as the taxation policies are extremely complicated and crazy to a majority of people. This complexity either pushes them to cursorily select a plan that may not be the most suitable or discourages them to even think about it. Just as shown in our analysis in the three scenarios, the “wisest people” would earn over millions of dollars more than others would. Knowledge really is power!

Tips

Specifically, the Roth IRA is best suited for people who expect that their future tax rate will be higher or that they will be in a higher tax bracket when they start taking withdrawals. The examples given in this post are actually conservative; very high income people could get hit with even higher taxation rates or surcharges.

If you identify yourself as this type of person, the best choice is to open a Roth IRA and enjoy the advantages of it. You only need to be taxed whenever you put money into your account, and then you will be free from the stress of taxes and instead enjoy the magic of money compounding.

Last but not the least, timing is also important. The money you earn when you start putting deposits into a Roth IRA at age 22 makes a significant difference than if you start at 32. Keeping all other factors constant, under the Florida case above, you will receive $739,288 if you open the Roth IRA 10 years later, which is $1,028,807 less than you would at 22! Similarly, under the New York case, you will have only $627,859 if you start using the Roth option at 32.

All in all, to make the most amount of money, the best choice is to open a Roth Individual Retirement Account as soon as possible. It is never too early to start!

More Stories

ABBOTT AND ABBVIE: THE POWER OF SPINOFFS, ILLUSTRATED

T. ROWE PRICE: THE EXEMPLARY DIVIDEND STOCK?

3 GOOD DIVIDENDS FOR BAD TIMES