By Jiayi Liang, Equity Analyst

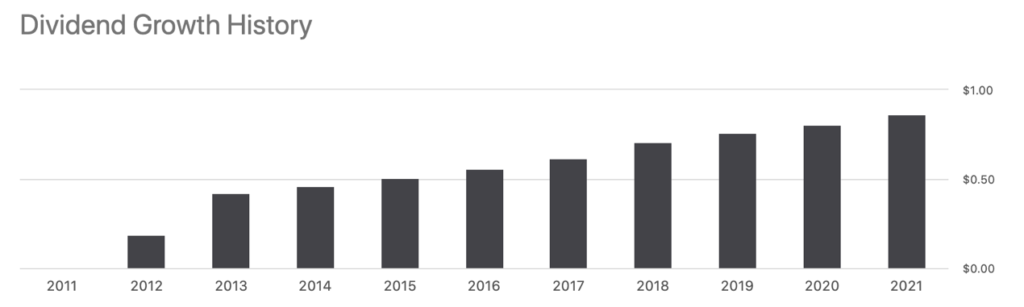

Apple Inc. is a global technology company which specializes in smartphones, personal computers, tablets, earphones, and accessories and digital services. Thanks to its broad line of products and services, the tech giant has witnessed an overwhelming expansion in revenue, dividend growth, and stock price. Currently, it ranks as the top technology company, with total revenue of $365.82 billion in 2021, and top 2 by market capitalization reaching $2.19 trillion. In addition, it has achieved a 5-year average net income growth of 17.39% and a dividend growth rate of 8.75%. If Apple can maintain it’s current dividend growth rate, then the payout can double every 8 years.

All these financial metrics demonstrate the strong performance of Apple. As Apple has already been the market leader for about twenty years, is Apple stock expected to keep growing in the future? In the following, we will seek out the answer by analyzing from two points of view: the company’s innovation culture and its coming-out-soon feature Apple Pay Later.

1. Innovation Culture: “People First”

Apple has been the forerunner in the global market for almost two decades. Its groundbreaking innovation is well recognized by the public. Equipped with a world-leading technology team, Apple has the ability to develop updated versions of existing products while simultaneously introduce entirely new products at a very efficient rate.

According to its press release this month, Apple announced several innovative developments: the newest version iOS 16 will allow customers to choose their favorite type styles and colors of the date and time on the Lock Screen, and the updated iCloud Shared Photo Library will provide families a much quicker way to share photos seamlessly.

However, Apple would not be so successful for that reason alone. The core competitive edge is its distinctive innovation culture – always “people first.” As Apple CEO Tim Cook said in an interview: “It’s always products and people. The question at the end of every year, or every month or every week or every day, is, did we make progress on that front?”

In 2007, the first iPhone was unveiled to the world. Although the first smartphone was created long before that, iPhone was a big leap forward in the technology field. It brought an innovative breakthrough with its “people first” goal: instead of restricting people to computers to surf the web, the invention of iPhone allowed users to access the internet in a much more convenient way. Three years later, iPads entered the market, redefining the concept of tablets – portable, lighter with higher capacity. This innovation helped Apple make a profit of $67.7 billion.

In 2016, Apple made another revolutionary design, introducing Airpods to the public. Again, the focus of the new product was not technology but people. Instead of having to wear a clumsy heavy headphone, people’s daily lives have become much easier: they could now workout while listening to music or catch a subway while talking to friends on the phone. As the first wireless earphone, Airpods has brought around $12 billion revenue for Apple each year.

Besides the smartphones, tablets, and earphones, Apple has also been investigating the implementation of augmented reality (AR) into the new versions of iOS. Recently, Tim Cook implicitly corroborated a rumor that Apple is working on an AR headset which is very likely to be released in January 2023. While AR headset is a head-worn apparatus that allows viewers to see images superimposed onto the real environment, Tim Cook highlighted that the core of this technology is putting humanity at the center of it. Again, Apple knows what really matters to people as well as how to persuade customers to choose their products. This is why that, even though Apple is not the first entering the AR market, it will still far outstrip other peers.

2. Apple Pay Later

Even though all those innovations we mentioned above are extraordinary and influential, the most noteworthy is Apple Pay Later. In recent years, Buy Now Pay Later (BNPL) has gained an increasing popularity, accounting for more than 5% of all ecommerce spending. As it provides customers with higher security and convenience, this short-term financing allows people to split up the cost of a purchase into four equal installments over six weeks. The first payment occurs on the date of the transaction, then one payment every two weeks after that.

In June 2022, Apple announced that its new feature Apple Pay Later will be launched with iOS 16 in this coming September. Wading into an industry which has experienced incredible growth, Apple will discover tremendous opportunities to make profits as well as a large number of competitors. Fortunately, Apple has competitive advantages to eclipse these competitors.

Firstly, it has been widely accepted as a top enterprise around the globe. Because of such a big reputation, it is much easier for Apple to promote its new products. Therefore, compared to a little-known start-up company, acquiring customers will be a breeze for Apple.

Secondly, thanks to its comprehensive products and services, Apple’s influence on people’s daily life goes way beyond phones. When a customer gets a new iPhone, a whole set of apps have already been installed on it, including Apple Wallet, Apple Movie, Apple TV, and Apple Health. In other words, iPhone has ‘put the world in our pockets’. It brings great convenience to consumers while at the same time makes great profits by potentially discouraging them from using other apps. Apple’s “walled garden” of services is just more convenient for customers. Why go elsewhere when everything you need is already on your phone and fully integrated into your digital world?

According to its press release, Apple Pay Later will be available anywhere that Apple Pay is accepted, in apps or online. In addition, the feature also provides convenience to merchants who have already cooperated with Apple Pay. They do not need to do anything else to accept the new feature. On the contrary, Affirm, Klarna, or Afterpay do not have these stepping stones. Their users have to waste a lot of time either signing up an account on websites or downloading the apps. In addition they require customers to fill out a bunch of personal information such as name, phone number, email address, date of birth and billing address, these companies also require that users type credit card information for the first purchase, with some of them may even asking for a Social Security number. Many customers with a deep and trusting pre-existing relationship with Apple simply won’t bother. It will be much easier for people to choose Apple Pay Later over these fussy, lesser known competitors.

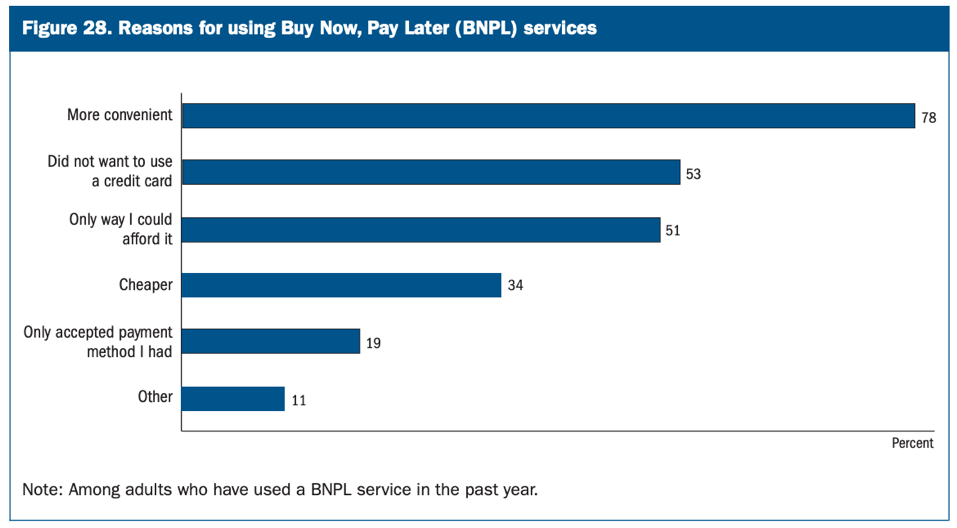

Not only will the new feature easily attract a large customer volume, but it possesses great potential to make profits for Apple. Merchants are subject to a fee on each transaction, usually between 2% and 8% of the purchase amount. Whenever consumers default on payments, they are charged late fees, usually ranging from $5 to $15. The late fees will rise if the users continually miss payments. In a report by the Fed in 2021, overall, 10% of people used a BNPL service in the previous 12 months with over half of them indicating that it was the only way they could afford their purchase. Among them, 23% paid late. Apple will have the ultimate leverage over these slow paying clients; for many their cellphone is the only thing of value they possess. If they don’t pay the high late fees associated with Apple’s Buy Now Pay later, Apple can just shut down their phone. No one else has that kind of leverage over a client base with shaky credit histories.

Ultimately, “Buy Now Pay Later” is just a fancy name for risky, high interest lending to the masses. With Apple’s pre-exsiting cash hoard, incomparable easy of use, and leverage over untrustworthy borrowers, this new feature could be a bonanza for shareholders. No other competitor will come close.

Conclusion

In short, we have strong confidence in Apple’s promising future. Thanks to its core brand culture, high technology research, and its own version of Buy Now Pay Later service, the tech giant will continue to grow its cash flow and dividend for years to come.

More Stories

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?

MCDONALD’S: SERVING UP TASTY DIVIDEND PROSPECTS