By Ryan James, Dividend Analyst Fellow

Both Target ($TGT) and Walmart ($WMT) have taken major drops that were once unthinkable for large-cap companies worth hundreds of billions of dollars. That feeling of stability in large-cap stocks is fading in this volatile market. Target shares fell (-24.93%) on May 18, erasing $53.67 per share and nearly $25 billion in market cap. Walmart took a three-day plunge of (-19.66%) at the same time as Target, losing $29.14 per share and over $100 billion in market cap.

These enormous dips are the result of poor earnings reports. Target missed on earnings but surpassed revenue expectations. Their earnings per share (EPS) for the quarter was $2.19 (adjusted) against the $3.07 expected; their revenue was $25.17 billion against the $24.49 billion expected. Walmart followed the same pattern: their EPS for the quarter was $1.30 (adjusted) against the $1.48 expected; their revenue was $141.57 billion against the $138.94 billion expected.

These misses in EPS by 28.66% and 12.16%, respectively, do not appear to warrant drops of this caliber in stock price. And, alone, they do not. The numbers were but a small part of the contributing factors to these drops. Both stores cited higher costs and supply chain woes as detriments to their businesses in their earnings calls. The stores are experiencing shortages of goods and rising costs which must be shifted to customers. The US Producer Price Index (PPI) is at 137.79, up 0.52% from March to April. This means that it is more expensive for manufacturers to create goods, thus they charge retailers such as Walmart and Target higher prices. Because retailers are paying more for goods, they charge more for those goods, creating higher prices for consumers as reflected in the US Consumer Price Index (CPI).

This inflation makes the goods that retailers sell more expensive, causing consumers to buy less. This is the cause of a paradigm shift between the two stocks. While neither store is seen as more luxurious, Target’s consumer base is composed of higher-earning consumers than Walmart’s. The two companies tend to attract different customers; consequently, they have little direct competition with one another. Inflation tends to have a more significant impact on less affluent individuals; consequently, Target’s customer base will be less affected than that of Walmart. This signifies that inflation will be a larger obstacle for Walmart.

Other large-cap retail stocks, such as Costco ($COST) and Best Buy ($BBY), reported good earnings that pleased investors shortly after Walmart and Target’s less-fortunate earnings reports. This is a good sign for both companies.

Financials

The two companies’ balance sheets are moving in opposite directions: Walmart is decreasing its balance sheet and Target is increasing it. Both companies experienced an upward trend in their balance sheets at the start of every fiscal year from 2019, but Walmart’s decreased this year by over three percent, a value of $7.636 billion; concurrently, Target’s balance sheet increased by five percent, a total value of about $2.563 billion. With the established effect of inflation having greater significance for Walmart, this puts Target in a superior position.

Target’s cash flow statement represents that the company has had an increase in cash flow at the start of each of the past five fiscal quarters and the start of each of the past four fiscal years. Walmart has been volatile, reversing from increasing to decreasing every quarter since Q2 2021, culminating in a (-7.4%) decrease in income in Q2 of this year from Q1. However, Walmart has seen a continuous increase in income at the start of each of the past four fiscal years.

The cash flow for both companies is disappointing and volatile, but Walmart is even more so, falling into negative territory in the most recent quarter.

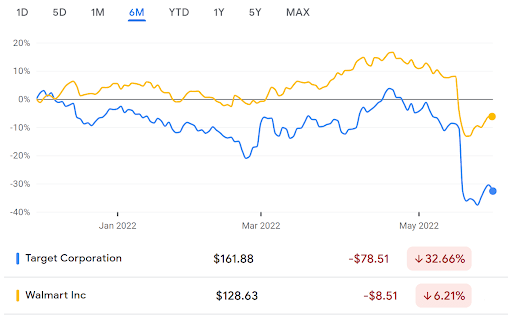

These two stocks are being heavily compared because they are peers with incredibly similar fundamentals, and their stocks have recently had massive drops. As displayed in the chart (with market information as of June 1, 2022, before the opening bell), Walmart has had a better time recovering from the drop. It has also generally and consistently outperformed Target over the past six months.

Walmart’s economic moat is far wider than Target’s, and it is stable whereas Target’s moat is trending downward. It is less volatile, making for a safe bet in current macroeconomic conditions but giving it less growth potential. The main case for Walmart is its size and dominance, though it is having trouble with competitors such as Amazon, especially as e-commerce has taken over since the onset of the COVID-19 pandemic. Target has less leverage than Walmart because it is much smaller in size, and, though it has been doing well in e-commerce, it is difficult for it to succeed because consumers tend to look at larger brands such as Walmart and Amazon before moving on to Target. However, Target seems to be trending favorably in the current market, setting it up to outshine Walmart in growth.

Qualitative and Quantitative Value Comparison

Bloomberg Terminal tweeted, “The market is showing demand for structured products that allow buyers to build specific exposure to ESG sectors while maintaining bespoke risk characteristics.” Investors are repositioning with ESG in mind. While neither company is particularly adept in this area, Target stands as the definitive victor when compared to Walmart in ESG standards. This mostly comes down to the social component: Walmart has a remarkably poor social record with many individuals going as far as to boycott the company for it.

In terms of recent chart events, Walmart looks better than Target. Target has displayed a triple moving average crossover, a bad sign for the stock. Walmart’s price has crossed its moving average, a good sign. These events matter little in the long term, but they are somewhat significant in the short term.

Target has a higher dividend yield (2.15%) than Walmart (1.74%). In this volatile market, dividends can be a useful tool to earn income even as the broader market declines. Whether automatically reinvesting these dividends or holding them, a higher yield is favorable.

Target has a Price to earnings ratio of 13.37, and Walmart has a P/E ratio of 27.67. Target’s P/S ratio is 0.7318 while Walmart’s is 0.6235. Target, based on available data, seems to be of a fairer value despite having a lower P/S ratio.

Target’s profit margin is 5.48%, far higher than Walmart’s profit margin of 2.26%. Target receives more of a return relative to its resources and operating expenses.

1.80% of Target’s shares outstanding are short, compared to only 0.47% for Walmart. Investors have more faith in the latter.

Both stocks will follow the broader market, and their performance is contingent on whether the bear market continues. Based on fundamentals, statistics, and market trends, Target will likely outperform Walmart and is the preferable stock pick.

More Stories

INFLATION CRUSHING STOCKS FOR THE TRUMP ERA

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?