Donald Trump’s hypothetical tariff proposals, coupled with his deportation policies, are expected to drive inflation higher in 2025. While some of Trump’s tariff threats will likely remain empty threats used for leverage in economic negotiations, we can expect a considerable amount of these threats to be realized. In addition to tariff increases and the deportation of millions of undocumented immigrants, the current debt levels in the United States also appear to be concerningly inflationary, as the U.S.A.’s current debt of over $35T is completely unsustainable.

So, considering that higher inflation levels are practically inevitable, where do you need to relocate your investments to hedge against inflation successfully? Many would argue that bonds are the answer, but dividend stocks surprisingly make more sense when you break it down…

By Grant Bailey, Equity Analyst

Bonds don’t make a lot of sense to invest in during high inflation in actuality because the bonds in which you are investing are not growing at a higher rate than inflation; in fact, bonds aren’t growing at all, since the return is fixed. Conversely, dividend stocks with a great track record and room for growth do not have fixed returns, which allows your investment to grow at a higher rate than inflation. “But what if my stock shares don’t grow faster than inflation?” That’s where dividends enter the conversation. If a stock is paying out a dividend, that dividend can rise higher than inflation, and it’s especially attractive if the dividend is already well above 2%. How do you find these sorts of gems? It takes research, screening, analyzing, and occasional estimating. Fortunately for you, I’ve done all of that already!

Merck and Co (MRK)

Merck is a very well-known company in the healthcare industry, but they’ve recently suffered a share price drop of over 25% from their 52-week high of $134. What caused the drop? Fierce competition. Merck gets nearly half of its entire profit from Keytruda, but unfortunately for them, there’s a new guy on the block… Summit Therapeutics’ upcoming product, ivonescimab. This upcoming medicine hugely outperformed Keytruda in its phase 3 trial which was located in (brace yourself) China. While that trial may not be entirely 100% accurate, it could at the very least indicate a serious threat to Keytruda-related profits. Additionally, ivonescimab is most certainly not the only potential competition that Merck needs to stay aware of, as several other healthcare companies such as BioNTech are also working on creating competition for Keytruda.

So, why buy? One of the biggest reasons is that their current pipeline involves over 100 programs, of which more than half are in Phase 2 and 35 programs are in Phase 3. While most of these upcoming products are existing medicines, several of them aren’t, which indicates solid profit potential in virtually untapped markets. These programs should definitely be able to soften the blow if Keytruda’s sales start to die out.

From a value perspective, Merck looks very solid, objectively speaking. With a P/E ratio of 16.67, Merck is considered slightly undervalued compared to its competitors. Merck’s operating margin of over 22% is also very impressive, as it indicates that Merck is operating very efficiently. With both a healthy current and quick ratio, Merck is also able to easily pay off their short-term obligations.

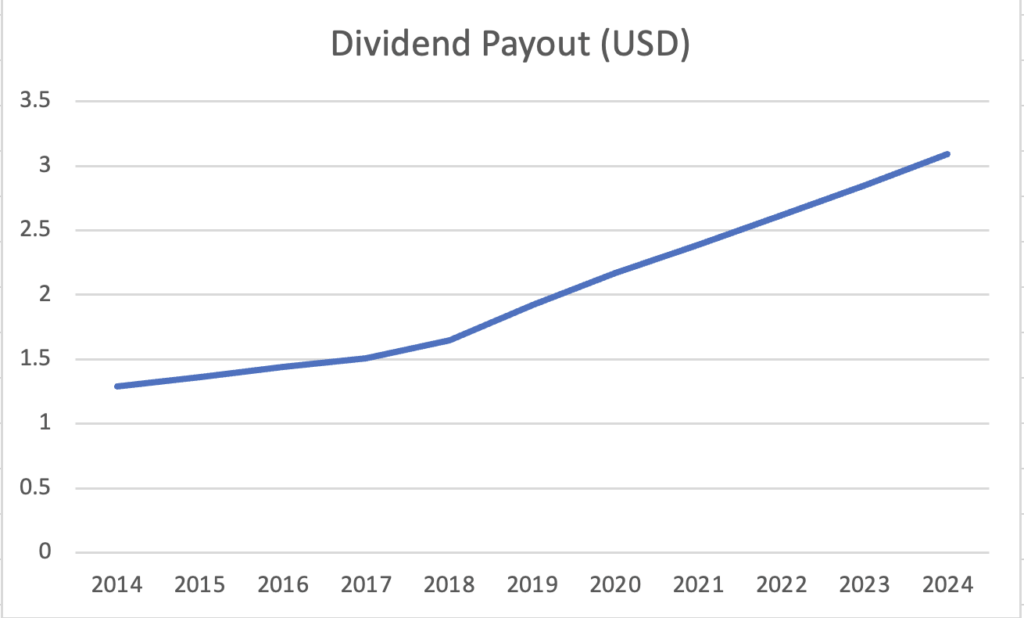

Merck’s impressively consistent dividend is the cherry on top, as Merck currently pays out a dividend of $3.09 per share and a payout ratio of around 50%. This payout ratio indicates that Merck’s current dividend is sustainable and should still have some room for growth. Another reason you should expect this dividend to continue to grow is that Merck has consistently improved its dividend payout each and every quarter the the past 2 decades. As you can see from the chart below, Merck’s dividend growth has crushed inflation over the last decade.

Amgen Inc (AMGN)

While much of the market enjoyed huge gains in 2024, Amgen was on the sidelines. Amgen’s stock is down over 16% over the past year. What primarily caused this drop was its phase 2 trial of Amgen’s weight loss drug, which posted results that were considerably worse than expected. But after suffering a 20% loss from early November 8th to today, the damage might be done. With over 30 products in Phase 3, Amgen could be on the verge of a resurgence. Amgen is well-known for being one of the more innovative healthcare companies in the United States, and since they rely heavily on novel drugs, it naturally would make them more of a growth pick than a value pick. While they do have a very concerning amount of long-term debt, it doesn’t seem as though it has had a huge effect on their stock price thus far; they first loaded on huge amounts of debt in early 2023, but just a year after this occurrence, Amgen found itself up over 20% in spite of its debt. Additionally, it should be noted that this debt was used to finance the purchase of Horizon Therapeutics, a maker of rare disease drugs that brings a number of promising compounds to the table.

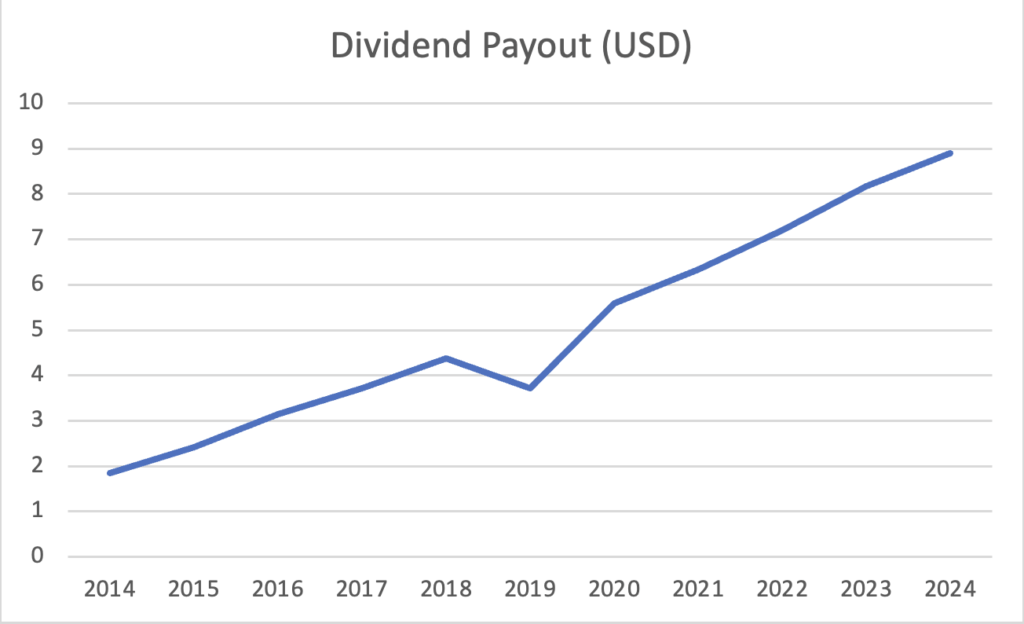

The company’s stock never really had seen much of a decline at all up until the disappointing results on its weight-loss drug. What’s also impressive is that Amgen’s operating margin sits at nearly 20%, indicating that it’s using its cash very effectively and efficiently. Furthermore, Amgen has consistently increased its dividend almost every quarter, and the current dividend sits at a hefty 3.47%. With a payout ratio of roughly 40%, this dividend still has a lot of room for growth as well. As you can see from the chart below, inflation has been no worry at all for Amgen investors.

With a P/E ratio of 33.45, many investors might choose to stay away from this stock. However, Amgen’s stock had previously increased healthily despite a P/E ratio of over 50 (before the poor weight-loss drug results). If they’ve done it very recently before, it seems quite reasonable to assume that they could do it again.

As aforementioned, this isn’t supposed to necessarily be a value pick, anyway. While picking growth stocks does typically add risk, this stock actually seems to have better value than some would probably expect; Amgen currently holds a Zacks Value Style Score of A, which means the stock is trading below fair value compared to the rest of the market. Amgen also holds a Zacks VGM (Value, Growth, and Momentum) Score of A. Observing the collected data, Amgen should certainly be considered for your portfolio.

AT&T (T)

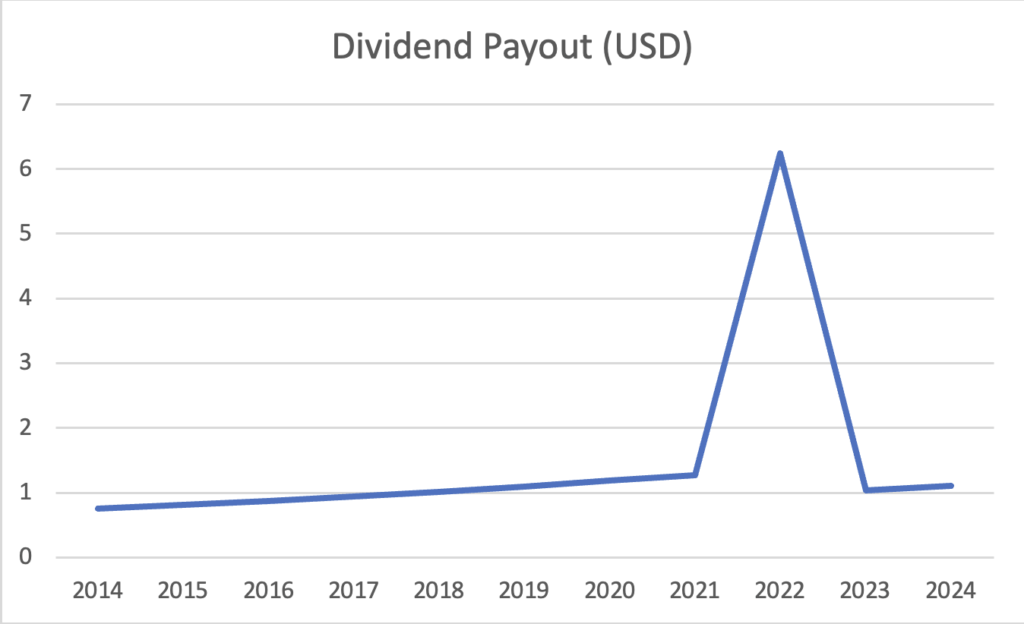

This stock has been on a tear in the past year, up over 30%. However, there seems to still be a lot of room for growth. What caused the growth? According to Forbes, AT&T’s growth was a result of healthy free cash flow, coupled with margin improvements. Looking at the metrics right now, both appear to be very strong; AT&T’s P/FCF (price divided by free cash flow) at this moment is 8.15. P/FCF is often used to evaluate a company based on cash flow and anything under 15.0 is considered undervalued. With an operating margin of almost 16%, AT&T seems to be using its cash very efficiently. So, if these 2 numbers are what’s primarily driving AT&T’s growth, and those numbers are still very strong, why would we assume that AT&T’s stock is done growing just because they’re up 30% already? The stock holds a Zacks VGM Score of C along with a Zacks Value Style Score of B. While this may tell you that this stock is just another average stock, it’s important to consider that value stocks do typically outperform growth stocks over inflationary time periods. AT&T’s dividend growth was lackluster over the last ten years, but the company seems much better positioned to grow over the next decade.

In case you still aren’t convinced, AT&T also pays a strong dividend at 4.84%, with the dividend payout increasing nearly every quarter since early 2023. This dividend should also be quite sustainable, as the current payout ratio stands at around 46%. This could be seen as more of a value pick than a growth pick, but it should still be poised for further growth despite its already outstanding short-term growth. With a market capitalization of over $162B, any risk associated with the purchase of this stock will naturally be slightly lower, since AT&T is most certainly here to stay for the foreseeable future. While this stock may have the least intriguing growth prospects compared to Amgen and Merck, it also appears to be an inarguably safe pick for 2025.

All things considered, Merck is likely the best choice between the three stocks mentioned above; it has both exceptionally favorable valuation and growth potential. If you’re specifically looking for a growth stock, Amgen is probably your best bet for 2025. If you’re specifically looking for a safe value stock, AT&T should be more highly considered. That said, all three of these choices seem as though they can outperform the market through stock growth coupled with dividend growth in 2025.

More Stories

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?

MCDONALD’S: SERVING UP TASTY DIVIDEND PROSPECTS