By The Sick Economist

A lot of people view dividend stocks as a way to preserve wealth. A way to gain safe and regular income from wealth that has already been accumulated. But did you know that income stocks can also be an effective way to get rich? Although many dividend stocks lack the panache and media buzz of “growth” stocks such as big technology names, there is a method of dividend investing that can help you grow your wealth at an exponential rate.

This method is referred to as “dividend growth investing.” The idea may seem counterintuitive at first, but some basic arithmetic reveals the awesome compounding power of boring stocks.

The basic concept is the following: don’t focus on stocks with the highest dividend yields, focus on stocks that grow their dividend at a very high and sustained rate. In other words, don’t worry about scoring a stock that currently yields 10%. Rather, focus on finding a stock with a modest dividend yield that is growing at an annual rate of 10%.

This methodology is recommended for anyone who will measure their retirement in decades rather than years. If you are a 75-year-old retiree, you would probably be better off just choosing stocks that have high dividend yields now. However, if you have just quit your corporate career at age 45, and want to live off your dividend income for decades to come, dividend growth investing makes sense for you. Dividend growth investing is also a recommendable technique for people who either can’t or don’t want to do a lot of research. This is a very popular method, so it’s easy to find lists online of brand name stocks that grow their dividend rapidly.

Simple Math. Shocking Math.

As I mentioned earlier, I was never great at math in school. But even some basic arithmetic can demonstrate the amazing outcomes that are possible through dividend growth investing.

To start with, let’s ask ourselves the following: what constitutes above average dividend growth? Wyo Investments recently published a piece on this topic on the website Seeking Alpha. The author is a young retiree with eleven years of dividend growth investment under his belt. Here is his criteria for “high dividend growth. “My current goal is twofold; Maintain 7% dividend growth without reinvesting dividends. Achieve 10% dividend growth with reinvesting dividends.” (Seeking Alpha, 1/5/21). The author goes on to list a portfolio of 40 stocks, many of which are household names, that have met that criteria.

What has been the practical implications of that growth? Between the years 2016 and 2021, his overall dividend income increased from $8,000 per year to $12,500 per year. That is without him investing any additional capital; sometimes he spent his dividends, sometimes he reinvested them. Either way, he grew his passive income by over 50% in just five years. How many of you have gotten a 50% raise at your job over just five years?

Another way of thinking of the growth potential is simply to compare your rate of dividend growth to the rate of inflation. During the time period referenced above, inflation hovered somewhere around 2% annually. That means that Wyo Investments easily found investments with passive income streams that grew at four times the rate of inflation. You can see the powerful results achieved in just five years. What would the results look like over longer periods of time?

I’d Like To Buy The World A Coke

Typically when we think of millionaire-maker stocks, we imagine high flying growth stocks like Tesla, Google, or some biotech firm. But what if I told you that you walk by liquid gold every time you go to your grocery store? Plain, old, boring Coca-Cola has made a mind boggling fortune for Warren Buffett and many other investors.

Before we go into the specific math of Coca-Cola, we need to discuss a key vocabulary lesson. Typically, when we are talking about income producing stocks, the term used to discuss the current dividend is “dividend yield.” This is a percentage-based measure of how much the current dividend is. So, for example, if company X has a share price $10, and is paying a $0.50 annual dividend, then company X currently has a dividend yield of 5%.

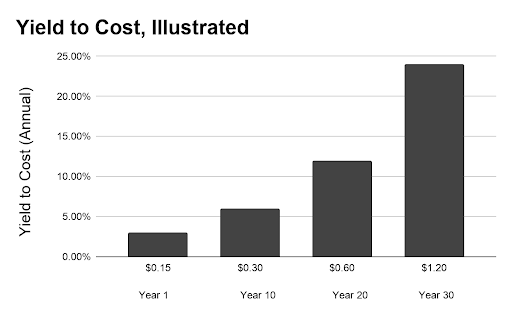

But the key concept to remember is that dividend yield is a fluid measurement that changes with market conditions over time. Your costs do not. So, if company X’s share price slowly rises to $20 over time, and the dividend slowly rises to $1 as well, then your current dividend yield remains 5%. But you bought the stock at $10 years ago. Now the dividend has risen to $1 per year. That means that your base cost has stayed the same, and your yield has doubled. So, your current dividend yield is 5%, but your “yield to cost” is a whopping 10%. This is the secret formula that makes boring companies like Coke so lucrative over time.

Author Sean Williams explained how Buffett has profited immensely from his long term investments in Coke and American Express:

Buffett also holds true to his winners. For instance, Coca-Cola has been a Berkshire Hathaway holding for more than three decades, while American Express has been a consistent holding for more than 25 years. As these two companies have appreciated in value and grown their payouts over time, Berkshire’s annual yield based on the original cost basis for Coca-Cola and American Express has soared. Paying out almost $261 million annually, yet with a cost basis of only $1.287 billion, AmEx is providing a roughly 20% yield each year. Meanwhile, Coca-Cola’s $656 million in annual dividends, relative to its $1.299 billion cost basis, means it provides a 50.5% yield from its initial cost basis every year. (Fool.com, 3/5/20)

Boring old Coca-Cola has made a fortune for Warren Buffet. It can do the same for you.

You buy shares in a theoretical company at $5. Even if they raise the dividend by 7% annually, the cost you paid for those shares will always remain fixed. Thus, your “Yield to Cost” as a percentage just goes up year after year, no matter how big the dividend grows. In this illustration, the investor likely benefited from share price appreciation as well.

Money For Nuthin’ And Divs For Free

Perhaps the best thing about dividend growth investment is that it’s uncommonly easy. If you found the search for fallen angel stocks to be intimidating and exhausting, then the relative ease of dividend growth investing may appeal to you.

A great place to start shopping for dividend growth is the “dividend aristocrats.” A company is dubbed a dividend aristocrat if it has grown it’s dividend every single year for 25 consecutive years. Think about all of the challenges that have arisen over the last 25 years! The tech bubble crash, 9/11, the Great Recession. For 64 very special publicly traded firms, all of these blows barely put a dent in their armor. They just kept paying more and more no matter what was going on in society.

According to Moneyinvestexpert.com, amongst these 64 companies, the average dividend growth rate was 6% annually, or three times the rate of inflation. But that was just the average. Of the 64 dividend aristocrats, the top had often grown their dividends at an annual rate of 12% or more over the last decade. That means that these “boring” companies doubled their dividend payout every six years! Have you ever had a job where you could double your salary every six years for decades on end?

It’s easy to identify great stocks for your dividend growth portfolio. Just Google “dividend aristocrats” and “dividend growth rate” or “DGR” and numerous lists will appear.

If you don’t even want to do that, you can easily harness the power of dividend growth investing through exchange traded funds. Here is a list of five different exchange traded funds that will help you harness the power of dividend growth without ever losing a night’s sleep (from Investopedia.com):

ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

ProShares S&P Technology Dividend Aristocrats ETF (TDV)

SPDR S&P Dividend ETF (SDY)

SPDR S&P Global Dividend ETF (WDIV)

ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL)

This is a powerful strategy considering the small amount of effort required. If you had bought one of the more established exchange traded funds above, SDY, in 2010, you would have turned $46 into $109 even if you spent the dividend every year. If you invest in dividend aristocrats and hold onto these stocks through thick and thin, you will be the one who winds up feeling like a king.

More Stories

3 DIVIDEND STOCKS THAT MIGHT BE SAFER THAN TREASURY BONDS, PART II

3 DIVIDEND STOCKS THAT MIGHT BE SAFER THAN TREASURY BONDS, PART I

MASTERING THE PROXY STATEMENT, PART V (THE ELECTRIC BOOGALOO)