By Herbert Han Cook

When it comes to investing in stocks, one key factor that attracts investors is the potential for dividend growth. One company that has caught the attention of many value investors is Deere, a leading player in the agricultural machinery industry. Dividend growth not only provides a steady stream of income but also signifies the financial health and stability of a company. In this article, we will delve into the fascinating journey of Deere & Company’s dividend growth and analyze its sustainability.

Before we dive into Deere’s dividend growth history, let’s first understand the concept of sustainable returns. Sustainable returns refer to the ability of a company to generate consistent and growing profits over the long term. It is crucial for investors to assess the sustainability of a company’s dividend before making an investment decision.

Deere’s dividend growth history

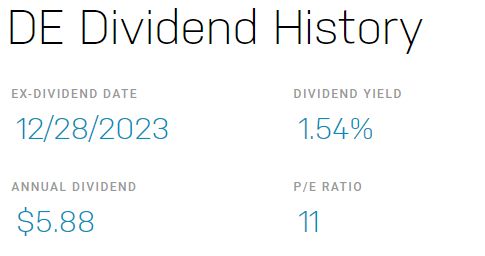

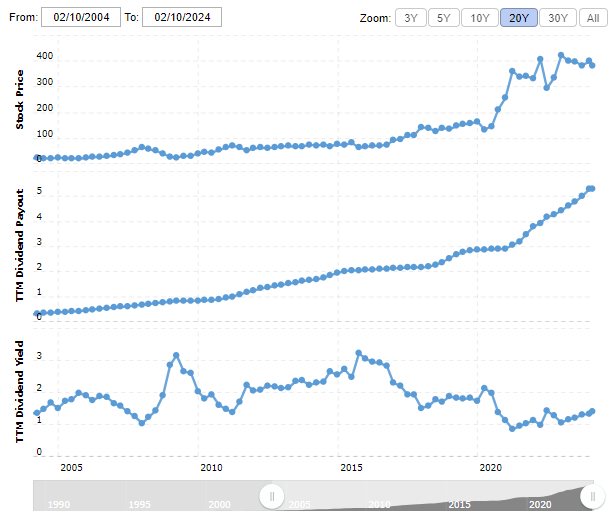

Deere & Company, a renowned manufacturer of agricultural machinery, has a remarkable track record of dividend growth. Over the years, the company has consistently increased its dividend payout, rewarding shareholders with a growing stream of income. From 2000 to 2020, Deere has managed to grow it’s dividend by a factor of 10. In two decades, the unheralded manufacturer of farm machines has grown it’s dividend from $.14 per quarter to $1.40 per quarter. Talk about a bountiful crop!

The company’s dividend growth history reflects its strong financial performance, strategic decision-making, and ability to navigate through economic cycles. Even during challenging times, such as the global financial crisis of 2008, Deere continued to increase its dividend, demonstrating its resilience and long-term focus.

Analyzing the sustainability of Deere’s dividend

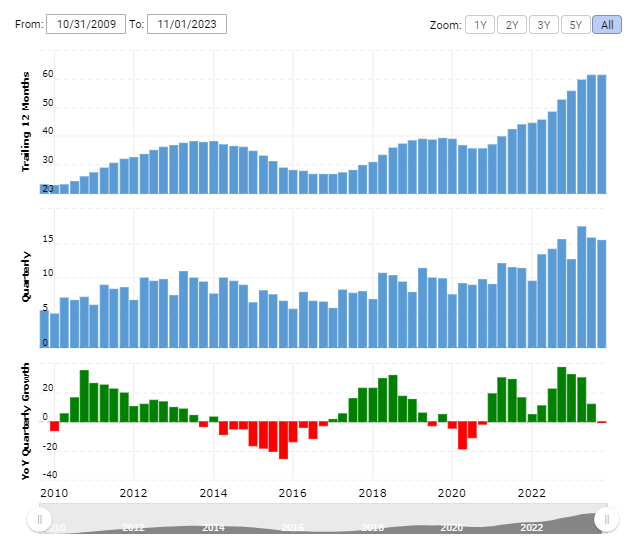

While Deere’s dividend growth history is impressive, it is essential to evaluate the sustainability of its dividend. A sustainable dividend is supported by a company’s earnings, cash flow, and financial stability. By analyzing key financial metrics such as payout ratio, free cash flow, and earnings growth, we can gain insights into the sustainability of Deere’s dividend. Even with all of those dividend raises, Deere still pays out just 21% of its profit. Which means that Deere’s dividend harvest should be ample for years to come.

Deere’s conservative payout ratio, which measures the proportion of earnings paid out as dividends, indicates that the company has ample room to continue increasing its dividend. Additionally, the company’s healthy free cash flow generation and consistent earnings growth provide further confidence in the sustainability of its dividend.

Growth prospects for Deere and its dividend

Looking ahead, Deere’s growth prospects remain promising. The company is well-positioned to benefit from several trends driving growth in the agriculture and construction industries. The increasing global population, rising demand for food, and infrastructure development present significant opportunities for Deere to expand its market share and drive revenue growth.

Furthermore, Deere’s focus on innovation and technological advancements positions it to capitalize on the growing trend of precision agriculture. The integration of data analytics, automation, and artificial intelligence in farming practices enhances productivity and efficiency, ultimately driving demand for Deere’s advanced machinery. The company is at the forefront of automation. How about a tractor that drives itself? How about machines that have eyes and brains, to know which weeds to kill, and when, without bothering the busy farmer? Additionally, Deere has ample opportunity to become even more than just a hardware company. These new automated machines aren’t just “brawn,” they are also “brains.” That means constant software updates, which may mean that Deere could soon reap the massive profit margins which are common for SAS (software as a service) companies.

Trends driving growth for Deere

Several trends are expected to drive growth for Deere in the coming years. Firstly, the ongoing digital transformation in agriculture presents a vast opportunity for the company. The adoption of smart farming techniques, including precision agriculture and autonomous machinery, enhances productivity and reduces costs for farmers. Deere’s investments in digital solutions and connectivity enable it to stay at the forefront of this technological revolution.

Secondly, the increasing focus on sustainability and environmental consciousness provides Deere with the opportunity to develop and market eco-friendly equipment. As governments and consumers prioritize sustainability, the demand for efficient and environmentally friendly agricultural machinery is expected to rise, benefiting Deere’s growth and market position.

Evaluating Deere’s financial stability and debt levels

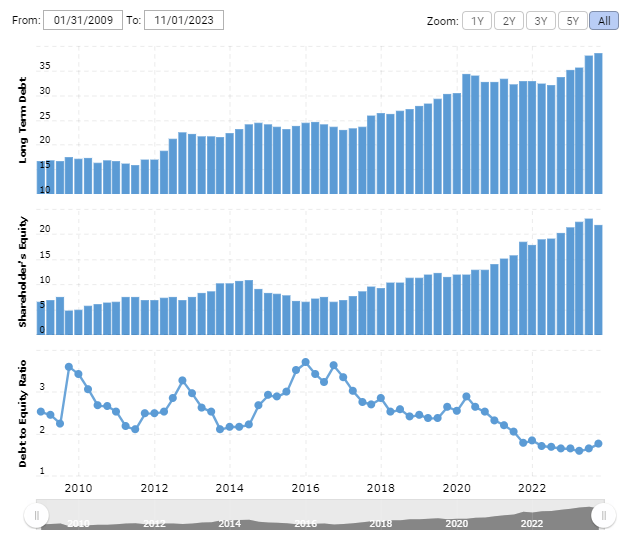

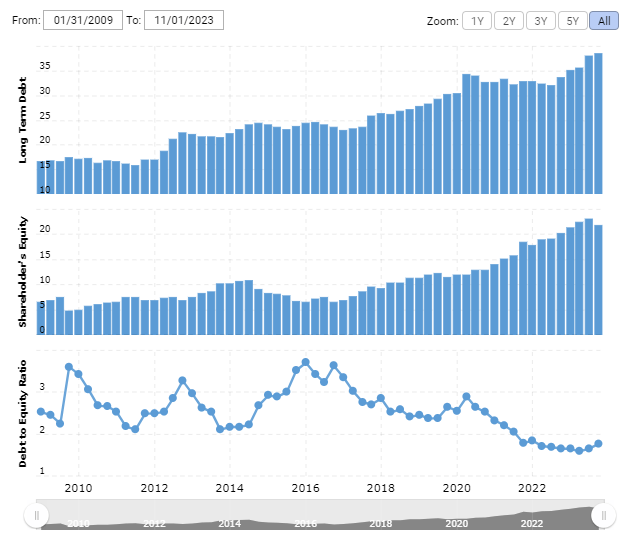

To assess the safety of Deere’s dividend, it is crucial to evaluate the company’s financial stability and debt levels. Deere boasts a strong balance sheet with manageable debt levels. Its prudent financial management and disciplined approach to capital allocation ensure that the company maintains a healthy financial position.

Furthermore, Deere’s ability to generate consistent cash flows and its low debt-to-equity ratio provide a solid foundation for sustaining its dividend payments. The company’s financial stability and responsible debt management contribute to the overall safety of its dividend.

In addition to evaluating Deere’s financial stability, it is essential to consider other factors that contribute to the safety of its dividend. These factors include the company’s competitive advantage, market position, and ability to adapt to changing industry dynamics.

Deere’s long-standing reputation as a leading manufacturer of agricultural machinery, coupled with its extensive distribution network and strong customer relationships, provides a competitive advantage. The company’s commitment to continuous innovation and investment in research and development ensures that it remains at the forefront of industry trends, further enhancing the safety of its dividend.

Valuation of Deere relative to the market and peers

When considering an investment in Deere, it is crucial to assess its valuation relative to the market and its peers. Valuation metrics such as price-to-earnings ratio, price-to-sales ratio, and dividend yield can provide insights into whether the stock is undervalued or overvalued.

Deere is a growth stock masquerading as a boring industrial conglomerate. As we discussed above, software is a larger and larger part of the company’s business. But many SAS companies trade at price to earnings ratios of 30, 40, or more. Deere trades at just 11 times earnings. For a company that has grown it’s dividend payout by 1,000% over the last two decades, this valuation seems like a screaming deal.

Conclusion

In conclusion, Deere & Company’s dividend growth history showcases its commitment to returning value to shareholders. The sustainability of Deere’s dividend is supported by its strong financial performance, conservative payout ratio, and ability to generate consistent cash flows.

With favorable growth prospects driven by industry trends and a solid financial position, Deere is well-positioned to continue delivering sustainable dividend growth. Investors seeking a combination of income and capital appreciation may find Deere an attractive long-term investment opportunity.

More Stories

INFLATION CRUSHING STOCKS FOR THE TRUMP ERA

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?