By Jiayi Liang, Equity Analyst

Economic downturns are inevitable in the long-term business cycle. During recessions, companies are severely impacted, suffering lower demand, rising layoffs, and depressed revenue. Meanwhile, the stock market becomes much more volatile with prices experiencing dramatic changes. In most cases, when the leading stock market indexes lose over 10% of their values within a short-term period, we label the situation a “stock market crash”. Such a crash could usually make people panic, leading to large-scale withdrawal by investors in order to either minimize their losses or meet a margin call. During these times, some of the dividend-paying companies cut their distribution to shareholders when their earnings are under pressure.

But is it really necessary for companies to lower their dividends during recessions? Should investors panic? In this article, we will review historical data related to the stock market and dividends, explore how often companies cut their dividends and to what degree they cut, and finally use existing data to predict the likelihood of companies cutting dividends in the next few years.

Dividends Are Not as Volatile as Stock Prices

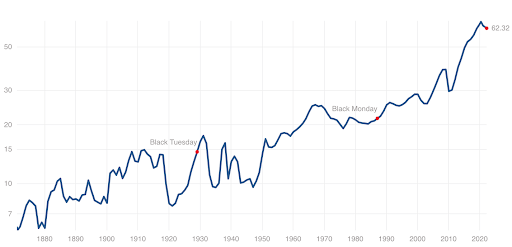

The first thing we need to know is that, historically, stock prices have fluctuated much more than dividends. We can see from the two charts below. The first plot shows S&P 500 12-month real dividend per share, adjusted for inflation. We could see several wild swings throughout the history, such as the Great Depression of 1929-1939, the Financial Crisis of 2007-2008, and the COVID-19 pandemic of 2020. However, besides these outliers, the dividend growth rate has remained relatively steady, fluctuating within the range of 10%.

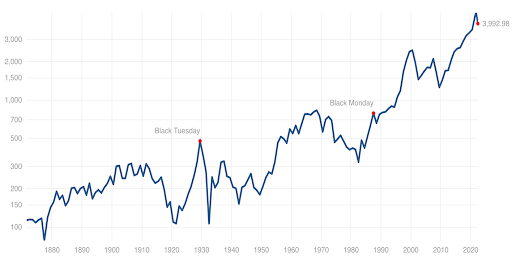

The second chart shows S&P 500 real stock prices, adjusted for inflation. Even though the general pattern is very similar to the dividend growth trend, we could see that prices have fluctuated in a much larger degree in either direction. Due to the Wall Street Crash of 1929, the price declined from 420.31 in 1929 to 167.80 in 1932; During the Global Financial Crisis, the price plummeted from 2,034.12 in 2007 to 1,185.20 in 2009; Because of the Coronavirus, the price dropped from 3,574.01 in December of 2019 to 2,970.89 in March of 2020.

In addition to the charts, we could also use statistics to compare the volatilities of dividend and price. Dividend change has a range of 61.29 with a minimum of 5.77 and a maximum of 67.26. On the other side, price fluctuation has a range of 4776.59 with a minimum of 78.22 and a maximum of 4854.81. If we calculate standard deviations, we could see that price moves have been twice as volatile as dividends.

Evidently, the drastic decline in stock prices does not necessarily represent the weak operational performance of the companies. Such a huge price drop may be caused by the depressed global trend during recessions instead of the incompetency of a specific company. Moreover, investor sentiment also plays an important role in fluctuating prices. Irrational exuberance describes the phenomenon by which investors overvalue the stock market, which then drives asset prices higher than those assets’ fundamentals justify. On the contrary, investors can be very pessimistic about the stock market which then causes panic selling, leading to a dramatic plunge in stock prices. All these market sentiments could lead to a disconnect between stock prices and underlying fundamentals, which implies it is unnecessary to cut dividends during recessions.

Historical Cases

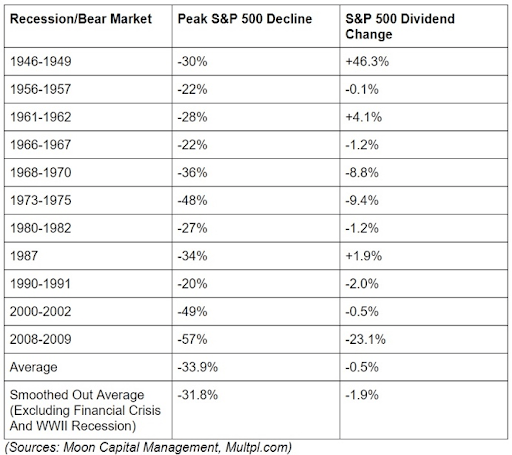

Now, we will examine historical evidence to see what companies did when facing recessions. We could see from the table below that in general, although stock prices plummet significantly, companies either maintained their dividends and waited it out, or chose to reduce only a trivial amount if it was absolutely necessary. Admittedly, there were several exceptions which showed either a large rise or a large drop. However, these dramatic changes in dividends usually occurred due to reasons independent of the underlying profitability of the company. In the following below, we are going to analyze the root causes of these outliers.

1945 Recession after WWII

The first outlier in the table above was the 46.3% jump in the first row. After World War II, federal spending significantly dropped as the government stopped purchasing military weapons and hiring soldiers. The reduced government spending lowered GDP, leading to an economic contraction immediately. Nevertheless, without the mandatory requirement to meet wartime needs, factories and industries were no longer forced to produce bombs. The shift from bombs to regular goods in manufacturing encouraged a surge in private consumption and earnings. Gradually, the economy recovered which was followed by a broad period of worldwide economic expansion. The stock market soared with the success in stabilizing and growing stock prices by a number of international cooperative arrangements, which explained the remarkable jump in dividends in the following three years after 1946.

Financial Crisis of 2007-2008

The second noteworthy percentage in the table was -23.1% with the corresponding recession during 2008-2009. This aberration was largely due to the TARP bailout imposed by the federal government on banks. By accepting bailout funds, banks were forced to cut their dividends whether they were still making profits or not. For example, JP Morgan cut its dividend from 38 cents to 5 cents per share quarterly by February of 2009. This first-time cut since 1990 occurred after the company received $25 billion in TARP bailout funds. However, as the CEO Jamie Dimon claimed, the cut had nothing to do with TARP but was to help the company save $5 billion each year to improve its financial flexibility. Similarly, Wells Fargo cut its dividend from 34 cents to 5 cents per share, which allowed it to save $5 billion annually.

All these significant cuts did not last very long. Both banks recovered soon after the crisis with great progress made to increase dividend yield. JPM has 40 cent per share now after four times of raising its dividend since 2010. WFC’s yield also started to recover in 2011.

Therefore, the large dividend cut during the financial crisis of 2007-2008 was mainly caused by banks being compelled to comply with the government’s regulation. Shareholders did suffer much lower dividend yields, but it was only a temporary loss.

COVID-19 Pandemic of 2020

Another outlier was the COVID-19 pandemic in recent years. Admittedly, in general, companies were cutting their dividends on a small-scale from 65.52 in December of 2019 to 62.32 in March of 2022 due to the pandemic. However, most of the leading companies had been planning layoffs and furloughs to lower financial burdens rather than cutting the benefits of their shareholders. For example, on March 26, 2020, Caterpillar decided to “temporarily suspend operations at two plants and one foundry” while announcing a payout of $500 million in dividends to shareholders. Similarly, Stanley Black & Decker announced layoffs and issued $106 million in dividends to shareholders on April 2. Five days later, on April 7, Levi Strauss had decided to layoff 4,000 workers a while on the same day, the company announced a distribution of $32 million to shareholders.

Overall, most of the firms spared no effort to protect their shareholders, even letting employees go before cutting dividends. Managers were doing so to maintain investors’ confidence in the companies’ profitability and to keep a well-performing image to the public. In other words, companies would only choose to cut their dividends when they have no other alternatives at all.

Likelihood of Cutting Dividends in the Next Year

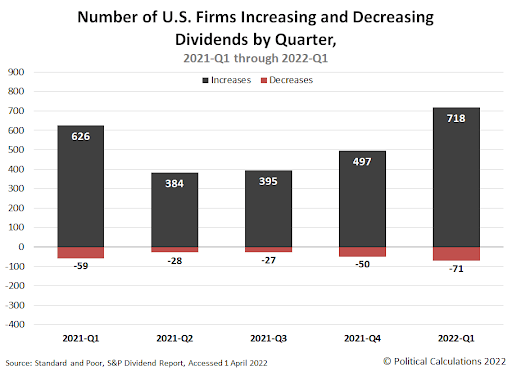

We have already seen that people rarely cut their dividends during recessions, but what about over the next few years? Will people cut, maintain, or increase their distribution to the shareholding owners? Now, we will look at some recent data and make predictions for the future based on current economic situation. The chart below visualizes the count of U.S. firms either increasing or decreasing their dividends from the first quarter of 2021 to the first quarter of current year. Since 2021-Q3, the number of firms announcing a rise in dividend payouts has increased: 395 publicly traded dividend-paying firms in 2021-Q3, 497 in 2021-Q4, and 718 in the just completed 2022-Q1. The rising trend in the chart corresponds to the real situation that COVID-19 has been under more control and remained relatively steady compared to last two years. The government in each country has implemented certain regulations to get the world economy back on track. Firms have regained their confidence in the economy as their revenues have been back to normal. Therefore, it is very reasonable to believe that, as long as there are no unexpected issues such as new global pandemics and political turmoil, there will be a 90% probability that companies will continue to raise their distributions to shareholders, at least over the next few years.

Conclusion

In conclusion, during recessions, stock prices can plummet as companies struggle to sustain a strong financial position. The most important thing to understand is the disconnect between the superficial drop in stock price and the financial strength of the company. Some companies that suffer drops in shareprice are actually be unaffected by the economic downturn and continue to churn out profits with higher earnings. Management would choose to cut their dividends only when it is absolutely necessary. The analysis above demonstrates that, on average, dividends merely fluctuate within a range of 0.5%. Even though there were some outlier situations, they often had nothing to do with underlying fundamentals, and we know that big companies usually have the ability to survive downturns without cutting their distribution to investors. Therefore, as long as we are holding high-quality stocks and a well-diversified income portfolio, the best way to survive an economic contraction is keeping investments unchanged and waiting patiently.

More Stories

3 DIVIDEND STOCKS THAT MIGHT BE SAFER THAN TREASURY BONDS, PART II

3 DIVIDEND STOCKS THAT MIGHT BE SAFER THAN TREASURY BONDS, PART I

MASTERING THE PROXY STATEMENT, PART V (THE ELECTRIC BOOGALOO)