By The Sick Economist

If there is one post on this website that could be considered the most important post, this would be it. The concept we are about to discuss can change your life.

It changed mine.

Two false statements separate millions of investors from the passive income they deserve.

Fallacy #1: Average dividends are 2-3%. If a stock pays much more than that, something is wrong.

Fallacy #2: Stocks with high dividends must be more risky. After all, more reward always comes with more risk.

Both of these statements are commonly believed, and not just by amateur investors. Many experienced financial advisors also believe these two statements. To be fair, they seem logical. But the logic is based on a profound misunderstanding about what goes on in corporate boardrooms across the United States.

The reason why these two statements are false is because corporate America is much more lucrative than most people realize. By now, you probably understand that I am not a fan of working in corporate America. But owning corporate America? Now that is another story entirely. Owning corporate America in the form of being a common shareholder is one of the greatest bonanzas in human history.

It turns out that most big name corporations only pay dividends between 1 and 3% because they feel like it. In fact, they could pay more cash to shareholders. Much more.

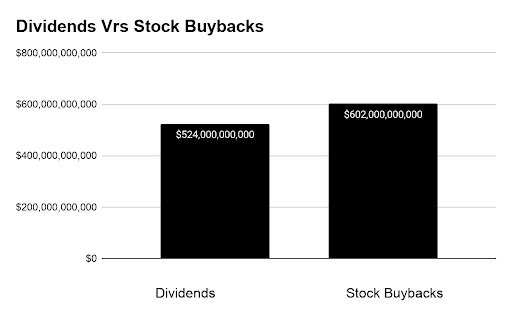

According to research done by Goldman Sachs, and cited in Barrons’s magazine, in 2021, analysts expect the S&P 500 companies to pay out $524 billion in dividends. At the same time, Goldman Sachs expects the very same companies to buy back $602 billion of their own stock. In 2019, a bumper year before the coronavirus crisis, the S&P 500 companies actually bought back $750 billion of their own stock!

So, that “safe” corporation that is safe because it only has a 2% dividend? Turns out, it easily could have paid a 5% dividend. Instead, management chose to spend that money on share buybacks instead. That 3% yielder? Actually, it could have been 6%. Again, management chose not to pay out that much in cash dividends. And this doesn’t even begin to take into account all of the money that was spent building corporate empires. According to statista.com, $3.9 trillion dollars changed hands in corporate mergers and acquisitions in 2019. If even a fraction of that money had been paid back to shareholders in dividends, rather than spent gobbling up other corporations, we could easily see dividends of 5% or more across the whole S&P 500.

But we don’t. For some reason, corporate boards in the United States tend to think of dividends last when considering how to allot corporate funds. Why?

The Rich Are Different from You and I….

The way that corporate cash flow gets allocated simply comes down to priorities, and the priorities of the corporate Masters of the Universe are quite different from your average mom-and-pop investor.

Theoretically, each publicly traded corporation is overseen by a board of directors composed of shareholders. By law, a majority of the board members must be “independent” shareholders, meaning they hold a certain amount of shares as a passive investment and are not employed by the corporation they govern. The theory is that these people should have interests that are very similar to you and me.

The one thing that separates most S&P 500 corporate directors from you and me is that they are fabulously wealthy. I don’t mean well to do, or upwardly mobile. I mean filthy stinking rich, tens or hundreds of millions of dollars rich. This changes their priorities whether they realize it or not.

Oceans of ink have been spilled over the growing gap between the “haves” and the “have nots” in America. It has been pointed out ad nauseum that the top 1% of Americans control an ever growing chunk of the economic pie. Most directors of large corporations are themselves highly accomplished executives, entrepreneurs, or ex-government officials. They have been chosen to direct the most complex, most prestigious corporations in the world based on their stellar record of prior corporate achievement. That means that most major corporations are being guided by people who have been in the 1% for years, if not decades.

It may seem counterintuitive, but the very rich in America do not seek to maximize their income. In fact, quite the opposite. Most very rich people in America spend substantial time and effort attempting to minimize income. Because in America, income means tax. Less income, less tax.

Try this thought exercise. Take a trip to fantasy island for a minute, and let’s say your net worth is around $100,000,000, not an unusual achievement for today’s high ranking corporate executives. Let’s say that most of that net worth is in stocks. It’s important to remember that even with that massive net worth, you are still employed. You get a paycheck in excess of $1,000,000 every year that pays for most of your needs. If you want an extra vacation home now and then, you simply cash in a million or two of stock and buy it. But mostly, your $100,0000,000 in net worth just sits there and grows, month by month, year by year. It’s simply too much to reasonably spend, and you’re not retired anyhow.

Let’s look at three scenarios and think about which scenario you would favor if you were in this position. In scenario #1, your $100M is invested mostly in high yield dividend stocks, and you get about 6% in dividends every year. This means that your passive cash income from your investments is a massive $6,000,000 per year. You need to pay tax on that. Currently you would be looking at something in the range of 23% tax, so a cool $1.5 million would have to go to Uncle Sam. You’re so rich it doesn’t make a difference but….ouch! Who likes sending more than $1M to the feds?

In scenario #2, your $100M fortune is invested in a simple basket of S&P 500 stocks, which yield around 2% in cash dividends every year. So, in this case, you get $2M in passive cash every year and you pay about $450,000 in taxes. Still, ouch, but less ouch.

In scenario #3, your $100M fortune is invested primarily in high flying tech stocks and biotech stocks, most of which don’t pay dividends. In this way, your fortune grows, on paper, as much as 12% per year. That amounts to $12,000,000 in paper profits each and every year. You get $0 in cash dividends, which means you pay $0 in tax every year. Your wealth grows by approximately $12,000,000 each and every year, and what you send to Uncle Sam is… nothing. Not bad, right?

Now, if you dare, multiply those numbers in your head by a factor of 10, or even a factor of 100. Many major corporations have directors and shareholders who would laugh at $100M. A lot of tech founders and executives have amassed fortunes well into the billions. What if those stocks paid hefty dividends? Who wants to pay tens, or even hundreds of millions, in tax?

So there you have it. The #1 reason why most major corporations in America pay only modest dividends is because the tycoons that run them don’t want to pay tax on cash flow they don’t need anyhow. Yes, they vaguely recognize that millions upon millions of small mom-and-pop investors could use enhanced dividends to pay for a modest existence. But most corporate directors are so rich that they live in their own world of wealth and privilege. Everyone they know wants lower income to pay less tax. Low corporate dividends are a symptom of our nation’s growing wealth inequality.

Managers in Paradise

In theory, each public corporation is overseen by an independent board of directors who hold the c-suite accountable. In reality, many board members find it more profitable and easier to just go along with entrenched management. A lot of the largest corporations in America are run more for the benefit of the CEO than anybody else. In addition to the reasons discussed above, the c-suite may have a few distinct reasons for shunning dividends and choosing corporate buybacks instead.

Dividends are considered to be “sticky.” This means that if a company runs into hard times, and has to cut its dividend, shareholders notice, immediately. If a corporation has paid a 3% dividend for many years, runs into some kind of problem, and is forced to cut that dividend, many long time shareholders will sell, and the stock price may start to fall. From the point of view of management, this makes the situation worse.

However, corporate share repurchases are sort of an invisible force. In theory, each share repurchase increases scarcity of shares, thus making each remaining share more valuable. In reality, there is only a fuzzy relationship between stock buybacks and share price. It’s not like shares immediately increase in market value as soon as a buyback is completed. However, if a dividend is cut, the punishment in share price can be harsh and immediate.

Simply put, share buybacks are seen by most corporate managers as more low risk to them. If a dividend is cut, bad things start to happen immediately, and corporate managers can be blamed. Share buybacks are more flexible. Since their tangible benefit is mostly theoretical anyway, buybacks can be cut with few repercussions for management. How is that for twisted logic?

Another reason why some corporate managers choose stock buybacks over dividends is because they can use share buybacks to directly rig their pay packages. Many high level corporate executives earn multi-million-dollar bonuses based on a measure that is called “Per Share Earnings.” This is the total earnings of the corporation, divided by the number of shares outstanding. So, if a company makes $100M and has 1 million shares outstanding on the market, then the earnings per share are $1. However, if the company makes the same $100M, and buys back 10% of it’s shares, then we divide $100M by only 900,000 outstanding shares. Shazam! Now the company earns $1.11 per share, even though the total earnings stayed the same. Cue massive bonus and third vacation property.

Why is this bit of financial chicanery allowed to happen in broad daylight? Remember, the CEO chooses the board of directors, and then the board of directors oversees the CEO. If that seems like an incestious little arrangement, it is. But somehow corporate America hands in massive profits decade after decade, and share prices go up and up, so few people complain.

Speaking of massive profits: there is one last reason why many brand names and major corporations pay out much lower dividends than they could. They are so grotesquely profitable that they really don’t need to draw any attention to the cozy racket they have set up. According to research done by Rakesh Shamra at Investopedia.com, the iPhone 7, which retailed for about $649 in 2016, cost about $5 in labor to assemble. Major corporations have piled up billions and billions in excess cash that is just sitting around, even after buying back countless billions of stock AND paying a dividend. If Apple paid out a 6% dividend, instead of it’s current 1% dividend, do you think people might start to wonder if they were paying too much for an iPhone?

Again, the people who make big decisions at Apple are so unfathomably wealthy that they will never spend the vast fortunes they have accumulated. So, given that cash flow is the last thing they need, why draw unneeded attention to the fact that they found a way to mint money by exploiting foreign labor? They would prefer to squirrel away hundreds of billions of dollars, which is what they have done, rather than drag it into the light where it could be scrutinized. Small dividends mean small transparency and small accountability for the corporate titans who reign over today’s S&P 500 companies.

Saved by the Bell

You can think of the investing ecosystem like a high school. In that high school, the S&P 500 stocks represent “the cool kids.” Rock stars like Tesla, Google, and Facebook are the center of all of the attention, and they set the tempo that everyone else moves to. But if you ever went to high school, you know that there are all kinds of other cliques, many of which provide unique value. You had the drama kids, the band nerds, and the technogeeks. You had the grade grubbers, the stoners, and the foreign exchange students. If there is one lesson that many of us learned as the years have gone by, it’s that a lot of those less popular kids have done just fine as they have gone out into the world.

I am going to teach you to do just fine by ignoring what the cool kids are doing and looking for value in other parts of the equity ecosystem. The S&P 500 is just one subset of publicly traded companies. In reality, there are thousands of different investments to choose from.

Stocks that pay high dividends are not necessarily dangerous, and there may not be anything wrong with them at all. They’re just poorly understood, like that computer nerd back in high school who is a tech billionaire today. He was overlooked in high school because he thought differently than others, and he didn’t give a flip about what the cool kids were doing. But anyone with a discerning eye back then would have known that shunned kid was going somewhere.

Forget what the “cool kids” are doing. Try investigating the awe inspiring power of compounding dividends if you really want to see something cool.

More Stories

3 DIVIDEND STOCKS THAT MIGHT BE SAFER THAN TREASURY BONDS, PART II

3 DIVIDEND STOCKS THAT MIGHT BE SAFER THAN TREASURY BONDS, PART I

MASTERING THE PROXY STATEMENT, PART V (THE ELECTRIC BOOGALOO)