This week the Fed slashed interest rates again. With yields sinking across the world, companies with generous dividends are rapidly becoming more and more valuable. Healthcare investors can find a bonanza of opportunities to add attractive dividend yields to their portfolios. We asked analyst Kody Kester to give us his take on United Health, one of the largest healthcare businesses in the world…..

As a dividend growth investor, I’m always looking for companies that offer a mix of dividend growth, safety, and yield.

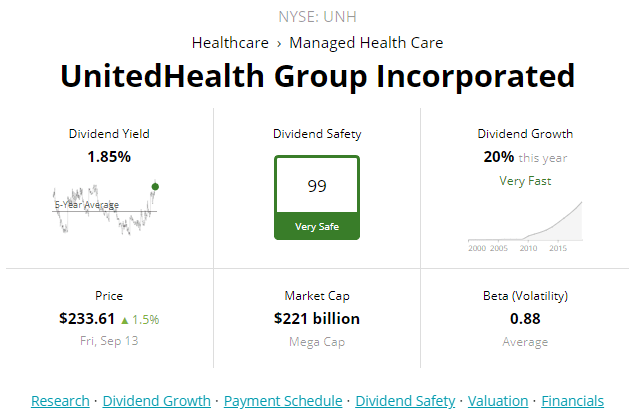

Although UnitedHealth Group’s yield isn’t very high, it is line with the S&P 500’s yield while offering a very safe dividend and dividend growth that will likely leave that of the S&P 500’s dividend growth in the dust.

Today, we’ll be examining UnitedHealth Group’s dividend safety/growth profile, the company’s fundamentals/risks, and the valuation aspect of an investment in UnitedHealth Group.

I’ll then end the article with a prediction of UnitedHealth Group’s annual total returns over the next decade from its current stock price.

A Very Safe Dividend With High-Single Digit Long-Term Growth Potential

In order for us to establish UnitedHealth Group’s dividend safety, we’ll be examining the company’s EPS and FCF payout ratios.

In its previous fiscal year, UnitedHealth Group generated adjusted EPS of $12.88 against $3.45 in dividends paid during that same time, for an EPS payout ratio of 26.8%.

For its current fiscal year, UnitedHealth Group increased its full year outlook for adjusted EPS of $14.70-$14.90 against $4.14 in dividend slated for this fiscal year, for an EPS payout ratio of 28.0%

Moving to FCF, United HealthGroup generated $15.713 billion in operating cash flow against $2.063 billion in capex, for total FCF of $13.65 billion in FY 2018, using information from UnitedHealth Group’s most recent 10-K. Against the $3.320 billion in dividends paid out during that same time, this equates to an FCF payout ratio of 24.3%.

From an FCF standpoint, UnitedHealth Group’s payout ratio should remain in the mid-20% range for this fiscal year.

Overall, UnitedHealth Group’s EPS and FCF payout ratios are very safe for the foreseeable future.

Image Source: Simply Safe Dividends

Based upon my analysis of UnitedHealth Group’s dividend payout ratios, it should come as no surprise that Simply Safe Dividends and I agree that UnitedHealth Group’s dividend is very safe for the foreseeable future.

We’ll now transition into the company’s long-term dividend growth prospects.

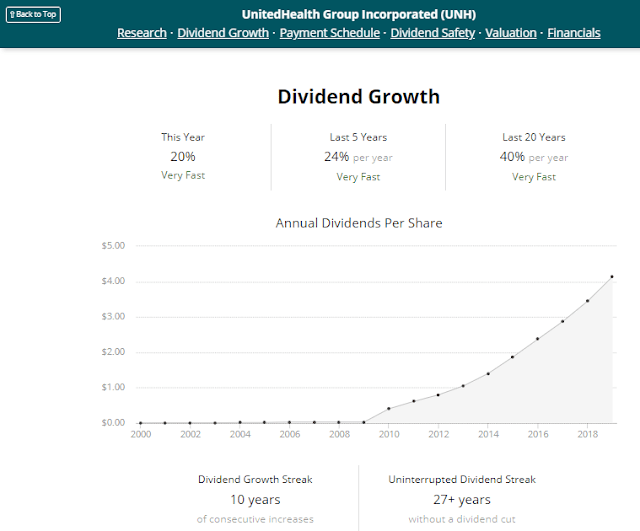

Image Source: Simply Safe Dividends

While a continuation of UnitedHealth Group’s 5 year DGR is unlikely, I believe there is still plenty of dividend growth in this company’s future.

When we consider that UnitedHealth Group’s dividend payout ratios are bound to expand in the years ahead as the business matures and that Yahoo Finance and Nasdaq are projecting 5 year annual EPS growth rates of 13.7% and 13.2%, it’s reasonable to conclude that dividend growth will be in the low to mid teens over the next 5 years before dropping off to a high-single digit growth rate once growth inevitably levels off.

A Strong Balance Sheet With Massive Growth Catalysts To Propel To Future Earnings Growth

In addition to gauging the safety and growth profile of a dividend, it’s important for investors to consider how a company is going to deliver upon the dividend growth that the investor in question is expecting from the company.

The notable competitive advantage that UnitedHealth Group possesses more than any of its competitors in a highly complex industry such as healthcare is scale.

UnitedHealth Group is the largest health insurer in the United States, processing over $750 billion in gross billed charges and $250 billion in aggregate healthcare spending on behalf of the customers and consumers that the company served in 2018 alone.

As healthcare spending in the United States is projected to grow by 5.5% annually through 2027 (and 5.4% annually through 2022 throughout the world), UnitedHealth Group will benefit from growth in its customer base through population growth and acquisitions of insurers throughout the world.

Adding to the case for an investment in UnitedHealth Group is the fact that the company’s balance sheet is very strong. According to page 41 of the company’s most recent 10-K, UnitedHealth Group’s credit rating at the end of last fiscal year was A3 from Moody’s, A+ from S&P, and A- from Fitch, all firmly investment grade credit ratings.

In its previous fiscal year, UnitedHealth Group was able to generate a solid interest coverage ratio of 12.39 (according to the data from page 51 of the company’s most recent 10-K). For context, Simply Safe Dividends rates an interest coverage ratio of over 8 for most companies as a safe coverage ratio.

Risks To Consider:

While UnitedHealth Group is an excellent business operating in an industry that will almost certainly continue to benefit from the secular trend of a growing and aging global population, that doesn’t mean the company comes without its share of risks.

While Medicare for All has been referred to as a long-term ambition by many 2020 Democratic presidential candidates rather than a practical policy proposal that would be passed should a Democrat candidate take the White House in 2020, it’s important for us to at least recognize that UnitedHealth Group operates in a highly regulated and complex industry (pages 17-18 of UnitedHealth Group’s most recent 10-K).

Should a policy such as Medicare for All eventually be enacted (though, it’s worth noting that such legislation would require Democrat control of the White House and Congress, the elimination of the Senate’s Filibuster rule, a majority vote in favor of such legislation in both the House of Representatives and the Senate, the President signing the proposal into law, and the Supreme Court upholding the constitutionality of such law), this would inevitably harm UnitedHealth Group’s profitability going forward in a material way.

It’s also worth mentioning that in an industry dependent upon scale, UnitedHealth Group’s results going forward will ride on its ability to successfully incorporate future acquisitions into its operations (page 25 of the company’s most recent 10-K). Any inability of the company to efficiently integrate an acquisition into its existing operations could materially impact the company’s ability to deliver on long-term growth targets.

While I’ve discussed a couple of the risks facing an investment in UnitedHealth Group, I would refer interested readers to pages 16-28 of the company’s most recent 10-K for a more comprehensive listing of the risks associated with an investment in UnitedHealth Group.

A Wonderful Business Trading At A Fair Price

Besides UnitedHealth Group’s strong operating fundamentals and growth catalysts, the company also offers what I believe is an appealing valuation.

While UnitedHealth Group’s dividend yield of 1.85% certainly isn’t going to impress an investor that needs income for the present, the company’s yield is roughly in line with the S&P 500’s yield.

Moreover, the 1.85% yield is 21% above its 5 year average of 1.52%, according to Simply Safe Dividends.

Even if we take into account that the next 5 years will come with reduced growth, I believe 1.75% is a fair value yield for UnitedHealth Group.

This implies that UnitedHealth Group is trading at a 5.3% discount to its fair value of $246.86 a share and offers 5.6% upside from its current share price of $233.75 (as of September 14, 2019).

The next valuation metric we’ll use to determine UnitedHealth Group’s fair value is the 5 year average forward PE ratio.

According to Simply Safe Dividends, UnitedHealth Group’s forward PE ratio of 14.9 is well below its 5 year average of 17.4.

Assuming a reversion to a forward PE ratio of 16 and a fair value of $251.01 a share (accounting for a slight reduction in the company’s growth going forward), UnitedHealth Group is trading at a 6.9% discount to fair value and offers 7.4% upside from the current price.

The final valuation method we’ll use to arrive at a fair value for UnitedHealth Group is the dividend discount model or DDM.

The first input into the DDM is the expected dividend per share, which is simply a company’s annualized dividend per share. In the case of UnitedHealth Group, the current annualized dividend per share is $4.32.

The next input into the DDM is the cost of capital equity, which is another term for the rate of return that an investor requires. In my case, I require a 10% rate of return because I believe it adequately rewards me for the effort that I put into researching investments and occasionally monitoring them.

The third and final input into the DDM is the long-term dividend growth rate, which is the most difficult input due to the number of factors that determine a company’s long-term DGR.

When we consider that UnitedHealth Group’s payout ratio will likely expand at least a bit over the long-term and that EPS growth over the long-term is likely to average out to around 8%, I believe that an 8.25% long-term DGR is a reasonable estimate.

This would again give us a fair value of $246.86 a share, which indicates that shares of UnitedHealth Group are trading at a 5.3% discount to fair value and offer 5.6% upside from the current price.

When we average the three fair values, we arrive at a fair value of $248.24 a share. Therefore, shares of UnitedHealth Group are trading at a 5.8% discount to fair value and offer 6.2% upside from the current price.

Summary

UnitedHealth Group has grown its dividend for the past decade, making it a Dividend Contender.

Despite the risk of healthcare reform in the years ahead, I believe that UnitedHealth Group’s strong balance sheet, business model, and growth catalysts will continue to guide the company’s future in the right direction.

Adding to the case for an investment in UnitedHealth Group is the fact that the company is trading near fair value.

UnitedHealth Group offers a yield that is competitive with the broader market, in addition to dividend safety and growth that is rivaled by very few companies in the world, underpinned by the growing demand for the services that UnitedHealth Group provides to its customers.

When we factor in the ~1.9% yield, somewhat conservative annual EPS growth of 8-9%, and 0.6% annual valuation multiple expansion, it’s likely that UnitedHealth Group will deliver annual total returns of at least 10.5-11.5% over the next decade, delivering alpha for investors during that time period.

More Stories

INFLATION CRUSHING STOCKS FOR THE TRUMP ERA

ABBOTT LABS: REAPING THE DIVIDENDS OF AN AGING PLANET

ALPHABET, INC: A DIVIDEND STAR IS BORN?